MOLINE, Ill. — Editor's note: Due to technical issues, this week's "Your Money with Mark" on-air interview is not available. We apologize for the inconvenience.

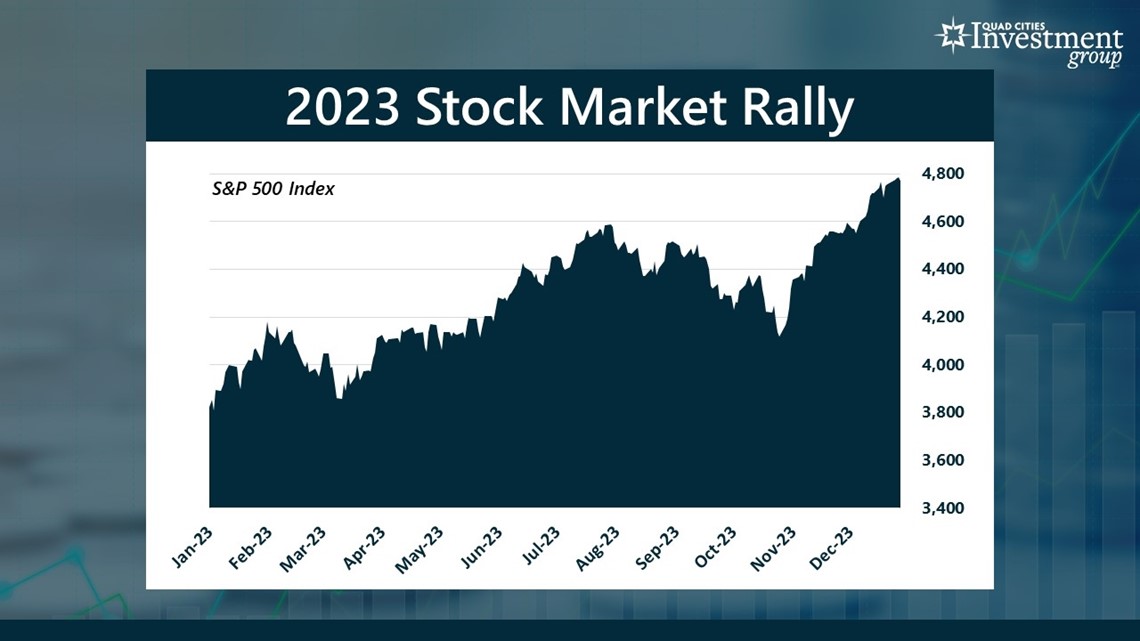

The past few years have been a whirlwind rollercoaster for stock market investors. In 2022, the benchmark S&P 500 stock index declined by nearly 20% while the NASDAQ fell over 33%. But last year investors cheered as the S&P 500 rebounded and gained 24%. Last week, the stock market rally continued as the S&P 500 closed at an all-time high. So far this year, the S&P 500 has gained 1.5%.

News 8's Devin Brooks sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss how the stock market recovered.

Brooks: Obviously 2022 was a brutal year for investors. But why did we see such a strong recovery in the stock market last year?

Grywacheski: There were 3 main phases to last year’s rebound in the stock market. This rebound we saw last year actually started around October 2022 when Wall Street realized the worst of this inflation problem was likely behind us. Thus, we saw a boost in the stock market from October 2022 to about February.

Then in May, all this excitement over AI and how it can transform the economy with all its potential applications created this second surge in the stock market.

And finally, in November, we get this third boost in the stock market in the hope that this inflation problem is resolved and shouldn’t really be a problem anymore.

Brooks: Do you think this momentum in the stock market will continue into the rest of the year?

Grywacheski: This third part of this stock market rally is what concerns me the most. Again, a lot of this rise in the stock market over the past couple of months is on the assumption that the battle against inflation is essentially over — and I disagree with that notion. As I’ve said many times, I think inflation will remain stubbornly high for quite some time. In fact, just two weeks ago the national rate of inflation jumped from 3.1% to 3.4%. The longer we have stubbornly high inflation, the longer it negatively impacts consumers, businesses and, ultimately, the U.S. economy. So, while I certainly hope this ongoing rally continues, I’m cautious about a potential pullback in the stock market if inflation continues to remain stubbornly high.

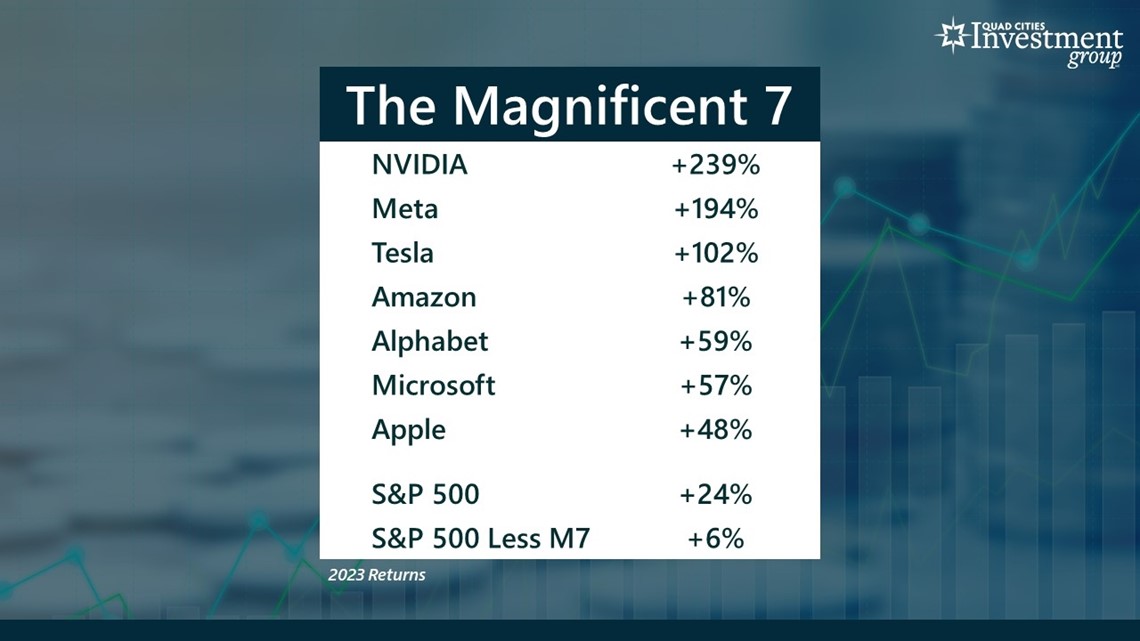

Brooks: We hear a lot about “The Magnificent 7” stocks and their impact on the stock market last year. What can you tell us about “The Magnificent 7”?

Grywacheski: The Magnificent 7 is the name given to the seven companies that drove a lot of the stock market rally last year. They’re companies that either directly create AI technology or are expected to significantly benefit from the many AI applications that can be used to either reduce costs or increase revenues. These seven companies are NVIDIA, Meta, Tesla, Amazon, Alphabet, Microsoft and Apple.

And these are the percentage gains that company stocks rose last year. For example:

- The stock for NVIDIA (which makes AI computer chips) rose 239% last year.

- Meta (formerly known as FB), its stock rose 194% last year.

For perspective, the S&P 500 — which measures the stock performance of the 500 largest companies in the U.S. — rose 24% last year.

But these seven stocks, collectively, accounted for about 75% of the S&P 500’s total gain last year.

That means if you were to exclude these seven stocks from the S&P 500, the remaining 493 stocks would have risen only 6%.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more Your Health segments on News 8's YouTube channel