MOLINE, Ill. — Last week was a chaotic ride for the U.S. stock market. On Thursday and Friday, both the S&P 500 and Dow Jones Industrial Average suffered their largest two-day decline since March 2023. The tech-heavy NASDAQ fell even more, losing nearly 5% of its value over the two days. The NASDAQ is now down 10% from its recent all-time high set just three weeks ago.

News 8's Devin Brooks spoke with Mark Grywacheski from the Quad Cities Investment Group to give some insight into the drop's impact on consumers.

Devin: What caused this big sell-off in the stock market on Thursday and Friday?

Mark: We’re right in the heart of the latest earnings season where companies are releasing their financial results for the April-June second quarter. And what we’re seeing is one company after another lower their revenue/profit forecasts for the second half of the year.

Even before this latest earnings season, there was concern about the future outlook of the U.S. economy. Wall Street knew it was expected to weaken but there was considerable debate on just how much it would weaken. But now, over the past few weeks, you have all these companies expressing serious doubts about the strength of the U.S. economy in the second half of the year.

Devin: What exactly are these companies saying that’s raising concerns over the health of the U.S. economy?

Mark: One of the common themes we’re hearing from companies is a weakening of the American consumer. That all these years of high inflation and high interest rates are taking a visible toll on consumer spending. Remember, consumer spending drives more than 2/3 of our nation’s entire economic growth.

To help offset rising prices, consumers have been forced to pull money from their savings and retirement accounts. They’ve also been forced to take on a record-high amount of debt, especially credit card debt. And companies are feeling that pressure from consumers who are saying, “I can’t afford to keep up this level of spending and I’m certainly not going to take on any more debt to do so."

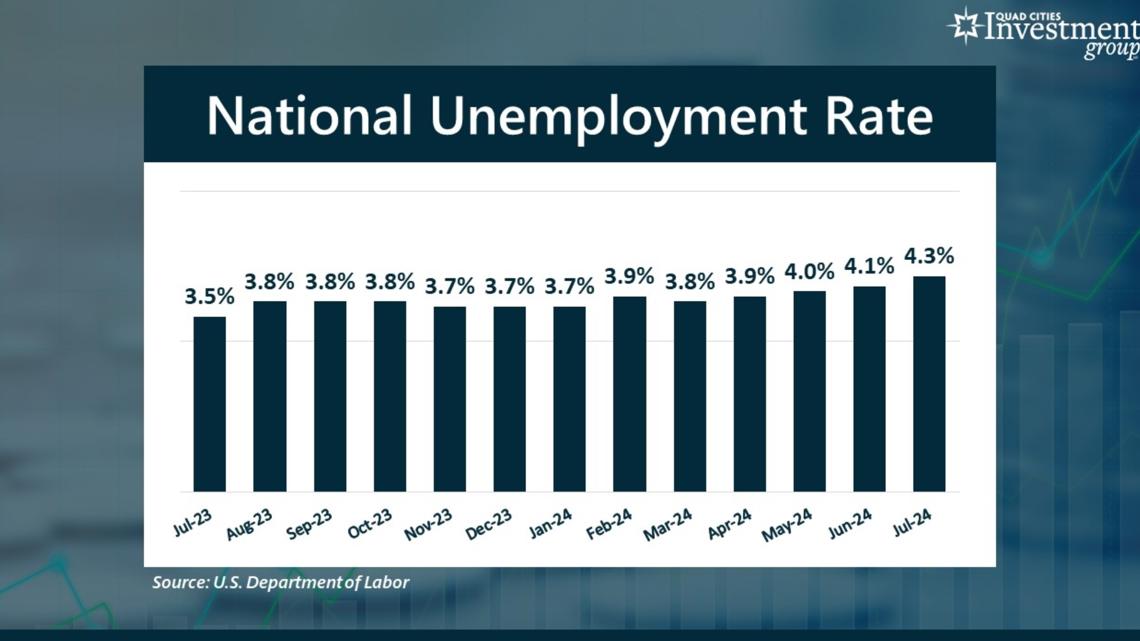

Devin: On Friday morning, the Department of Labor released its monthly Employment Report for July which showed the unemployment rate jumped to a three-year high of 4.3%. What’s your take on this latest report on the labor market?

Mark: This was a very disappointing Employment Report that further stoked Wall Street’s anxieties over the state of the U.S. economy.

The unemployment rate jumped from 4.1% to a 3-year high of 4.3%.

Annual wage growth is at a 3-year low.

In July, just 114K new jobs were added, one of the lowest monthly gains in nearly four years.

This latest data on a weakening labor market — combined with these comments being made about a weakening consumer — have heightened fears the economy will dip back into recession. And that apprehension is being reflected in a very volatile and choppy stock market.

___________________________________________

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more Your Money with Mark segments on News 8's YouTube channel