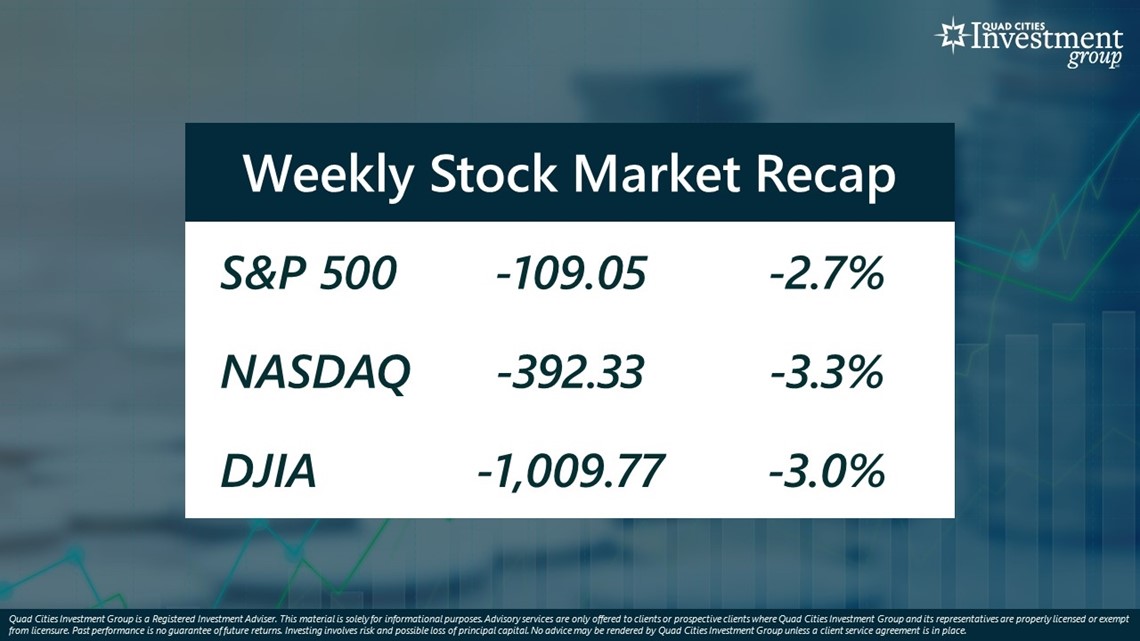

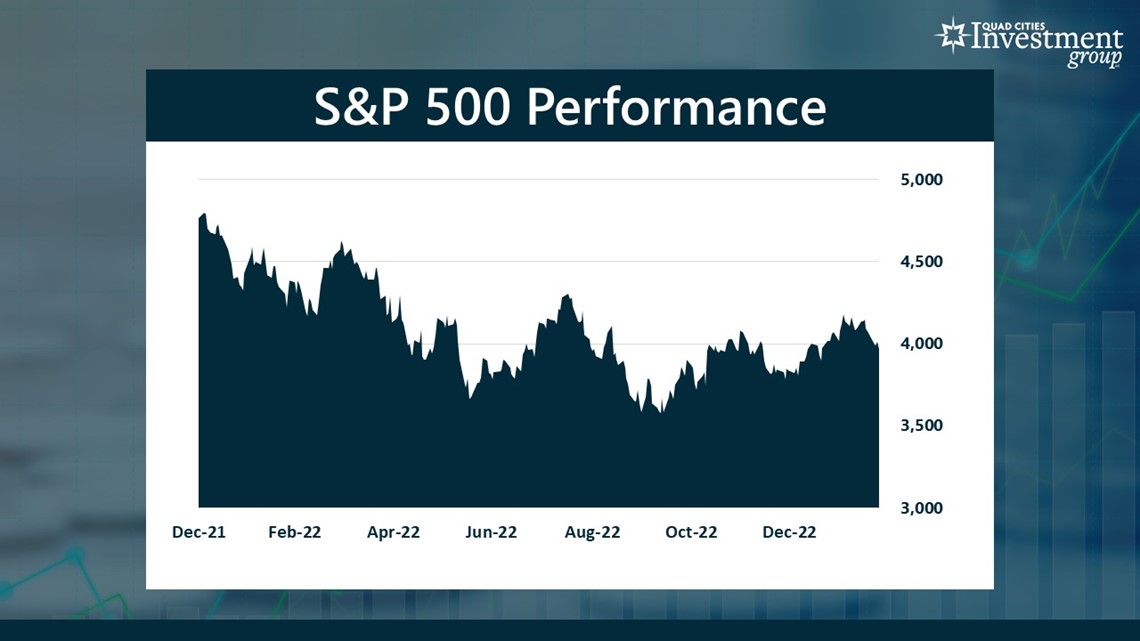

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index fell by 2.7%, NASDAQ fell by 3.3% and DJIA fell by 3.0%.

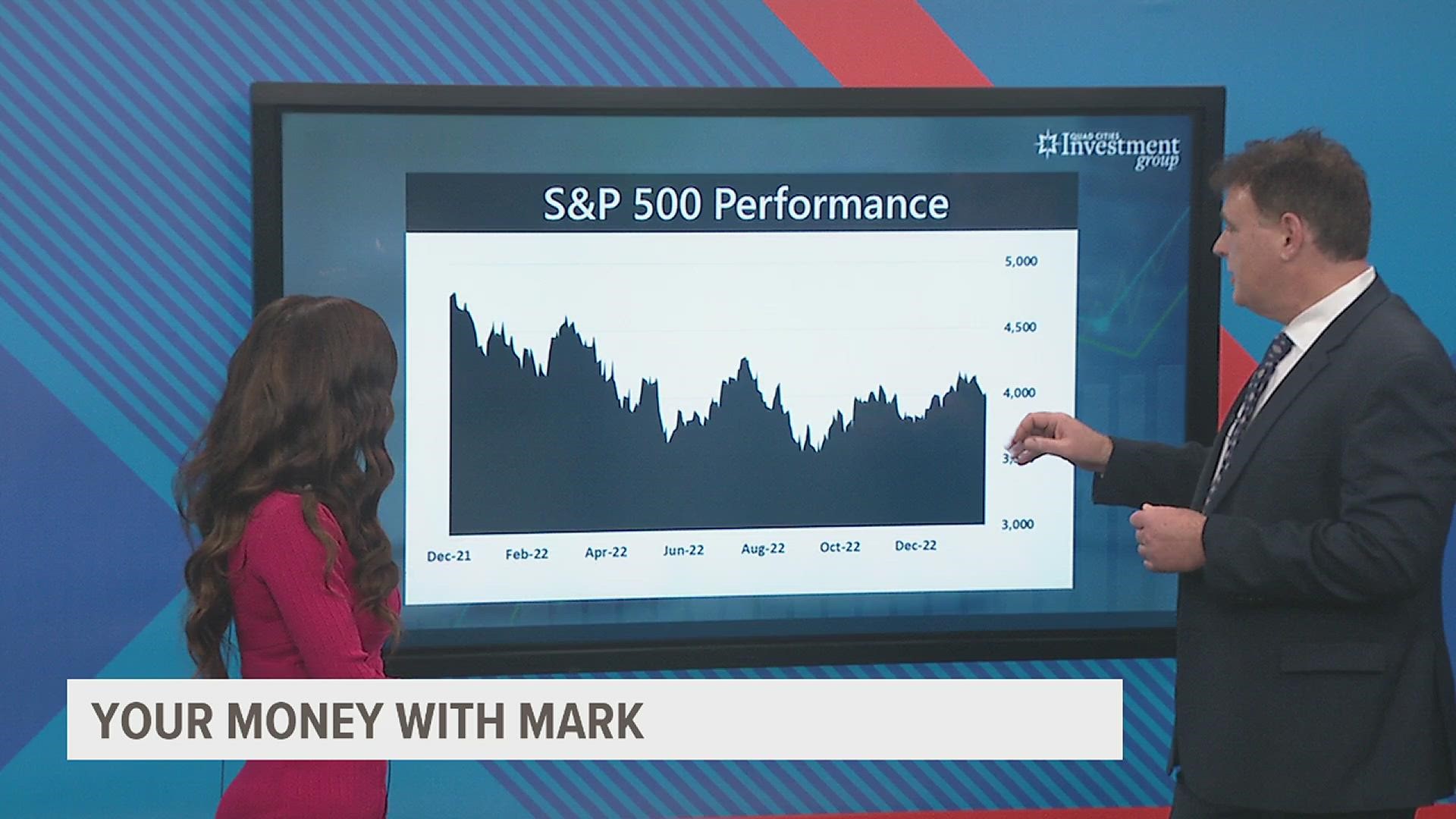

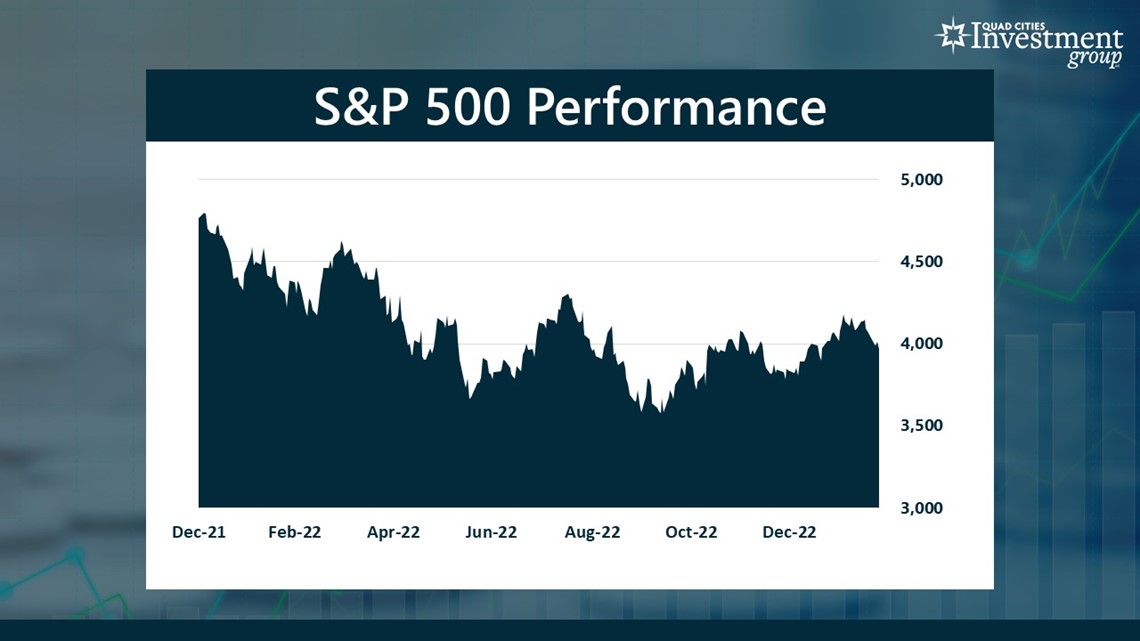

2022 was a chaotic year for the US stock market. Last year, the benchmark S&P 500 fell by almost 20%. January provided investors some much needed relief, as the S&P 500 rose a heft 6.2% to start the year. But February hasn’t been so kind. Last week, the S&P 500 fell for the third consecutive week, once again fueling concerns on the future outlook of the US stock market.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's Ann Sterling to discuss the S&P 500's 2022 performance, and how inflation has impacted the US stock market.

Sterling: January really got a lot of investors hoping that “maybe” the worst of this stock market decline was behind them. But why are we seeing yet another sell-off in the stock market in February?

Grywacheski: It all ties back to inflation. Inflation is what triggered this ongoing 14-month decline in the stock market back in January 2022. To help get this inflation under control, the Federal Reserve has been forced to start raising interest rates. We’ve had the most aggressive pace of interest rate hikes in over 40 years. This combination of high inflation and rising interest rates risks sending the economy into recession. And it’s that anxiety by Wall Street over the economy going into recession being reflected in this 14-month decline.

This rise in the stock market in January, as well as February’s decline, is very similar to what we’ve seen over the past 8 months. We get this initial rally on the hopes that “maybe” inflation is finally under control. But then we get some additional economic data that says “No, this high inflation is still a problem that hasn’t yet been resolved.

Sterling: What’s your thoughts on the stock market for the rest of this year

Grywacheski: In my opinion, I think that 2023 will be very similar to last 8 months of 2022. We’ll continue to get these large up-and-down spikes in the stock market based on the good news/bad news we get on inflation – which will ultimately impact what then happens to interest rates and the economy.

Ideally, we want inflation (which is currently at 6.4%) to return to its target rate of 2%. But, in my opinion, there’s more and more evidence that any return to a 2% rate of inflation will be a very slow, gradual process.

Two weeks ago, Federal Reserve Chair Jerome Powell hinted that inflation will likely remain higher-for-longer. Last week, we got additional economic data that also advances that “higher-for-longer” pace of inflation.

I think this stock market will remain choppy until Wall Street gets some level of comfort that this inflation is finally under control- and it’s just not there yet.

Sterling: What advice do you have for investors who have already gone through 14 months of this chaos and now hear that this may last for the rest of 2023?

Grywacheski: This is a stock market that’s going to require patience. Remember, the ultimate goal is to return the all-time highs we had in the stock market back in January 2022. In the entire 130+ year history of the US stock market, the market has always recovered, it’s always went on to set new all-time highs. We just don’t know how many days, weeks or months that will be.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel