MOLINE, Ill. — The subject of artificial intelligence has quickly become a hot topic on Wall Street. But how quickly are businesses looking to embrace this groundbreaking technology? And for the roughly 160 million Americans currently employed, what impact could artificial intelligence have on the labor market?

News 8's David Bohlman spoke with Mark Grywacheski of the Quad Cities Investment Group about how the AI craze has boosted NVIDIA's revenue.

Bohlman: Explain to us a little bit more what AI actually is?

Grywacheski: There’s a number of different sub-categories of AI, but at a very, very broad level, there’s two main categories: “weak” AI and “strong” AI.

- Weak AI is teaching/instructing a computer or machine to do a defined set of tasks. And it can’t operate beyond that defined task or knowledge base. For example, AI is currently used in self-driving automobiles. That same AI technology can’t be used to help balance your checkbook because that AI technology was created for a specific task — to drive your car.

- The other major category is called “strong” AI and right now that technology currently doesn’t exist. But you’re getting into what’s called “machine learning”. It’s where a machine or computer takes a pre-existing knowledge base and teaches itself how to do new and different tasks.

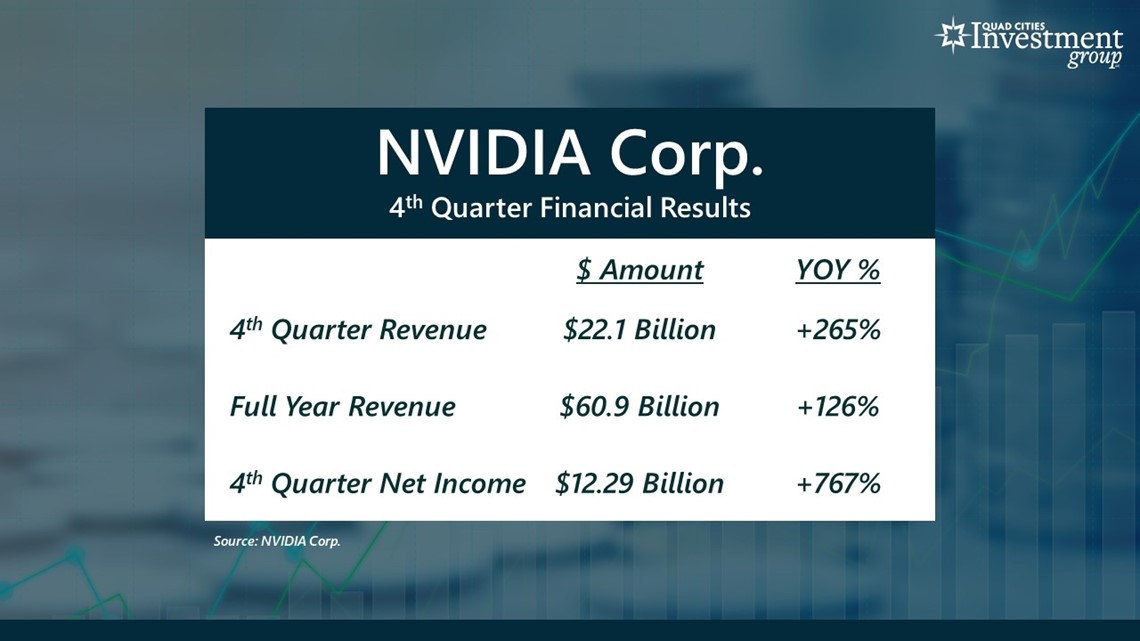

Bohlman: Last week NVIDIA Corporation released their latest quarterly earnings. What are your thoughts on their latest financial results?

Grywacheski: NVIDIA is one of the leading companies in this AI movement. NVIDIA is the primary manufacturer of the microchip processors used in computers and machines to power AI applications. NVIDIA currently controls more than 90% of that market. On Wednesday, NVIDIA released its quarterly financial results for the Q4:

- Its Q4 revenue was $22.1B, up 265% from the Q4 of last year.

- It reported full-year 12-month revenue of $60.9B, up 125% from the prior year.

- Finally, its Q4 net income (profits) was $12.29B, up 767% from the Q4 of last year. No, that’s not a typo!

Since Jan. 1, 2023, NVIDIA’s stock has risen 439%. On Wednesday, its CEO said “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.”

So, what NVIDIA is saying is — and being proven by its financial results — is that this fascination with AI is being backed up by companies around the world demanding AI technology to implement within their own companies.

Bohlman: This all leads to the question, how will AI impact the labor market?

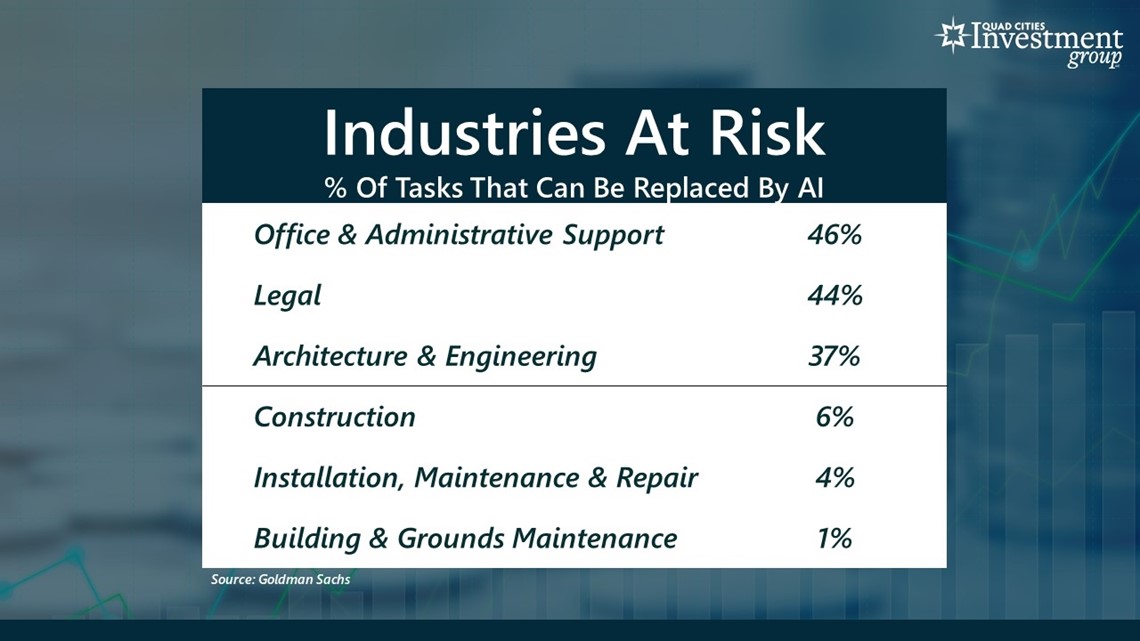

Grywacheski: According to a recent study, within the U.S. alone, roughly 25% of all current work could be fully replaced with AI.

Historically, advancements in technology have impacted lower-wage, manual, physical tasks the most. For example, machine automation on a factory floor or a financial institution using computers to process vast amounts of transactions in seconds. But research suggests that AI is expected to have a much greater impact on higher-waged, professional, white-collar employees.

For example, the industry with the highest exposure to AI is Office & Administrative Support, where an estimated 46% of all tasks could be replaced with AI. The 2nt most at-risk industry is the legal profession, where 44% of all work tasks could be replaced with AI.

Conversely, physically intensive occupations are less likely to be replaced with AI.

For example, just 1% of tasks in the Building & Grounds Maintenance industry could be replaced by AI.

Historically, however, any displacement in the labor market tends to be a more gradual process rather than an overnight event.

Watch more news, weather and sports on News 8's YouTube channel