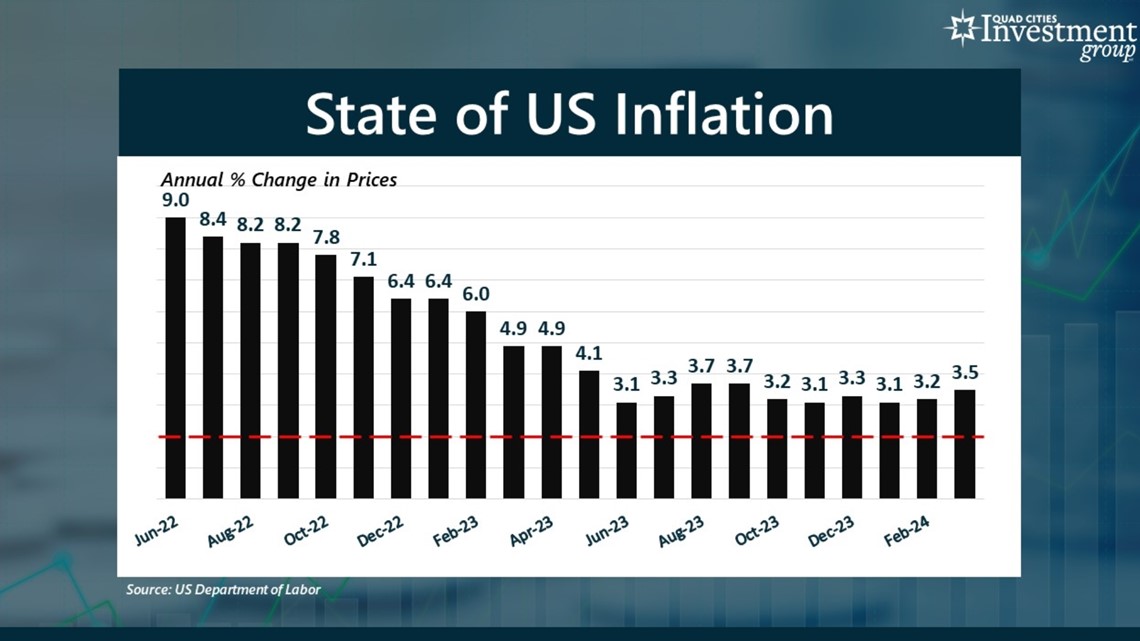

MOLINE, Ill. — Rising consumer prices have remained a challenge for most American households. The price you pay for everyday goods and services continues to cost consumers a lot more. Though the rate of inflation has declined from its peak of 9%, inflation still remains stubbornly high. On Wednesday, the Department of Labor reported the rate of inflation jumped higher from 3.2% up to 3.5%, a six-month high.

News 8's David Bohlman spoke with Mark Grywacheski from the Quad Cities Investment Group about the recent inflation report and the state of prices in the U.S.

David: What are your thoughts on this latest inflation report that was released last Wednesday?

Mark: It’s certainly not what Wall Street was hoping to see. Last June, when inflation had declined to 3.1%, there was some hope that it would continue to decline to that ideal, target rate of inflation we want to get back to. But over the past nine months, those hopes have quickly been dashed.

That steady decline in the inflation rate from June 2022 to June 2023 has basically hit a brick wall. In March, the national unemployment rate jumped from 3.2% up to 3.5%, a six-month high. March was the 46th consecutive monthly rise in consumer prices. So, here we have this inflation problem that’s well into its 3rd year that simply just won’t go away.

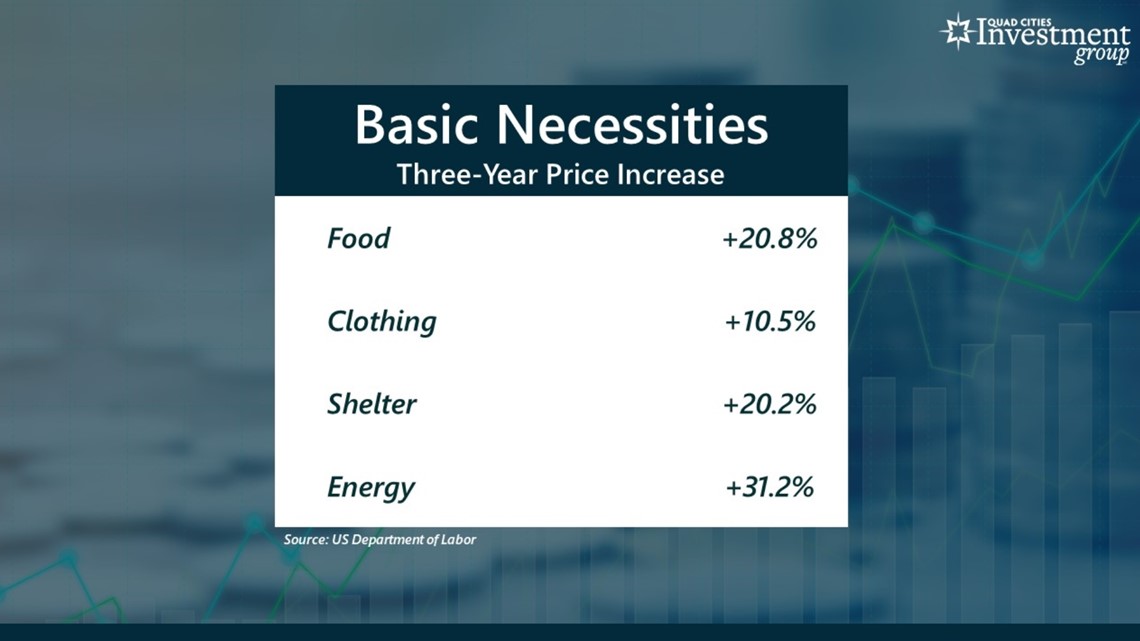

David: One of the areas most impacted by this inflation has been everyday basic necessities. Are we finally starting to see some relief or moderation in this area of consumer spending?

Mark: One of the identifying characteristics of this current inflationary cycle is that one of the areas hardest hit by these rising consumer prices has been everyday basic necessities: food/clothing/shelter/energy.

Over the past three years, food prices have risen 21%. The cost of shelter has increased by 20%. Energy prices have risen over 31%. Now, over the past few months, we have seen some moderation in clothing and energy prices. However, we continue to see this steady, upward pressure on food and shelter costs.

The fact that everyday basic necessities have been one of the hardest hit areas for inflated prices, makes it very difficult for consumers to navigate this inflationary landscape. It’s not that these are what we call “high-end luxury goods and services” that consumers can simply do without. They need to buy these items to provide for themselves and their families.

David: With the ongoing conflict between Israel and Hamas - and now we’re seeing an expanded conflict between Israel and Iran - what’s the potential impact on inflation here in the US?

Mark: When the Israel/Hamas conflict first broke out in October, the initial consensus was that it was an isolated conflict and wouldn’t have much impact on the US economy or the global economy. However, the big concern is if this conflict starts expanding across the broader Middle East region, which is home to some of the world’s largest oil fields and largest oil-producing nations.

But if this conflict is now spreading to Iran, and potentially other Middle East countries, this could quickly send oil prices much higher. Over the past 1-2 weeks, we’ve seen crude oil prices jump to a 6-month high of around $85/barrel. But if oil continues to rise from $85/barrel to $90 or even $100, that could send US inflation surging much higher. And if US consumers, businesses and manufacturers see a massive spike in gasoline, diesel and energy prices, to what extent does that negatively impact the direction of the American economy?

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on our YouTube channel