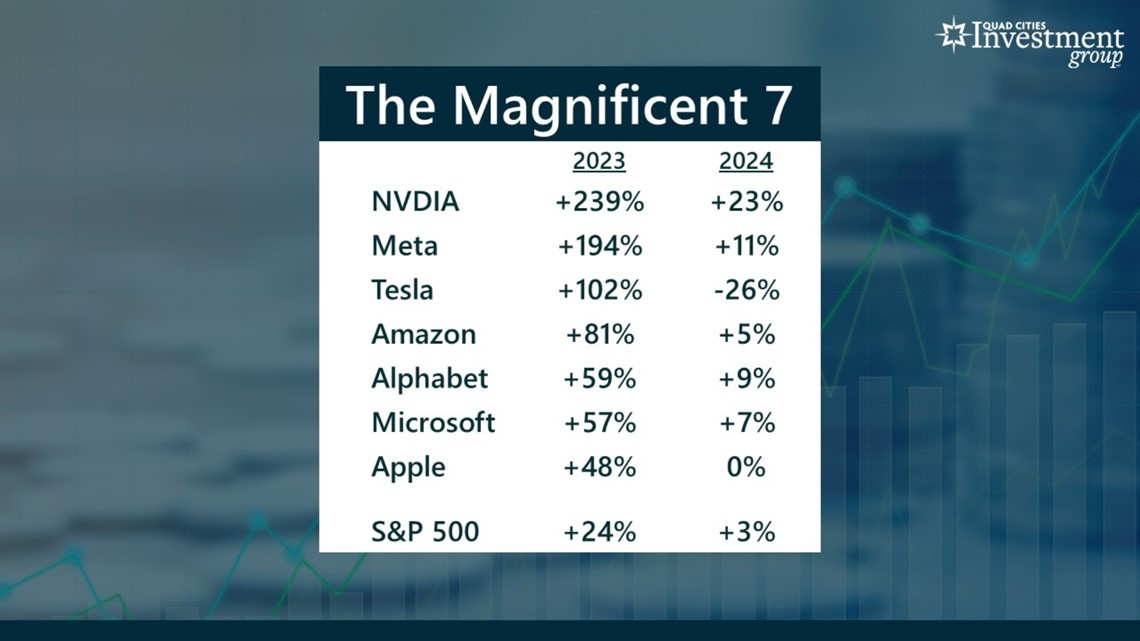

MOLINE, Ill. — Called “The Magnificent 7”, the stocks of NVIDIA, Meta, Tesla, Amazon, Alphabet, Microsoft and Apple have generated a lot of excitement – and money! – for investors. Last year, the stocks for these seven companies rose an average of 111%, far exceeding the S&P 500’s gain of 24%. But is all this excitement over these seven stocks really justified?

News 8's Devin Brooks spoke with Mark Grywacheski of the Quad Cities Investment Group to discuss the impact these companies have.

Devin: Why is there so much excitement over these 7 stocks?

Mark: It’s really about the future of AI. Now, for years we’ve had many basic forms of AI. Its main use is to accumulate and analyze vast amounts of data very quickly.

- When you go on the internet, basic AI tracks your activity and recommends things you might want to buy or directs advertising content to you.

- In warehouses, basic AI is used in robotics and in managing inventory.

- At home, basic AI is used in your cellphone, home entertainment and home security systems.

- On the more complex level, you’re getting into self-driving vehicles like Tesla.

But the recent excitement is about the untapped potential of AI and how it can literally transform our lives and the economy. And right now, the key words being “right now”, Wall Street believes these 7 companies are the industry leaders in that charge. These companies either directly create AI technology or are expected to significantly benefit from AI technology.

Devin: For investors who might want to invest in these companies do you think these gains will continue?

Mark: When you look at the gains for The Magnificent 7 last year, on average, these stocks gained 111% compared to the S&P 500’s gain of 24%. So far this year, the S&P 500 has gained 3% while some of The Magnificent 7 have performed better or worse. Tesla’s stock is down 26% this year, much of that on the problems EV’s had during the cold/winter blast we had a couple of weeks ago.

But this initial rush to buy AI stocks reminds me of the technology boom/bust we had in the late 1990s/early 2000s. Back then I was on one of the trading floors in Chicago and saw firsthand the similar rush to buy any stock even remotely related to technology or that had the words “.com” in it.

And at the start of this tech boom, earnings didn’t matter. Profitability didn’t matter. Investors were just driving these tech stocks higher and higher on the untapped potential of technology – very similar to what we’re seeing now in many AI stocks.

But after about 1.5 years, we saw this consolidation by Wall Street saying:

- Ok, these are the major players within the technology space.

- Then these companies have some potential and we’ll keep an eye on them.

- And for many of the other companies, once that initial hype started to fade, their stock plummeted and many went bankrupt.

And in my opinion, I think you’ll see something similar in this AI rally. At some point, whether it’s two months from now or two years from now, I think you’ll see a similar consolidation of the major players within this space.

But if you do decide to invest in any of these AI-related companies, yes, they come with significant upside potential but they also come with significant risk.

____________________________

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.