MOLINE, Ill. — On Tuesday, the U.S. Census Bureau released its monthly Retail Sales Report for April. The retail industry reported just over $705 billion in sales in April, equaling March’s sales total. Six of the 13 retail sectors reported a monthly increase in sales. Over the past 12 months, retail sales have increased by 3%.

News 8's Charles Hart spoke with Mark Grywacheski from the Quad Cities Investment Group about the current state of consumer spending.

Charles: Obviously, consumers have been impacted by high inflation over the past three years. But looking at this latest report, what is the current state of consumer spending?

Mark: Despite three years of high inflation, consumer spending has remained resilient. But that said, we’re starting to see some cautionary flags about how long that resiliency can last. This latest Retail Sales Report does indicate a continued softening in consumer spending.

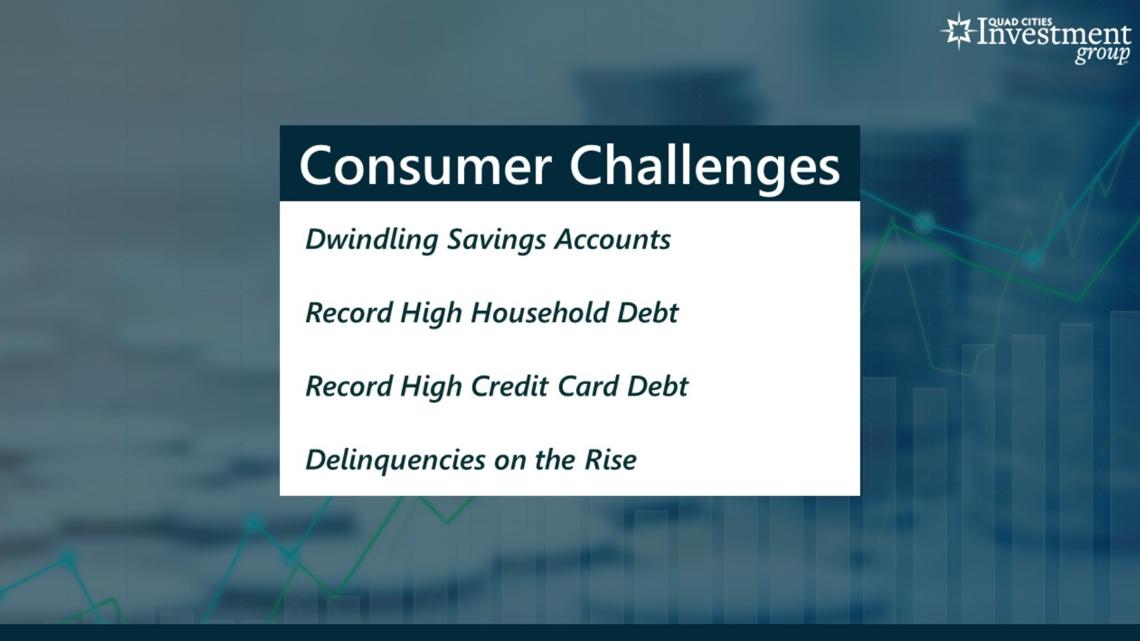

One of the biggest challenges we are seeing is a continued decline in consumer savings accounts. Back during the height of the global pandemic, people couldn’t go out and spend their money. Then combine that with stimulus checks and other government money given out. So, all that excess cash was sitting in people’s savings accounts. But now, that excess cash is pretty much gone.

Because savings accounts are declining:

- Americans have been forced to take on a record-high amount of household debt.

- Credit card debt is also at an all-time high.

- The number of delinquencies is on the rise:

- In May about 9% of all credit card balances transitioned into delinquency.

- In May about 8% of all auto loan balances transitioned into delinquency.

So, at some point, the consumer has to say, look, I don’t have any more cash to spend and I’m certainly not going to take on any more debt.

Charles: On Thursday, Walmart surprised Wall Street by reporting its 1st quarter earnings exceeded $161 billion — a 6% increase over last year. If consumer spending is starting to ease, why is Walmart doing so well?

Mark: Not only is Walmart America’s largest retailer but it’s often viewed as a bellwether for the state of the economy. Historically, Walmart is a place where budget-conscious families can get good value for money. And with 3+ years of high inflation, Walmart has focused on how it can expand providing that value for money to make it more attractive to consumers. It’s even adding higher-end, luxury brands to attract a more affluent customer base. In fact, during its last 3-month quarter, Walmart said that 2/3 of its gain in general merchandise sales came from households making more than $100K/per year.

Charles: Amazon also reported its latest quarterly earnings. What do their results say about the state of online shopping?

Mark: Amazon is the world’s largest online retailer and is the gold standard of online shopping platforms. Roughly 38% of all online shopping in the US is done on Amazon. The 2nd largest online retailer is Walmart, which accounts for just 7% of all online shopping.

Last year, Amazon reported global revenues of $554.02B. This year, that’s expected to rise by another 6%-7%. Every year, online shopping continues to take a bigger slice of the retail shopping pie. But given this high-inflation landscape, more and more consumers are using Amazon to help them research their expected purchases. 9 out of 10 shoppers will use Amazon to help them find low-cost items and the best value for money.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel