MOLINE, Ill. — For the past two and a half years, American households have been struggling against high inflation. But on Wednesday, Sept. 20, the U.S. Federal Reserve cautioned Americans that high inflation is expected to last a lot longer. The Federal Reserve is now projecting that high inflation will last another three years through the end of 2026.

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss the potential impacts of inflation.

Bohlman: Back in June, inflation had declined to 3% and there was some hope that maybe this inflation problem was over. What’s changed that the Federal Reserve now expects high inflation to last another three years?

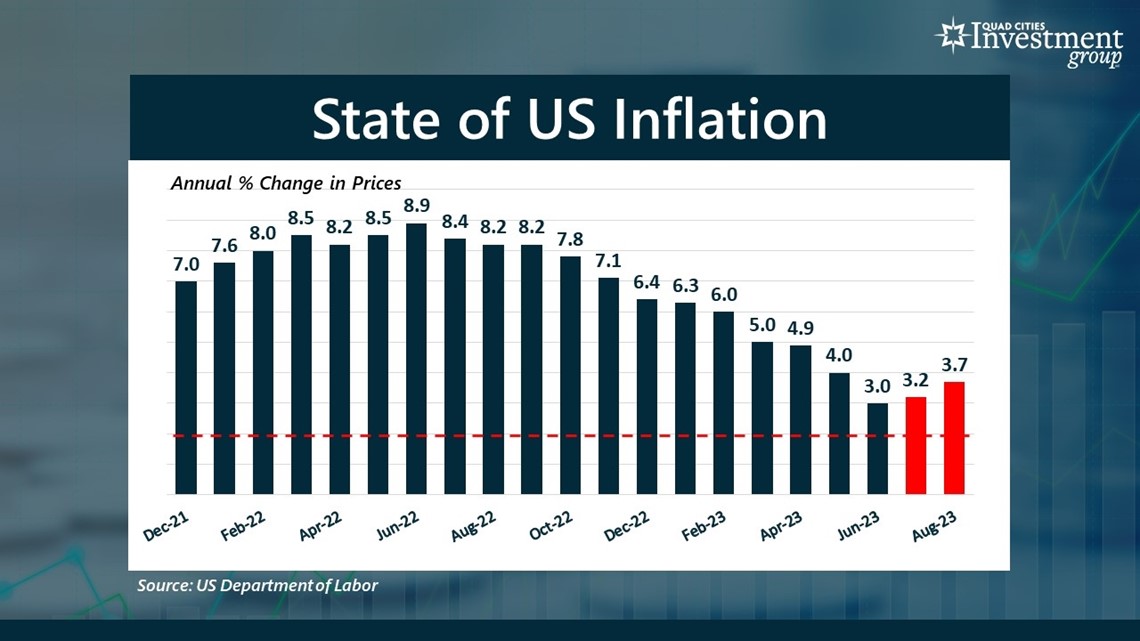

Grywacheski: Remember, the ultimate goal is to get inflation down to its target rate of just 2%. From June 2022 to June 2023, inflation fell from 8.9% to 3%. But as I cautioned, a lot of that was caused by a decline in energy prices. If you removed energy prices from the inflation calculation, it showed that outside the realm of lower energy prices, inflation was still quite rampant throughout the rest of the economy. But now those low energy prices — which, again, helped drive inflation lower from 8.9% to 3% — are starting to surge higher again. And that’s been driving inflation higher. In July, inflation rose from 3% to 3.2%. In August, inflation rose even higher to 3.7%.

The Federal Reserve — which as part of its mandate is to get this inflation back down to 2% — is starting to realize that these rising consumer prices are becoming more and more embedded within the economy. Therefore, the Fed is projecting that inflation won’t get back down to 2% until the end of 2026, another three years.

Bohlman: How are consumers expected to hold up now that inflation is expected to remain high for another three years?

Grywacheski: That’s really the big unknown question. Keep in mind, consumers have already been struggling with high inflation for the past two and a half years. The last time inflation was at or below 2% was all the way back in February 2021 (1.7%). This means, by the end of 2026, Americans will have faced nearly six consecutive years of high inflation.

But high inflation has already taken a punishing toll on American households. Savings accounts are dwindling. Household debt is at a record-high $17.06T. Credit card debt is at a record-high $1.03T. Can Americans really weather the storm of three more years of rising prices and high inflation? And I think that drives the concern of the economy going into recession. Consumer spending drives more than two-thirds of our country’s economic growth. But if consumers simply say “I can’t spend anymore," it risks a collapse in consumer spending which would likely send the economy into recession.

Bohlman: Over the past year and a half, we’ve seen interest rates steadily climb higher. What is expected to happen to interest rates in light of the Federal Reserve’s new forecast on inflation?

Grywacheski: In its attempt to try and get this inflation under control, over the past year and a half, the Federal Reserve has been aggressively raising interest rates. On Wednesday, the Fed ramped up its inflation forecasts for the next few years. So, as inflation is now expected to remain higher for longer, we should expect interest rates to remain higher for longer. That means interest rates on credit cards, bank loans, auto loans, and home mortgages will likely remain high for quite some time. The national average interest rate on a 30-year fixed mortgage is now around 7.6%, a 23-year high. Just two years ago, the rate on a 30-year fixed-rate mortgage was around 2.5%.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel