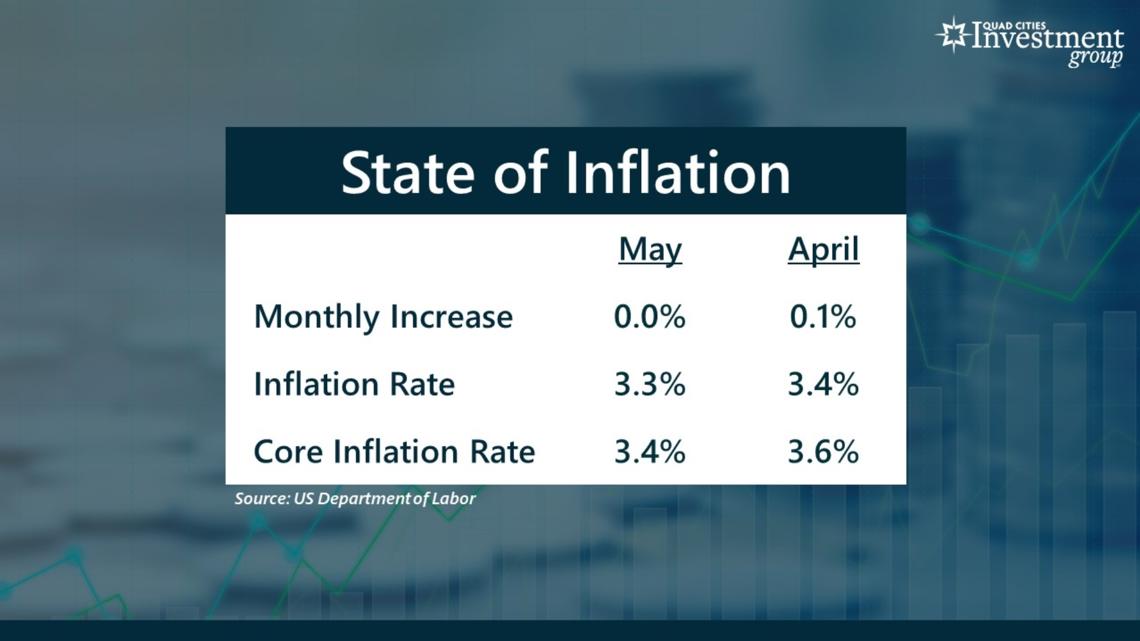

MOLINE, Ill. — On Wednesday, the U.S. Department of Labor gave its latest monthly report on inflation. In May, consumer prices remained unchanged from April while the national unemployment rate fell from 3.4% to 3.3%. The latest inflation data also suggests that consumer prices on many basic necessities might be finally starting to ease.

News 8's Charles Hart spoke with Mark Grywacheski from the Quad Cities Investment Group about the recent report.

Charles: What did this latest data say about the state of inflation?

Mark: On the positive side, consumer prices in May were unchanged. This ended a streak of 47 consecutive months where consumer prices have risen on a month-over-month basis. Granted, consumer prices didn’t decline last month. But, again, for the first time in 47 months they didn’t increase.

The national rate of inflation also fell from 3.4% to 3.3%. This means that consumer prices, on average, are still 3.3% higher than they were 12 months ago.

And finally, we look at what’s called “core” inflation, which strips out the more volatile and seasonal food and energy prices. Core inflation fell from 3.6% to 3.4% last month. So, overall, Wall Street was quite pleased with this latest inflation data.

Charles: What’s the inflation outlook for the rest of the year?

Mark: Even though inflation is currently at 3.3%, remember, the ultimate goal is to return to that ideal target rate of just 2%. But that still remains a significant challenge. When you look into the details of these recent inflation reports there are still a lot of spending categories we call “sticky”. In other words, they’ve been quite resistant in wanting to decline- the cost of shelter is a great example. So, the general consensus is that inflation will remain higher-for-longer and likely stay at or near 3% for the rest of the year.

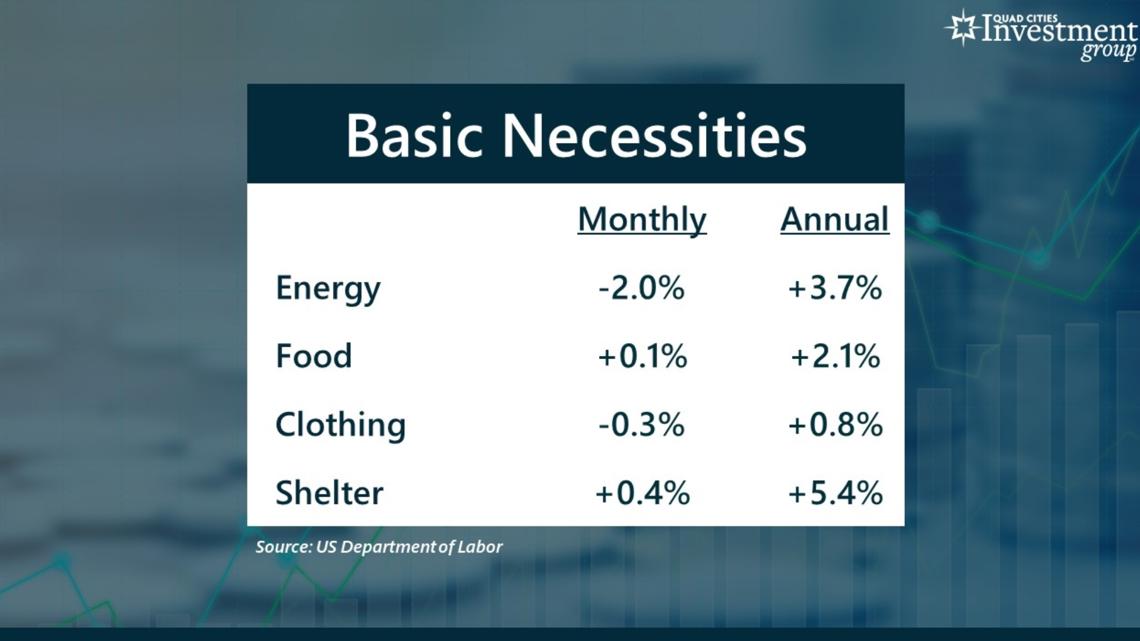

Charles: One of the areas most impacted by rising prices over the past three years has been basic necessities. Are we starting to see some relief in these consumer items?

Mark: One of the hallmarks of this current inflationary cycle is that some of the largest price increases have been on basic necessities: energy/food/clothing/shelter. But we are finally starting to see some relief in these items.

- Last month, energy prices fell by 2%. However, this is a very volatile category and energy prices are still up 3.7% over the past 12 months.

- Food prices only rose 0.1% in May and are up a more reasonable 2.1% over the past year.

- Clothing prices actually declined by 0.3% last month and are up only 0.8% in the past year.

- But one area of basic necessities that remains “sticky”, so to speak, is the cost of shelter. Last month, shelter costs rose another 0.4% and are up a hefty 5.4% over the past 12 months.

But as we can see, these inflationary pressures on basic necessities are starting to improve.

Charles: Lastly, one of the big concerns has been high interest rates. Did this latest inflation report provide any indication on when the Federal Reserve would start lowering interest rates?

Mark: Even though this was one of the better inflation reports we’ve seen in quite some time, the Federal Reserve wants to see more confirmation that this inflation problem has been tamed before it starts lowering interest rates. When you dive into the details of the inflation data, there are still a number of red flags that suggest that inflation will likely remain higher-for-longer. And that means the Fed will likely have to keep interest rates higher-for-longer. Most likely, the Fed will be able to start gradually lowering interest rates towards the end of the year, possibly in December. But that might easily get pushed back to the start of 2025.

________________________________

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more Your Money with Mark segments on News 8's YouTube channel