MOLINE, Ill. — With many interest rates on consumer debt at or near a 40-year high, it now costs consumers a lot more to borrow money. As a result, higher interest rates on credit cards, home mortgages and auto loans have placed a tremendous strain on many household budgets. But when will interest rates finally start to decline and give Americans some much-needed relief?

News 8's Devin Brooks spoke with Mark Grywacheski of the Quad Cities Investment Group to discuss the most likely scenario.

Brooks: Why did interest rates get so high in the first place?

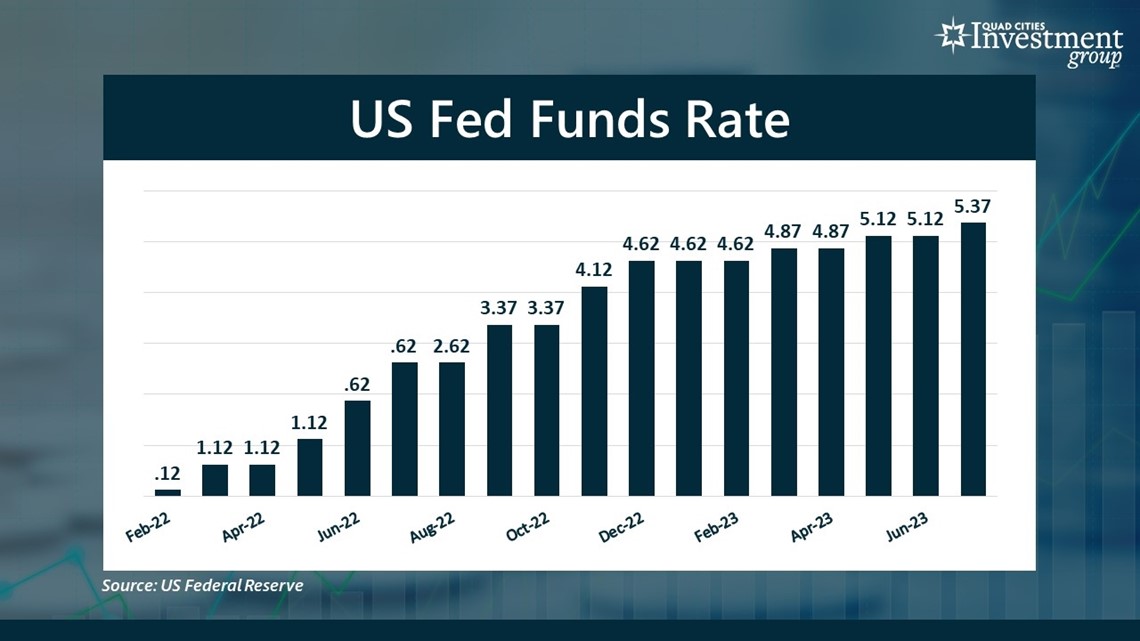

Grywacheski: The reason interest rates rose so high is because the Federal Reserve rapidly increased what’s called the Fed Funds Rate. The Fed Funds Rate serves as a basis for many forms of consumer debt — credit cards, bank loans, auto loans, HELOCs and home mortgages. And as the Fed Funds Rate is increased, that will typically drive interest rates on many of those types of consumer debt.

This has been the most aggressive pace of increases to the fed funds rate in over 40 years. And the reason the Federal Reserve has been so aggressive in raising the Fed Funds Rate is to help tap the brakes on surging inflation. As interest rates rise, it makes it more expensive for consumers and businesses to borrow money — you’re now being charged a higher interest rate. And the Federal Reserve hopes that will lower consumer spending and help drive consumer prices lower.

Devin: Why has the Federal Reserve kept interest rates high for so long?

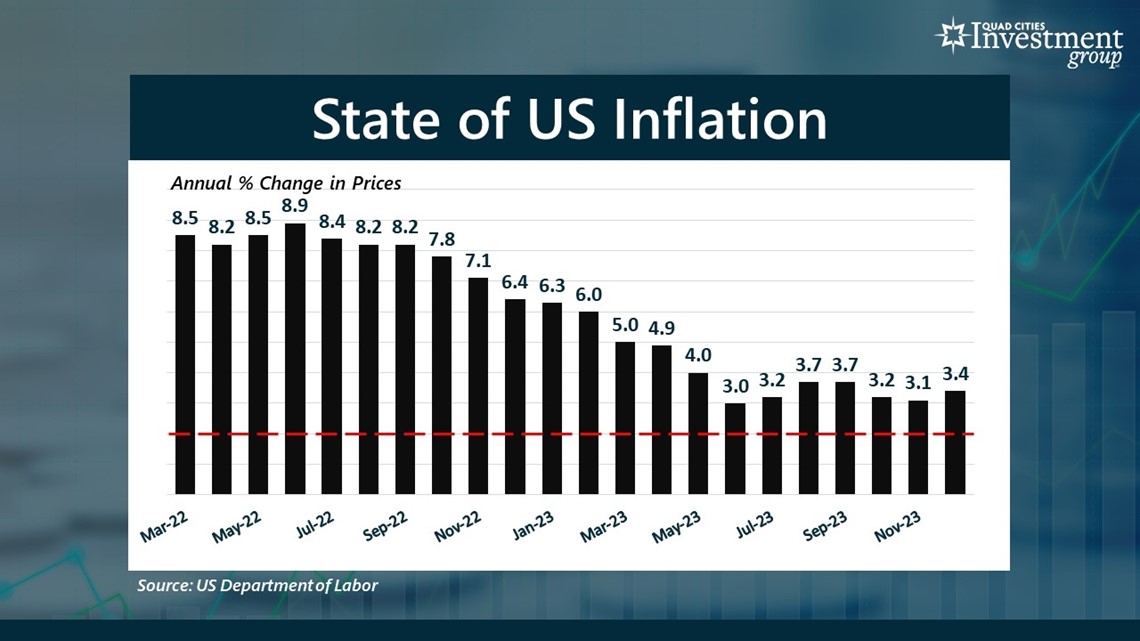

Mark: It’s because this inflation, which started to rise about three years ago, has remained quite stubbornly high. The ideal target rate of inflation the Federal Reserve wants to get back to is around 2%.

Now, inflation has declined from its peak of 8.9% in June 2022 to 3% in June 2023. But the latest report now shows inflation a bit higher at 3.4%. And when you take a deeper dive into the inflation data, it shows that inflation has become quite embedded within the US economy. And the deeper inflation has become embedded within the economy the more difficult it is to get rid of.

Devin: When do you think the Federal Reserve will finally start to lower interest rates?

Mark: There was some hope that the Federal Reserve would start lowering interest rates as soon as March, which is just a couple of months away. But at the Federal Reserve’s meeting on Wednesday, Fed Chair Jerome Powell quickly ended that hope.

A lot of the economic data we’ve seen over the past few months reinforces the notion that inflation has remained stubbornly high. The risk of lowering interest rates too soon is that it risks re-igniting inflation even higher. In other words, when you start lowering interest rates, it makes it easier and cheaper for people and businesses to borrow money. And that inherently fuels consumer spending and potentially drives consumer prices even higher — which we don’t want.

So, the Federal Reserve has to be very careful in just how fast it can lower interest rates without re-igniting inflation. The odds right now are that the Federal Reserve will start to lower interest rates in May or June. But again, this will be a very slow, gradual process.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel