MOLINE, Ill. — On Tuesday, The Conference Board released its monthly Consumer Confidence Index for May. Last month, The Conference Board reported a slight increase in consumer confidence after declining for three consecutive months. The Conference Board cited that concerns over inflation are still having the greatest impact on Americans’ sense of optimism.

News 8's Charles Hart spoke with Mark Grywacheski from the Quad Cities Investment Group about the importance of the Consumer Confidence Index.

Charles: Any time the Consumer Confidence Index is announced, it always garners attention. Why is consumer confidence so important to Wall Street?

Mark: It’s important to Wall Street that optimistic and confident consumers tend to spend their money much more freely, which ultimately powers the economy forward. The American consumer IS the main driver of our economy. Consumer spending accounts for more than 2/3 of our nation’s total economic growth. So, even if you have strong business spending and strong government spending, if the American consumer starts to tighten up their wallets, it really sets the tone and direction for the entire American economy.

Charles: When you take a closer look at the latest Consumer Confidence Index that was just released, what are your thoughts on the state of consumer confidence?

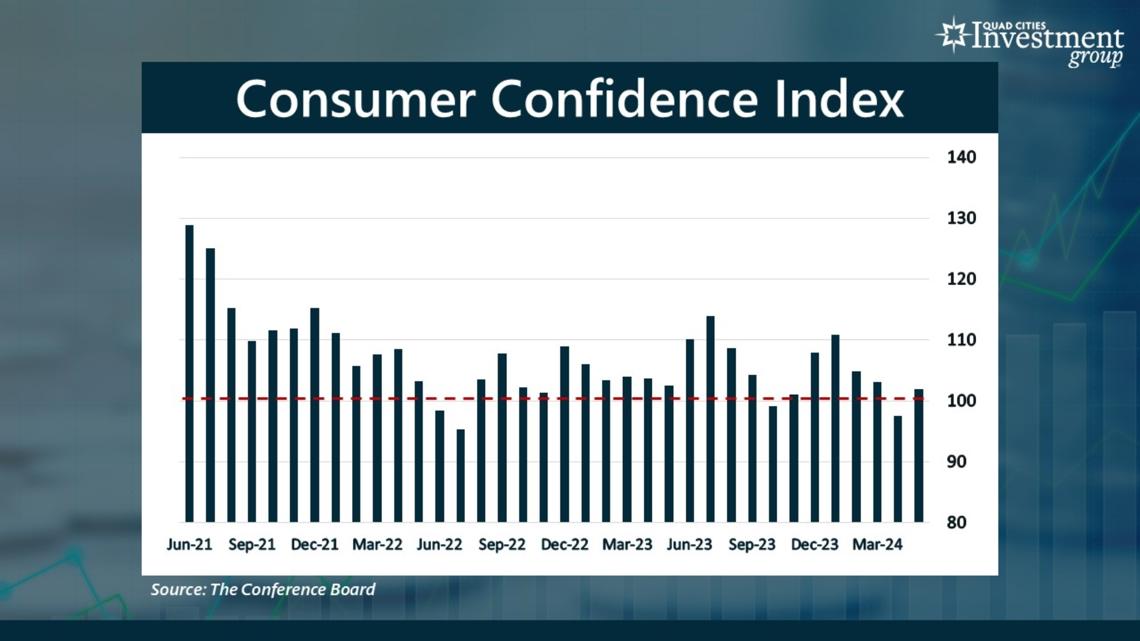

Mark: The Consumer Confidence Index has a benchmark of 100. Any level above 100 indicates optimism by consumers on jobs, income and the economy. Below 100 conveys pessimism. For some perspective, the all-time low for the CCI index is 25 set back in February 2009 during the global financial crisis. The all-time high was reported at 144 in May 2000.

Last month, the index jumped from 97.5 to 102. So, the index conveys the American consumer went from slightly pessimistic to slightly optimistic. Historically, an index level between the range of 120-130 conveys a solid level of confidence. But for the past three years, the index has hovered just above that benchmark 100 level which is the dividing line between optimism and pessimism. As The Conference Board reinforced in its latest report, inflation/high costs act as the biggest weight on the American consumer.

Charles: In its Report, The Conference Board cited a tremendous gap between short-term and longer-term consumer confidence. Why is that?

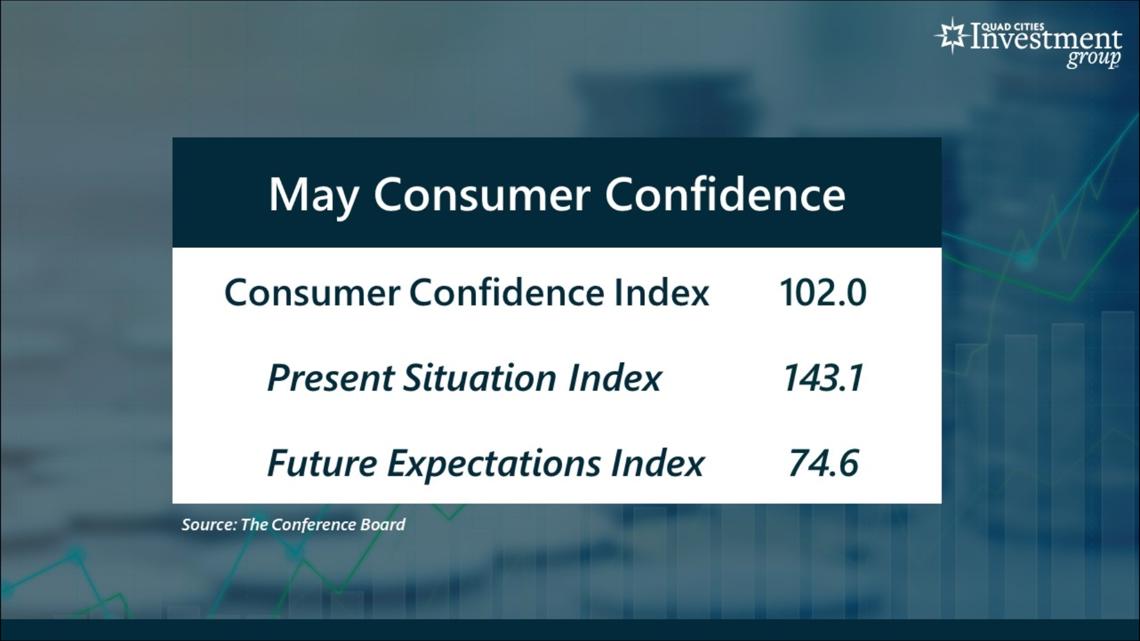

Mark: The Consumer Confidence Index is made up of two components:

- The Present Situation Index — which measures consumers’ degree of confidence right now

- The Future Expectations Index — which measures consumers’ outlook over the next 6 months

The Present Situation Index is very high at 143.1. That high degree of current optimism is being driven by a fairly strong labor market. Job stability has the greatest impact on family finances. When jobs are plentiful and people feel secure in their job outlook, they tend to be much more confident and optimistic.

Conversely, the Future Expectations Index is very low at just 74.6. This pessimistic future outlook is primarily of concerns of the US economy going back into a recession.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more Your Money with Mark segments on News 8's YouTube channel