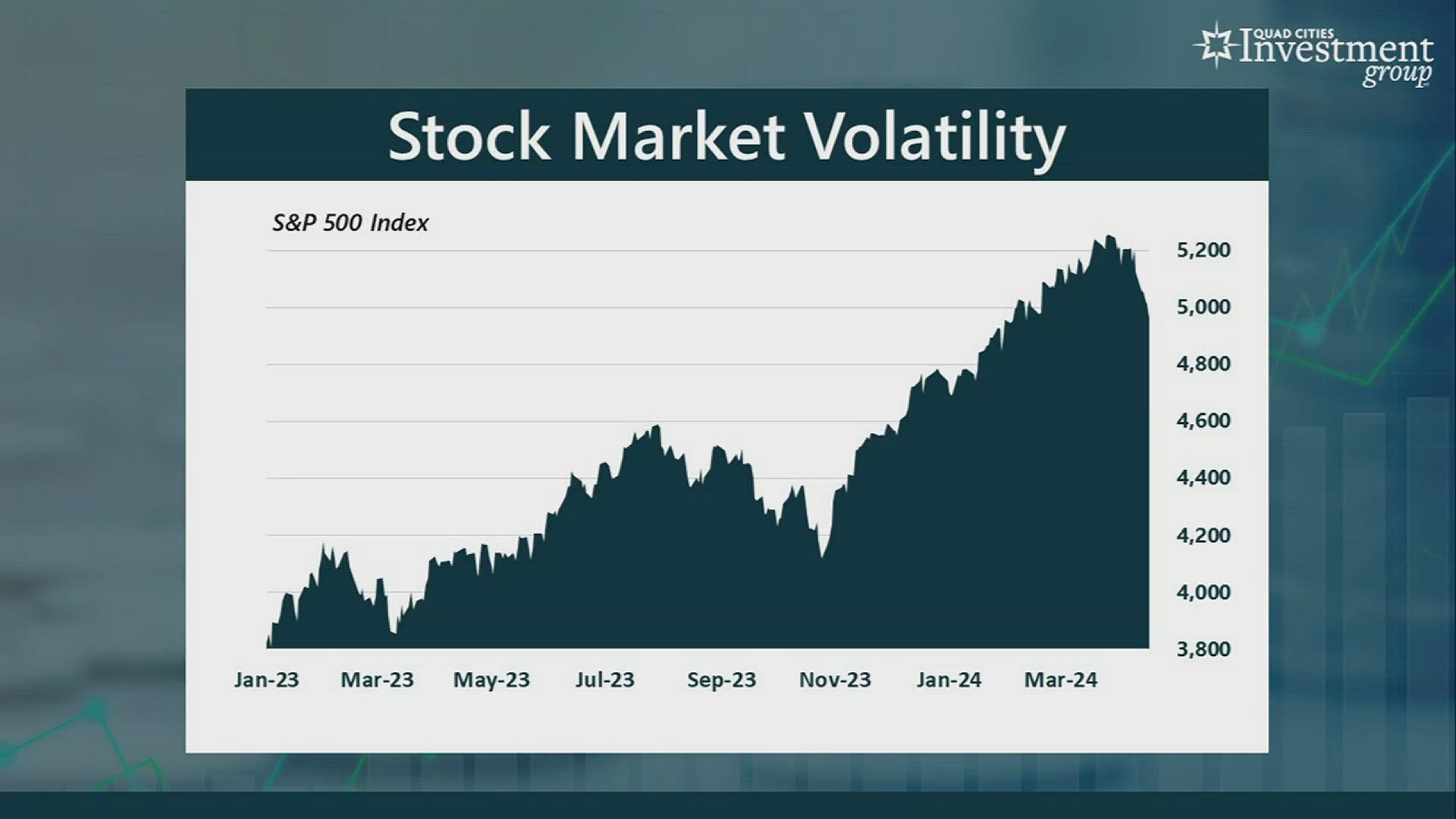

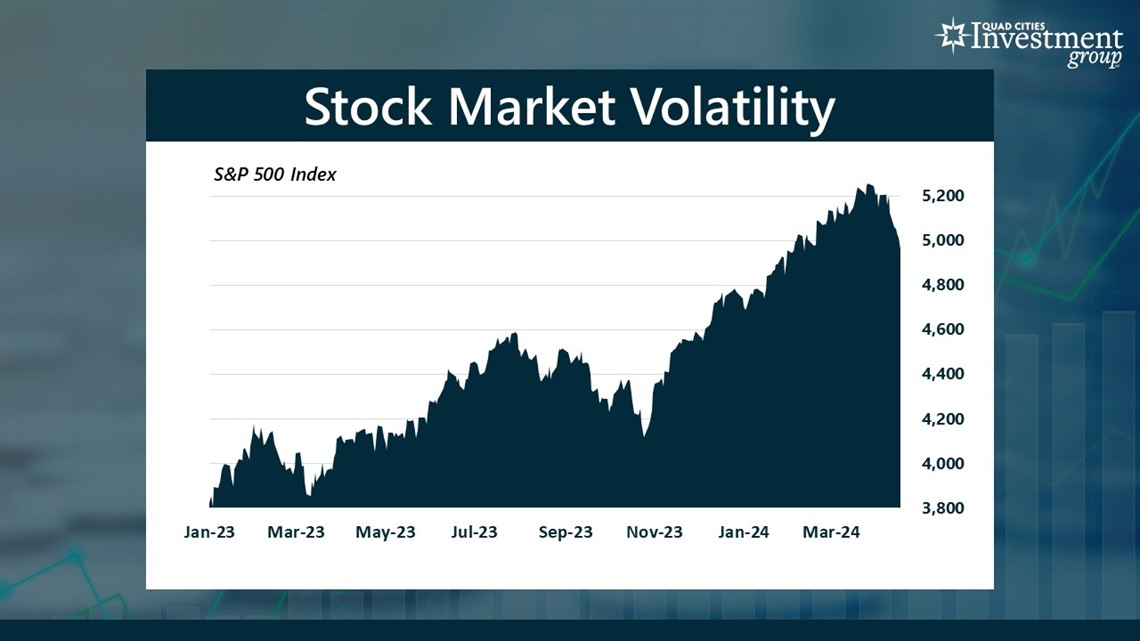

MOLINE, Ill. — It was a rough past week for investors and the U.S. stock market. On Friday, the benchmark S&P 500 stock index fell for the sixth consecutive day — its longest losing streak since October. This week the S&P 500 fell 3.1% while the tech-heavy NASDAQ declined by 5.5%.

David: What’s driving this recent sell-off in the stock market?

Mark: For much of the past year, we’ve seen this steady rise in the stock market driven by Wall Street’s energy/excitement over AI. But every few months it seems we get a rash of economic data that indicates inflation remains a significant problem for the US economy. And that’s what we’re seeing again now.

1 ½ weeks ago the latest inflation data showed that inflation jumped from 3.2% to 3.5%, a 6-month high. Then on Tuesday, Federal Reserve Chair Jerome Powell admitted that this inflation problem isn’t going away soon. Because inflation has remained so stubbornly high, the Federal Reserve will likely be forced to keep interest rates higher for longer. And when you look back at history, the longer you have high inflation and high interest rates, the greater the risk and potential impact on the US economy. And that apprehension pops up occasionally in these sudden pullbacks in the stock market.

David: Does this recent volatility in any way change your longer-term view of the stock market?

Mark: In my opinion, in the longer term I remain quite bullish and optimistic in the US stock market. I think at the heart of this stock market is Wall Street’s powerful fascination with AI where it wants to drive stock prices higher. I think Wall Street views AI as a historic moment of groundbreaking innovation that will impact economies and societies for generations. I think Wall Street is correctly looking at the impact of AI not just in the short-term but 5/10/20 years down the road.

But that said, in the meantime, there are a lot of anxieties that are leaving Wall Street a bit skittish:

- High inflation.

- High-interest rates.

- Does the new Israel/Iran conflict spread across the broader Middle East?

- There’s a Presidential election in less than 6 months.

- So, in my opinion, I do think we’re likely to see these bouts of volatility in the stock market throughout the rest of the year.

David: One of the big challenges consumers continue to face is high-interest rates. When do you think we’ll finally start to see interest rates decline?

Mark: Remember, it was the Federal Reserve that started raising interest rates back in March 2022 to try and get this inflation under control. But the Fed understands that if it starts lowering interest rates too soon, it risks reigniting inflation even higher.

When the Federal Reserve lowers interest rates, creating cheaper prices on goods and services on credit. This fuels consumer spending and creates an upward pressure on prices- which the Fed doesn’t want to see happen.

We saw something very similar in the mid-1970s/early 1980s. At the time, inflation had fallen from 12% to about 4-5%. And the Fed prematurely declared victory over inflation and started lowering interest rates. But then inflation reignited and surged to over 14%. The Fed wants to avoid a repeat of that disaster.

Back in January, there was hope that the Fed would be able to start lowering interest rates in 2024. But if inflation remains stubbornly high, that timeline might get pushed back into 2025.

Watch more news, weather and sports on News 8's YouTube channel