MOLINE, Ill. — It’s a new year and that means thousands of Americans are pursuing their New Year’s resolutions. Whether the goal is to adopt a diet plan to shed a few extra pounds, or maybe learn a new skill, it’s the perfect time to set those goals. Financial Analyst Mark Grywacheski reminds us to create financial goals for the new year as well.

Devin: A lot of people make New Year’s resolutions to try and make some positive changes to their lives. What do some of the latest surveys suggest Americans will be focusing on this year?

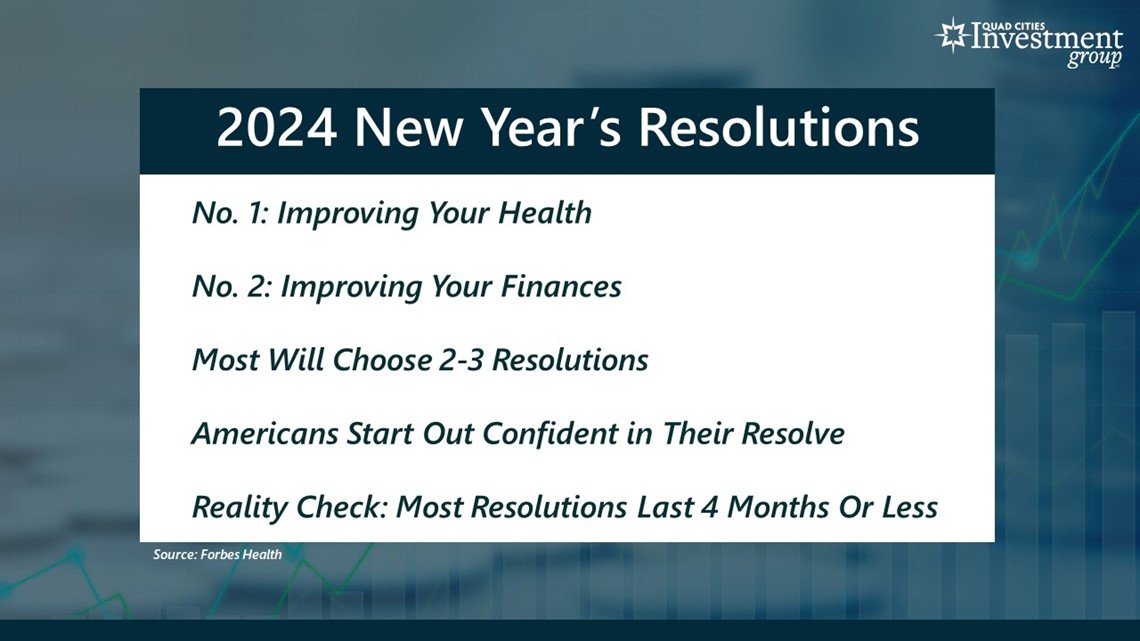

Mark: There are two major themes for this year’s resolutions.

The #1 resolution this year is improving a person's health by:

- Getting in better shape.

- Improving your diet.

- But also improving mental health.

The second most popular resolution is improving finances. Americans have been struggling with high inflation and rising interest rates. Total household debt and household credit card debt are both at record highs.

- Most Americans will choose about 2-3 resolutions to focus on.

- Americans start confident in their resolve. 80% feel confident they can achieve their resolution goals.

- But in reality, about 2/3 of all resolutions last just 4 months or less.

Devin: When it comes to financial resolutions, what steps are Americans looking to take to improve their household budgets?

Mark: The first financial resolution in 2024 is to save more money. 80% of Americans hope to build up their emergency savings. As a general rule, you should have enough emergency savings to cover 3-6 months of expenses.

The second most popular financial resolution is to pay down debt. With many interest rates at/near 40-year highs, the interest payments you’re charged on that debt can be quite punishing.

The third most popular financial resolution is to spend less money.

The biggest financial concern Americans have as they start the new year is the impact of inflation. Because of rising prices, the average American household is now paying about $10K/year for the same goods and services they bought 3 years ago.

Devin: What advice do you have for people who plan on setting some financial resolutions this year?

Mark: Try not to make it overly complex. Pick out 2-3 goals that you can focus your efforts on.

Create a monthly budget. This allows you to track/monitor your progress and helps account for those larger expenses that might pop up.

Be disciplined. If you have a sudden large expense, don’t give up. Regroup and stay focused on your goals and getting back on track.

Watch more news, weather and sports on News 8's YouTube channel