MOLINE, Ill. — When it comes to determining the health and vitality of our economy, the American consumer reigns supreme! Consumer spending drives roughly 70% of our nation’s economic growth. But last week, the nation’s retail industry reported that sales in January fell by 0.8%, the largest monthly decline in nearly ten months.

News 8's Charles Hart spoke with Mark Grywacheski of the Quad Cities Investment Group about the state of consumer spending.

Charles: What does this latest Retail Sales report say about the state of consumer spending?

Mark: We’ve had high inflation for three years. We’ve had high-interest rates for nearly two years. Today, interest rates on many types of consumer debt are at/near a 40-year high. And the concern on Wall St. is: At what point does this start to shut down consumer spending?

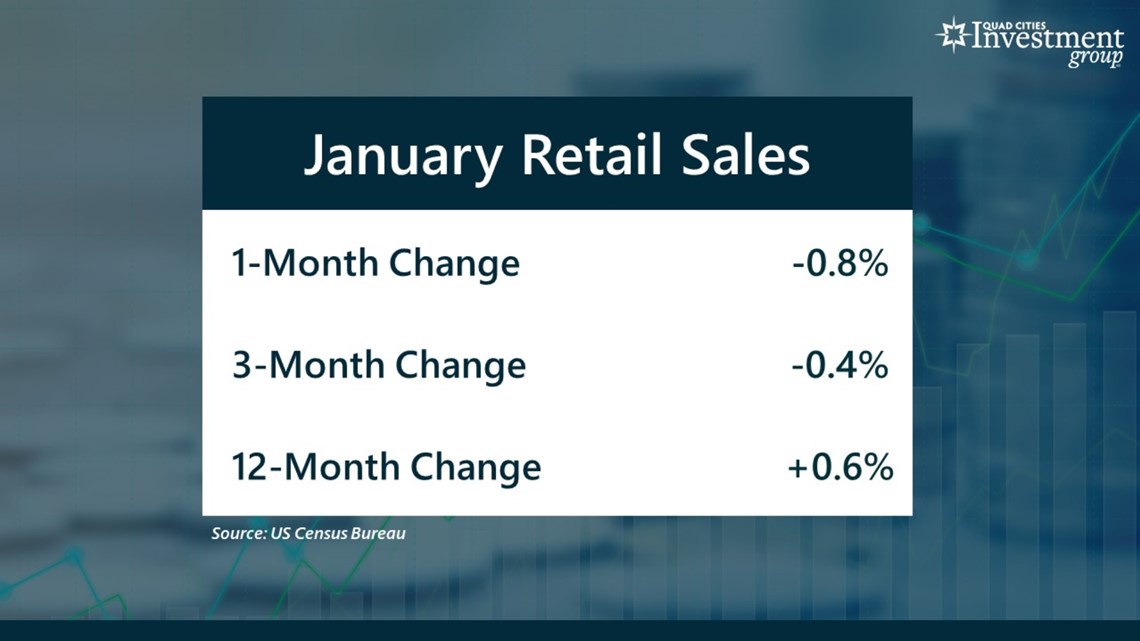

In January, retail sales fell by 0.8%. We’ve now had declining retail sales in three of the past four months. This was also the largest monthly decline in ten months. I think the size of this decline is overstated because of the adverse weather much of the country had back in January.

But that said, retail sales have declined by 0.4% over the past three months. Over the past year, retail sales have increased by just 0.6%.

So, even though I do think it’s too early to say that consumer spending is starting to dry up, this recent retail sales data has certainly raised some cautionary flags on Wall St.

Charles: To what extent do you think the labor market has helped drive consumer spending?

Mark: Despite all this inflation and high-interest rates, the labor market has remained fairly strong. The unemployment rate is at 3.7%. There are currently about 9 million unfilled job openings around the country. This conveys there’s still a strong demand by employers for qualified workers.

Typically, when jobs are plentiful and consumers are optimistic about their current/future employment situation, they do tend to spend their money much more freely.

Charles: Consumers have been struggling with high inflation for nearly three years. Why haven’t we seen a much more negative impact on consumer spending?

Mark: Over the past three years, these very high consumer prices have forced Americans to pull money from their savings/retirement accounts, to take on a lot more household debt and to take on a lot more credit card debt. But then you have to ask yourself, how much more can that last?

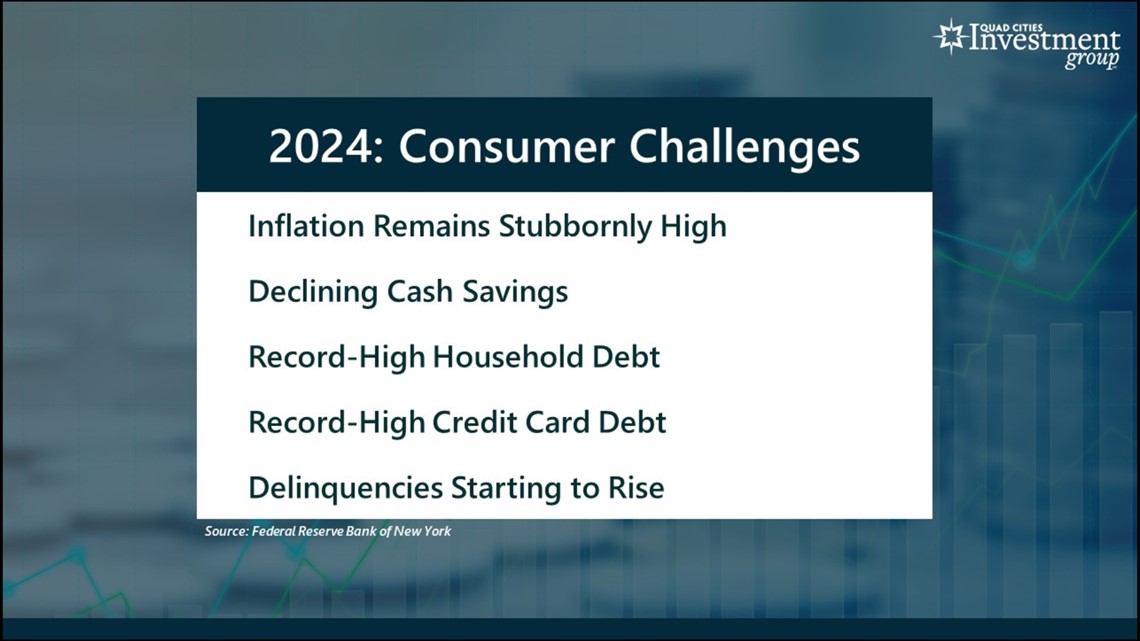

- First and foremost, inflation remains stubbornly high. Inflation has become quite embedded within our economy and is proving quite difficult to get rid of.

- Cash savings accounts are dwindling.

- Total household debt is at a record high.

- Credit card debt is at a record high. Over the last three years, credit card debt has increased by nearly 40%.

- Delinquencies are starting to rise, especially with credit card debt. The rate at which many credit card balances have become 30 days delinquent or 90 days delinquent is at the fastest pace in over 12 years.

___________________________

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. Quad Cities Investment Group may render no advice unless a client service agreement is in place.