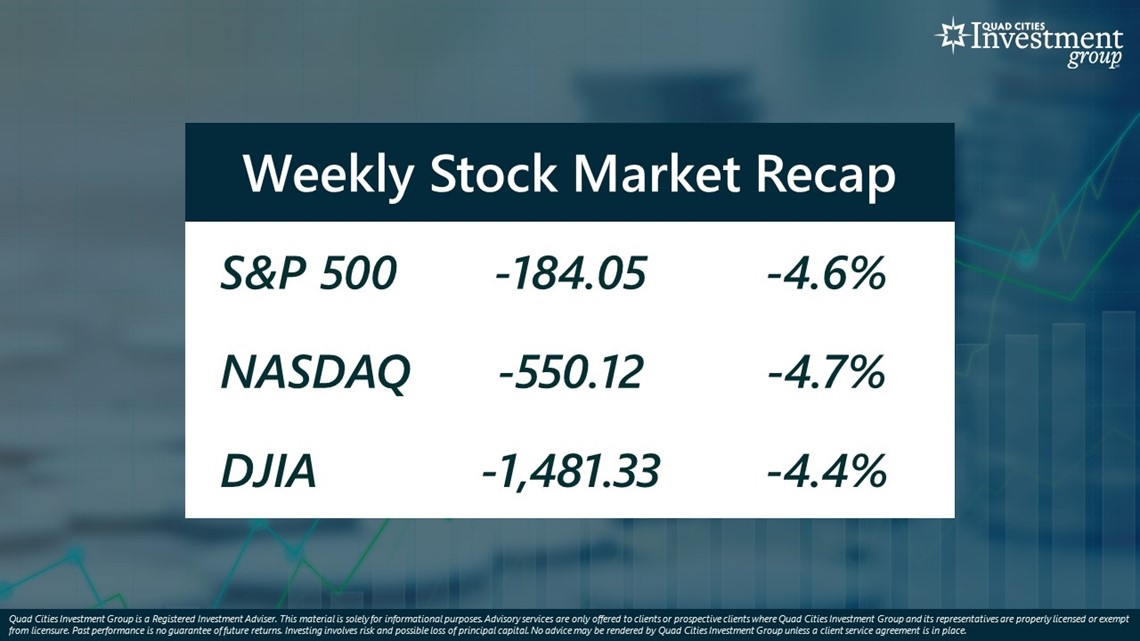

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index dipped 4.6%, NASDAQ dropped 4.7% and DJIA is down 4.4%.

Last week’s big decline in the stock market was triggered by comments made by Federal Reserve Chairman Jerome Powell. On Tuesday and Wednesday, Chairman Powell delivered his semi-annual testimony before the US Senate Banking Committee.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's David Bohlman to discuss the Federal Reserve's position and more.

Bohlman: What exactly did Powell say to create this sharp sell-off in the stock market last week?

Grywacheski: Even though the Federal Reserve didn’t create this high inflation, it’s the responsibility of the Fed to try and get it under control. And one of the main tools it’s been using is to raise interest rates. The Fed’s goal is that by making it more expensive to buy goods and services on credit, it will inherently reduce consumer spending and thus help keep rising prices in check.

But in his testimony, Powell made 2 very important statements:

1. That any return to a 2% target rate of inflation will likely be a very long and bumpy ride.

2. Most likely, the Fed will have to keep aggressively raising interest rates much longer/faster than Wall Street was expecting.

The longer/faster the Fed raises interest rates, the greater the odds of a recession and the greater the potential impact to the labor market.

Bohlman: Why would the Federal Reserve continue to raise interest rates if it knows it will potentially send the economy into a recession or negatively impact the labor market?

Grywacheski: The Fed argues this high level of inflation is simply not sustainable. For two years, Americans have been struggling with rising prices- especially in everyday basic necessities. Last month, 92% of the monthly rise in inflation was caused by the rising cost of food, shelter and energy. So, yes, these interest rate hikes will negatively impact consumers, business and the economy. But the Fed argues that any pain would be much greater if the Fed were to allow this high inflation to continue.

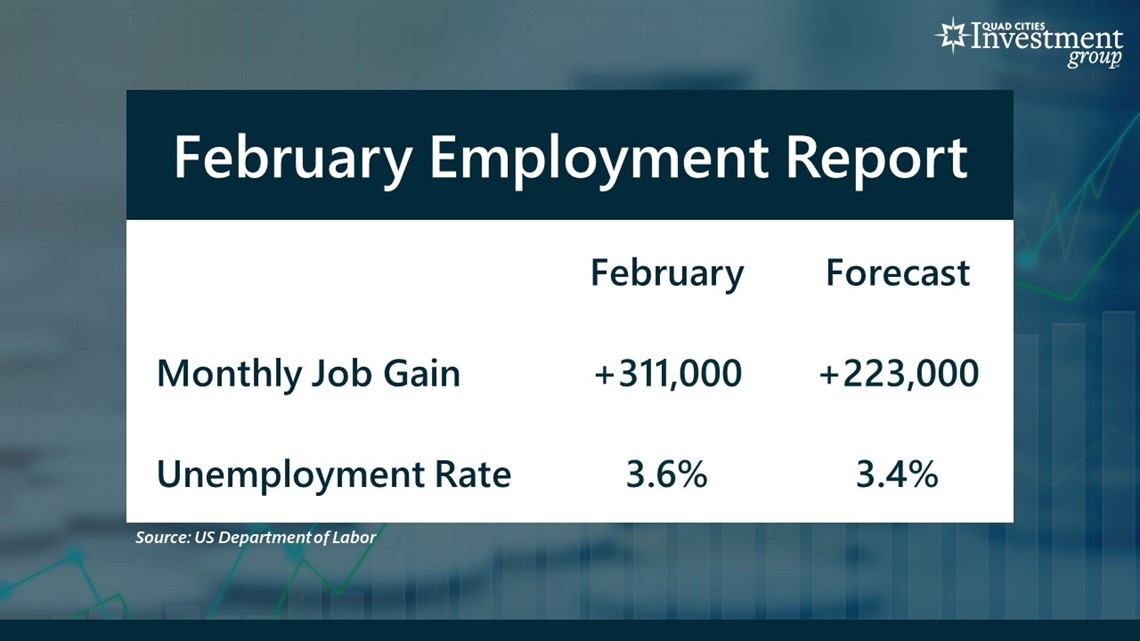

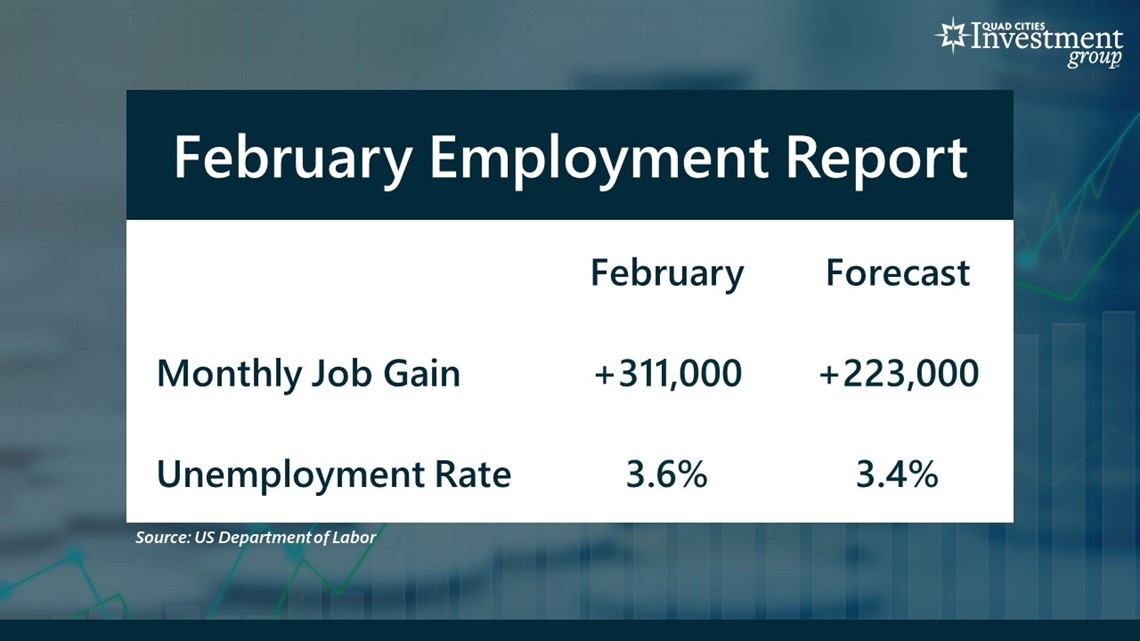

Bohlman: On Friday, the Department of Labor released the February Employment Report that showed the unemployment rate rising from 3.4% to 3.6%. Does that concern you in any way?

Grywacheski: The February Employment Report was a bit mixed. In February, 311,000 new jobs were added, above the 223,000 that Wall Street was expecting. The unemployment rate did rise to 3.6%, even though Wall Street was expecting the rate to remain unchanged at 3.4%.

As the economy continues to cool down, Wall Street already expects the unemployment rate to eventually rise from its current 3.6% to 4.5%-5% by year-end. And for each 1% rise in the unemployment rate- for example, if the unemployment rate rises from 3.6% to 4.6%- that translates to about 1.6 million workers losing their job.

Bohlman: If the economy does go into a recession, are you concerned the unemployment rate could go much higher than 5%?

Grywacheski: Over the past two years, the US labor force has declined by over 6 million workers. This means we have millions of people that were once working, are no longer working and, more importantly, no longer looking for work.

Because these people are no longer looking for work, they’re no longer deemed to be part of the labor force and are NOT included in calculating the unemployment rate. If we get a severe recession, it could suddenly force

millions of people to start looking for work and re-enter the labor force. And this could quickly send the unemployment rate much higher from the 1.5%-5% that is expected to maybe 7% or even 8%

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel