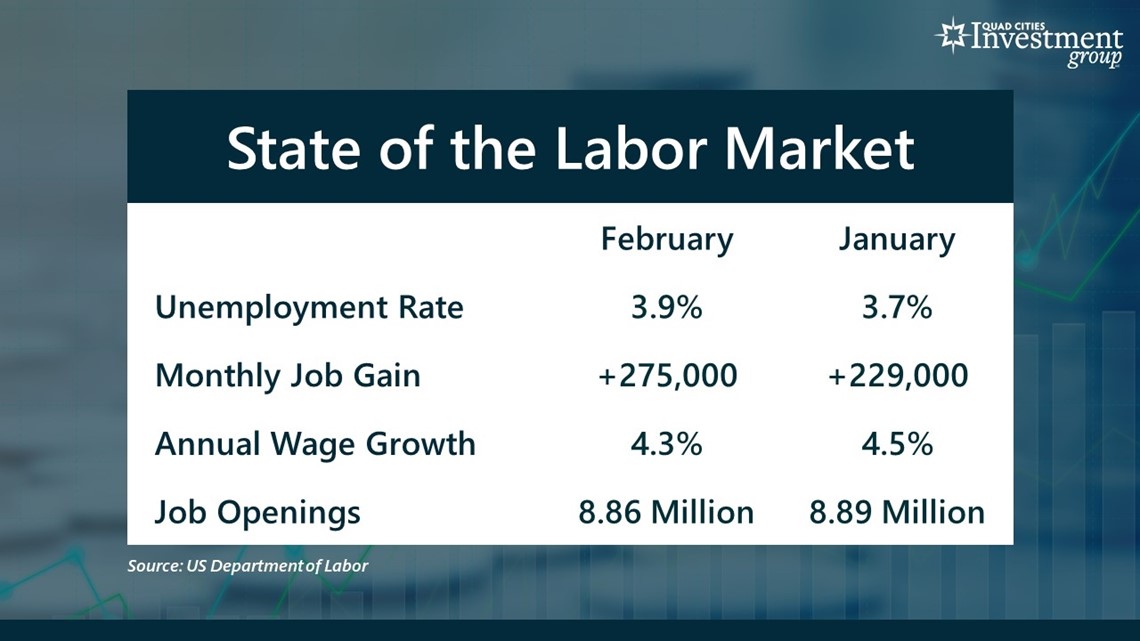

MOLINE, Ill. — According to the U.S. Department of Labor, in February, the US economy added 275,000 new jobs. This was well above the 190,000 that Wall Street was expecting. But the national unemployment rate also jumped from 3.7% to 3.9%, the highest unemployment rate in over two years. So, what exactly is the current state of the U.S. labor market?

News 8's Charles Hart spoke with Mark Grywacheski from the Quad Cities Investment Group to help understand where the U.S. labor market stands.

Charles: Give us your thoughts on this latest data on the labor market.

Mark: When you take a deeper dive into this labor market data, it shows that:

1. The labor market is still fairly strong.

2. But there’s clear evidence it is gradually weakening. (The key word being gradually)

- Unemployment Rate: In February, the unemployment rate jumped from 3.7% to 3.9%, a two-year high. Any unemployment rate below 4% is not a sign of strain/duress in the labor market. But if this unemployment rate were to suddenly jump to 5%, that would start to signal some red flags.

- In February, a very solid 275K new jobs were added, 46K more than January.

- Over the past two years, annual wage growth has been steadily declining. Last month, annual wage growth further declined from 4.5% down to 4.3%.

- The number of job openings has also been steadily declining. Currently, there are 8.86M unfilled job openings across the country. This is still a fairly strong number but it is down from the peak of about 12.2M job openings two years ago.

Charles: To what extent is this labor market expected to weaken over the course of 2024?

Mark: The general consensus is that this labor market will continue to gradually weaken over the course of the year. By no means is it a doom-and-gloom outlook. The unemployment rate is expected to increase to around 4.3%. Historically, that really isn’t that bad.

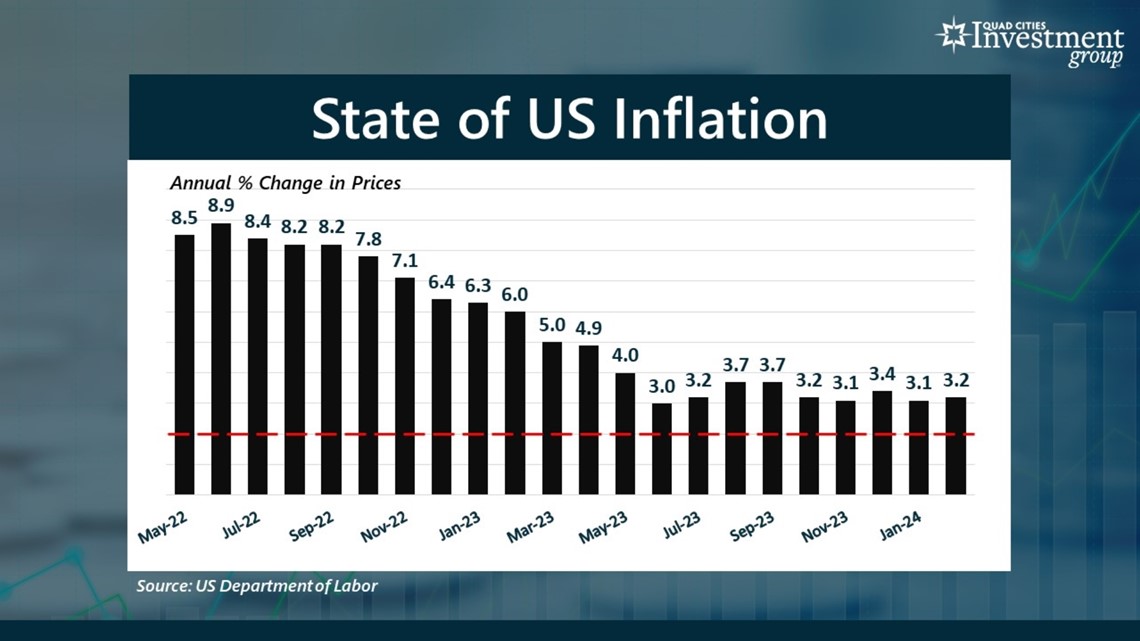

Charles: Last week the Department of Labor also reported the latest inflation data. Where are we with respect to inflation?

Mark: Three years later, inflation still remains a significant problem. In February, consumer prices rose another 0.4%. This was the 45th consecutive monthly rise in consumer prices.

Remember, the ultimate goal is to return to that target rate of inflation of just 2% (red dotted line). Inflation peaked at a 42-year high of 8.9% in June 2022. By June 2023, it had declined to 3%. But as we can see, over the past 8 months it’s hit this big wall of resistance. In February, inflation was reported at 3.2%, up from 3.1% in January. This means that consumer prices have risen by 3.2% over the past 12 months. So, this inflation remains stubbornly high.

Charles: Any indication on when inflation will get back down to that 2% target rate?

Mark: The Federal Reserve, which is tasked with trying to get inflation back down to that 2% target rate, as recently as December said we shouldn’t expect inflation to get back down to 3% until sometime in 2026. So, that’s potentially another two more years of excessively high inflation.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.