MOLINE, Ill. — High inflation and rising prices have placed significant strains on American families and their household budgets. On Thursday, Oct. 12, the Department of Labor released its September inflation report which showed that consumer prices rose another 0.4% last month. September marked the 40th consecutive monthly increase in consumer prices, the longest streak in 41 years.

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss the future of inflation.

Bohlman: What did this latest report from the Department of Labor convey about the ongoing state of inflation?

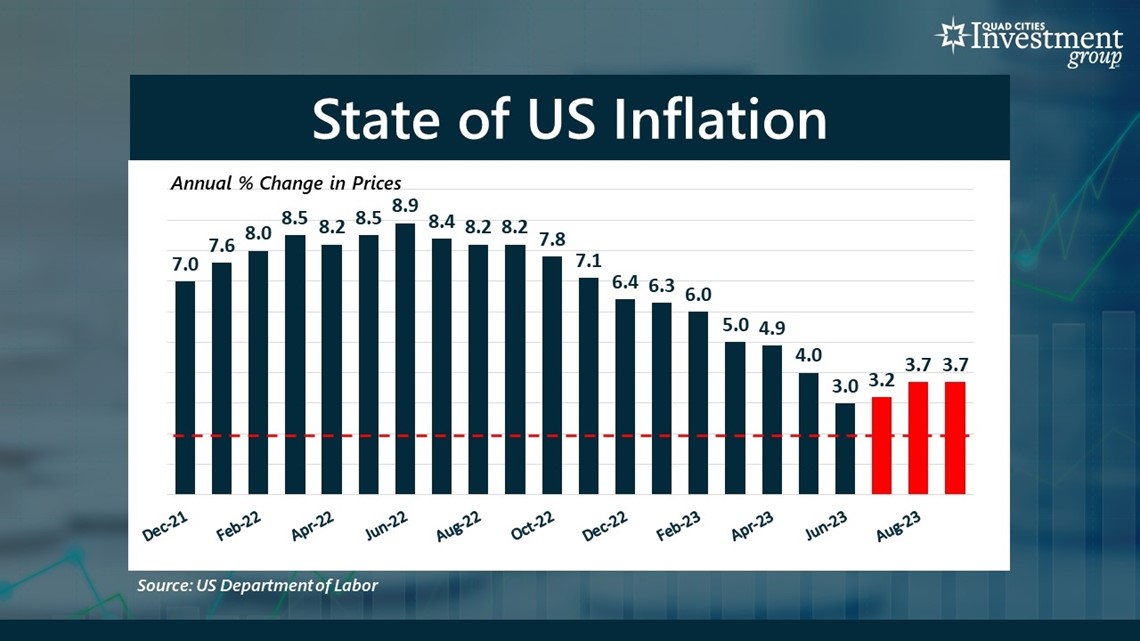

Grywacheski: Remember, any inflation rate above 2% is deemed excessive and causes undue strain on consumers, businesses, and, ultimately, the U.S. economy. After falling to 3% in June, inflation has once again started to rise. In July, inflation jumped from 3% to 3.2%. In August, it rose even higher to 3.7%.

But when you dive into the data a bit deeper, it reaffirms that this high inflation has really become embedded within the economy. And that’s a problem. Because that means it will likely take quite some time for inflation to return to its target rate of just 2% we want to get back to.

The Federal Reserve is tasked with trying to get this high inflation under control. So far, consumers have already been dealing with high inflation for the past 2 ½ years. But it was just a few weeks ago that the Fed acknowledged that this high inflation will likely last another three more years.

Bohlman: Consumers have also seen interest rates rise on many types of consumer debt. To what extent do you think these higher interest rates will impact their willingness to spend money?

Grywacheski: We’re already starting to see the impact that these higher interest rates are having on consumer spending, especially for home buyers.

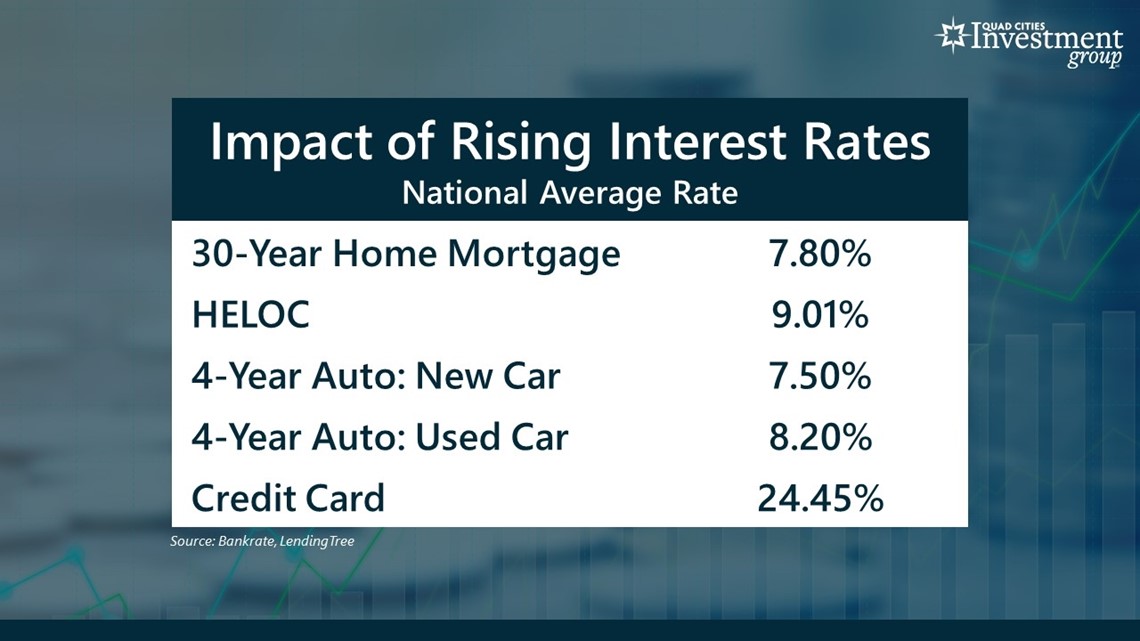

To help get this inflation under control, the Federal Reserve has been aggressively raising interest rates. But because inflation has become so problematic, the Fed has been forced to push interest rates to a 22-year high. And that adds yet another financial burden onto consumers.

For example, the national average interest rate on a 30-year home mortgage has soared to 7.8%. Just two years ago, the average rate was 2.75%. Assuming a family buys a $225,000 home and puts down a standard 20% down payment, this would increase their monthly principal and interest payment by $562, or roughly $6,800 per year. That’s a substantial added financial burden being placed on household budgets.

But whether it's mortgage loans, bank loans, auto loans, or credit cards, the interest rates consumers are paying are all near a 22-year high.

Bohlman: When do you think we’ll start to see a decline in interest rates?

Grywacheski: When and how fast interest rates start to decline will ultimately depend on the state of inflation.

There’s a term being thrown around on Wall Street which is “higher-for-longer”. With inflation expected to remain higher for longer, this means the Federal Reserve will likely have to keep interest rates higher for longer.

If inflation is expected to remain excessively high for another three years, interest rates will eventually decline, but that decline will likely be a very slow and gradual process.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel