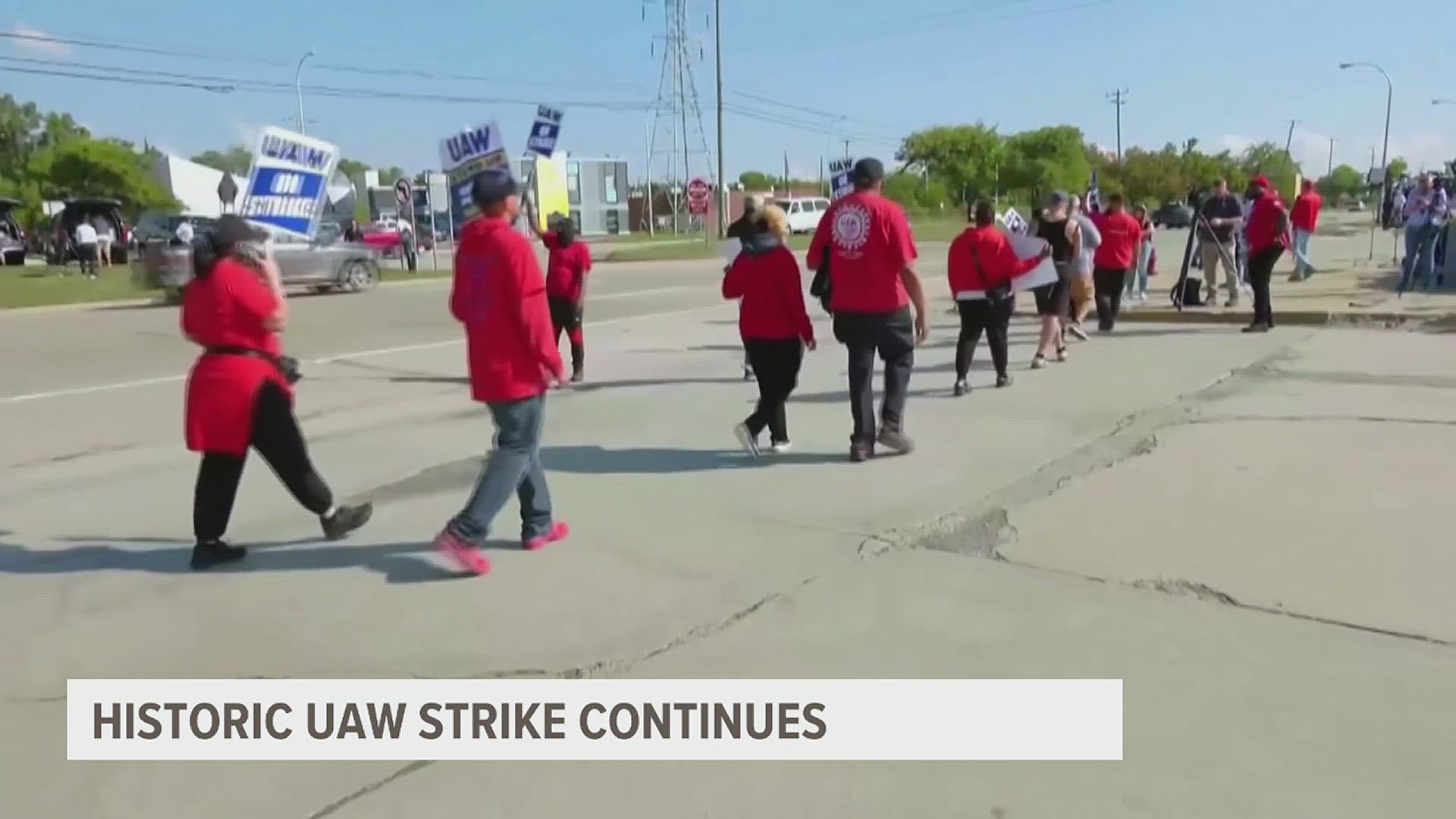

MOLINE, Ill. — On Friday, Sept. 15, the United Auto Workers announced a targeted strike at three manufacturing plants owned by the "Big Three" automakers – General Motors, Ford, and Stellantis.

The strike is a response after the UAW and Big Three automakers failed to reach a new labor agreement which expired at midnight on Thursday, Sept. 14. The UAW announced roughly 13,000 union workers went on strike Friday morning at General Motors’ Wentzville, MO plant, Ford’s Wayne, MI plant, and Stellantis’ Toledo, OH plant.

Workers at the other Big Three auto plants will continue to work without a new labor agreement but the UAW warns the strike may be expanded to other plants. On Sept. 22, it was announced that the union would expand its strike at 38 locations across 20 states. Approximately 5,6000 workers will join the 13,000 already on strike.

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss the potential ramifications of the strike.

Bohlman: How might this strike impact the economy?

Grywacheski: The impact on the economy, the Big Three automakers as well as the striking workers, will ultimately depend on how long the strike lasts. But at this moment, it appears both sides remain far apart from any type of resolution.

As for the economy, the U.S. economy is entering a very delicate phase. Even before this strike, the economy was already expected to significantly weaken in the Oct.-Dec. fourth quarter or at the start of 2024. Now, whether the economy dips into recession or not is still of much debate. Depending on who you ask, there’s about a 50/50 chance we do go into recession. But either way, the economy is expected to significantly weaken.

Now, as for the strike, it’s only three days old (as of Monday, Sept. 18) and limited to 13K workers at three plants. But if this strike continues to drag on and expands to all 150K UAW workers, that’s a significant blow to the economy. And in my opinion, that would increase the odds of a recession either later this year or at the start of 2024.

Bohlman: In what ways can a strike like this cause disruption to the economy and other companies?

Grywacheski: It’s not just the financial impact to the workers on strike or to the Big Three automakers. But as we saw here with John Deere in the Quad Cities, there’s an expansive network of vendors, suppliers, and companies that supply parts, materials, and services to John Deere. And during a strike, those companies (along with their workers) will also be impacted.

But also, those companies have their own network of vendors and suppliers. So, with companies the size and scope of General Motors, Ford, and Stellantis, the impact of a strike reverberates across much of the country.

Bohlman: To what extent do you think the strength of the labor market will play in negotiations between the UAW and the Big Three automakers?

Grywacheski: Two years ago, we really saw the height of the labor shortage. The number of unfilled job openings had soared from 7 million to a record high of over 12 million. This created a transformational shift in power from the employer to the employees as companies were desperately trying to find qualified workers. And we saw labor utilize that leverage in the John Deere strike back in late 2021.

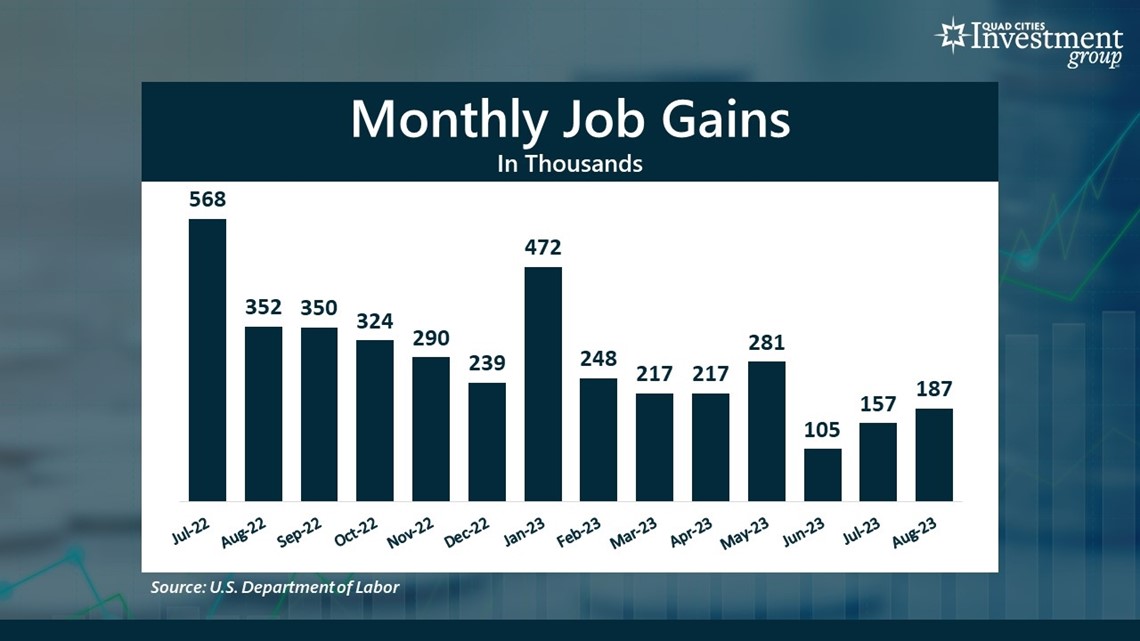

Now, without question, the labor market is still fairly strong, but it has been weakening. The number of new jobs being added each month has been steadily declining. The number of unfilled job openings has been steadily declining- especially in the manufacturing sector. Over the past 15 months, the number of unfilled job openings in the manufacturing sector has been cut in half!

So, that shift in power still benefits the UAW but not to the extent it did about two years ago.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel