MOLINE, Ill. — High inflation has taken its toll on many household budgets. It now costs the average American household an extra $13,000 per year more to buy the same goods and services they bought three years ago. But rising consumer prices have impacted retirees especially hard. According to a recent survey, inflation will force one in eight retired Americans to return to the workforce in 2024.

News 8's David Bohlman spoke with Mark Grywacheski of the Quad Cities Investment Group about how inflated prices will impact Americans.

Bohlman: Why has inflation impacted retirees so much more than many other Americans?

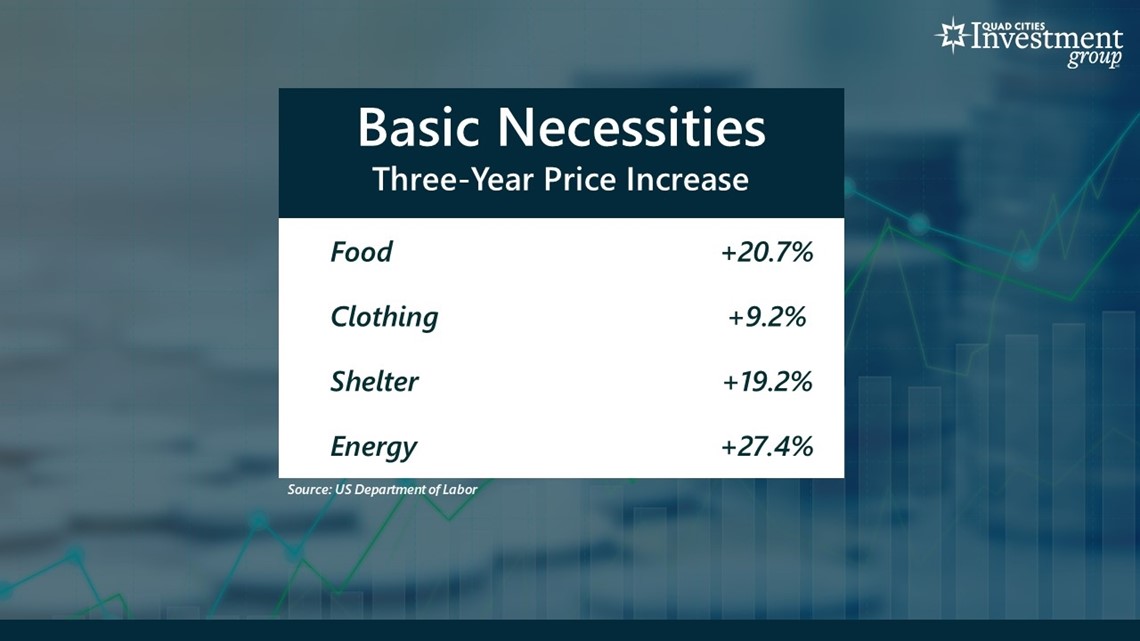

Grywacheski: Historically, inflation tends to impact retirees and low-income households the most. These two demographics typically spend the greatest percentage of their income on basic necessities. And one of the hallmarks of this current inflationary cycle is that some of the largest price increases have been on everyday basic necessities – food, clothing, shelter and energy. Since February 2021 (3 years ago):

- Food prices have risen a cumulative 20.7%.

- Clothing prices have increased 9.2%.

- The cost of shelter has risen 19.2%.

- Energy prices have risen 27.4%.

Bohlman: In what ways can retirees limit the impact from inflation?

Grywacheski: Unfortunately, retirees and lower-income households have little room to maneuver to avoid these high prices. And that’s why we’re seeing this influx of retirees back into the labor market. Food, clothing, shelter and energy are not exactly high-end luxury items you can simply do without. These aren’t what we call “discretionary items” like vacation spending. For example, instead of flying the family to Florida for 2 weeks this summer you stay local. Or, maybe you just forego a vacation this year. You can’t do without basic necessities. Americans need to buy these items to provide for themselves and their families.

Bohlman: We’ve had a lot of economic data released over the past few months. What’s the current state of inflation?

Grywacheski: According to the latest Consumer Price Index, inflation is currently at 3.1%. But remember, the ultimate goal is to get back down to that ideal, target rate of just 2%. I think that return path back to 2% will be a slow, gradual process. The challenge we’re seeing is that because we’ve had this excessively high inflation for three years, it’s become quite imbedded within the economy. And that means it’s going to take longer to get rid of.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel