MOLINE, Ill. — According to a just-released study by the Federal Reserve Bank of New York, credit card debt held by U.S. households has reached a record-high $1.08 trillion. Over the past year, credit card debt has risen by $154 billion. This is the largest annual increase in household credit card debt on record dating back to 1999.

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss how the credit card debt got so high.

Bohlman: Why are we seeing such a tremendous spike in household credit card debt?

Grywacheski: This very potent combination of high inflation and high interest rates has been a tremendous strain on American households over the past few years. It’s forced consumers to pull money from their savings accounts, pull money from their retirement accounts and to take on a lot more debt, especially credit card debt.

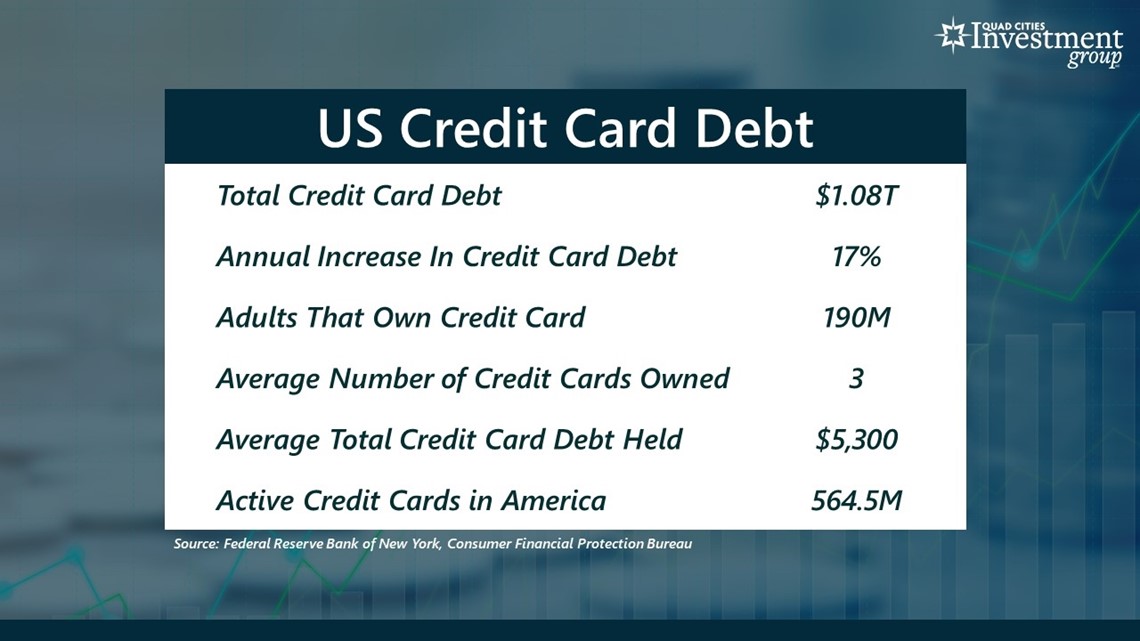

- Within a record-high $17.3 trillion of household debt lies a record-high $1 trillion in credit card debt. This year, total credit card debt reached the $1 trillion mark for the first time in history.

- Over the past 12 months, household credit card debt has risen by 17%, the largest annual increase in history.

- 190 million adult Americans own a credit card, which represents about 75% of the adult population.

- On average, each credit card holder owns three credit cards.

- For those who own credit cards, on average, the total credit card debt held is about $5,300.

- In total, Americans collectively own a staggering $564.5 million in credit cards.

Bohlman: With many interest rates at or near 40-year highs, how are these high interest rates impacting consumers who are taking on a lot of credit card debt?

Grywacheski: These rising interest rates are making it much more costly for households to take on any form of debt — whether it's credit card debt, auto loans or even home mortgages.

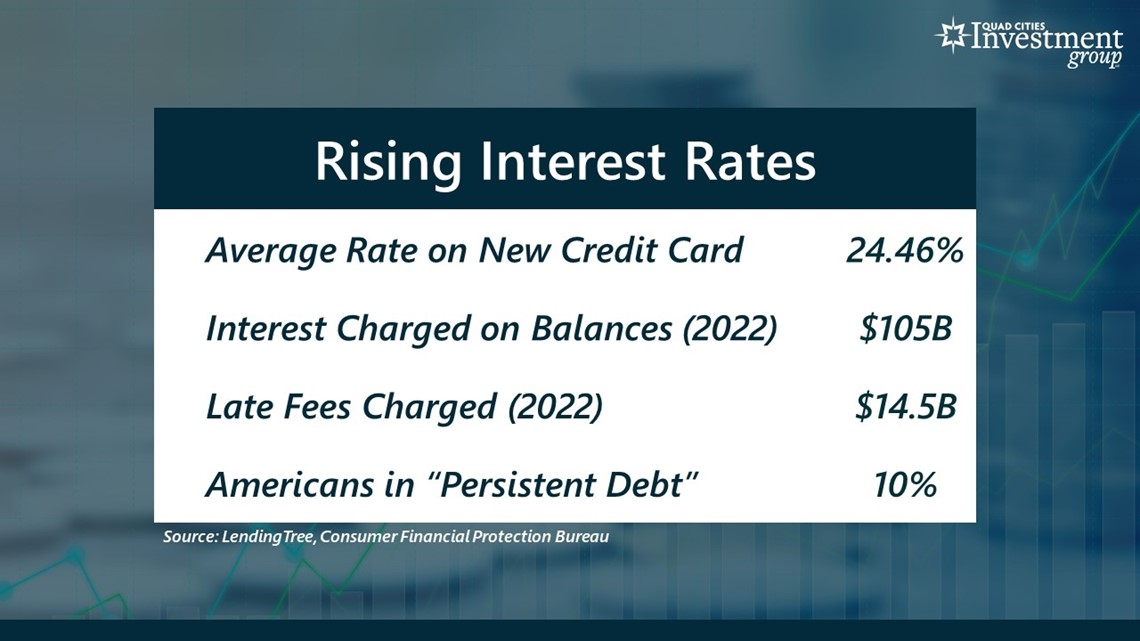

- The average interest rate on a new credit card is now a record-high 24.46%.

- Last year, credit card holders were charged a record-high $105 billion in interest on their open balances.

- Last year, credit card holders were charged a record-high $14.5 billion in late fees.

- And all this has created what’s called “persistent debt” for about 10% of all credit card holders. It’s where the interest and fees you’re charged exceed the amount of principal you’re able to repay. So, each month, your credit card balance continues to rise even higher. This leads to runaway credit card balances that consumers can’t escape from and their only option is to default or to declare some form of bankruptcy.

Bohlman: With the holiday shopping season already underway, what are some tips for consumers who may have to use their credit cards this holiday season?

Grywacheski: As always, really try to stick to your budget. During the holiday seasons, it’s easy to get caught up in the excitement of the holidays and blow through your budget. If you’re already carrying a credit card balance, see if you can transfer some or all of the existing balance to a card that offers a 0% interest rate for 12 months on any balance transfers. It allows you to pay down your debt without accumulating those high interest payments.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel