MOLINE, Ill. —

Not only was Friday the last trading day of the week, it also marked the half-way point of 2023. So far this year, investors have seen stock prices soar, providing some welcome relief after 2022’s heavy decline. The tech-heavy NASDAQ has gained 31.7%, its best first-half performance since 1983.

David Bohlman: There’s still a lot of concern about the economy; does it go back into recession? So why are we seeing such a big rise in the stock market to start the year when that uncertainty is still out there?

Mark Grywacheski: Last year’s heavy decline in the stock market was initially triggered by historically high inflation. Last June, inflation reached a 40-year high of 8.9%. That forced the Federal Reserve to start raising interest rates to help keep that inflation in check. That combination of high inflation/rising interest rates imposes a severe burden on consumers and the economy, and that’s why many are expecting the economy to enter a recession either later this year or in early 2024.

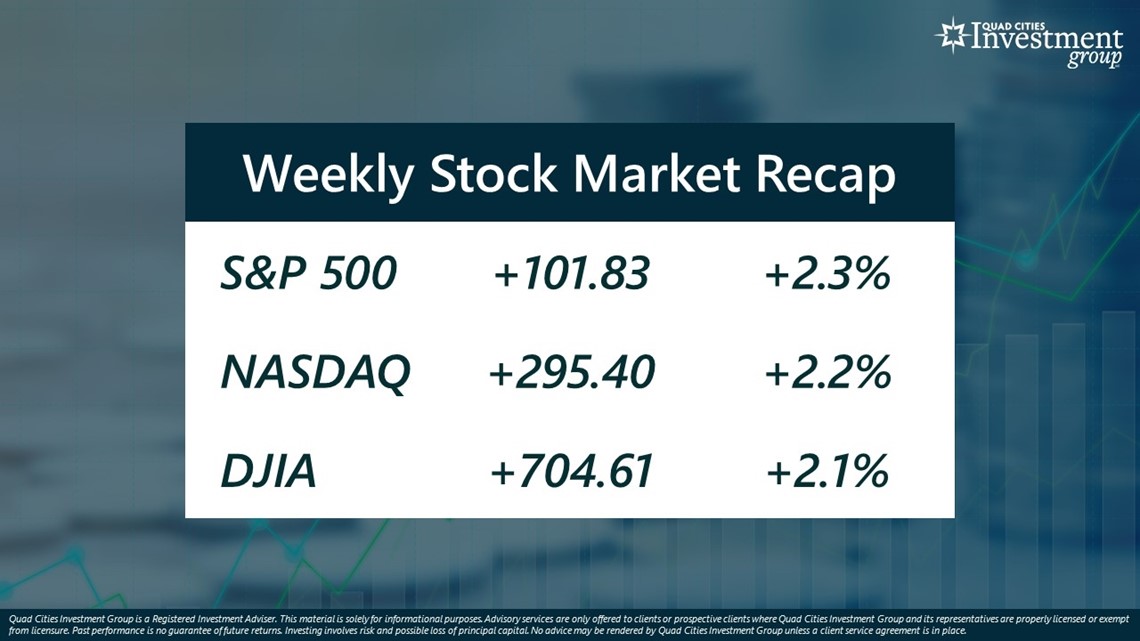

But this is the current rally in the stock market:

- S&P 500: Up 15.9%; Best 1st ½ performance since 2019.

- NASDAQ: Up 31.7%; Best 1st ½ performance since 1983.

- DJIA: Up 3.9%

This was triggered by the realization that the worst of this inflation is likely behind us. Then this rally caught its second wind back in March when Wall Street became enamored by more and more companies using artificial intelligence to grow and expand their business.

But, in my opinion, there are a couple of caveats:

1. Despite the strong rally so far this year, there’s still some ways to go before we return to those all-time highs we set back in January 2022.

2. A lot of people argue this second surge in the stock market caused by Wall Street’s fascination with AI is a little overdone. AI is still in its infancy. Also, the economy is still facing high inflation, rising interest rates and a very cloudy outlook over the economy.

Bohlman: With the wedding season underway, a lot of people will be getting married in the upcoming months. With the average cost of a wedding around $30,000, how should people prepare for the high costs of planning their wedding?

Grywacheski: Set a realistic budget and stick to it. If you set up a budget of $30K, be careful of not getting caught up in the excitement and add another $5K-$20K of costs. The last thing you want to do is start your married life with a mountain of debt because of the wedding.

Understand where the bulk of your wedding costs come from. This graph shows the top five biggest costs associated with a wedding:

- Venue: Accounts for about 37% of your wedding budget.

- Catering: Accounts for about 37% of your wedding budget.

Combined, these two account for 66% (2/3) of your total wedding cost. These are two areas that can quickly blow your budget out of the water.

Keep track of all your wedding costs you’re going to incur. Use an excel spreadsheet to track your projected costs to ensure you’re staying within your budget.

Bohlman: Today, more and more people are giving cash as their wedding gift. What’s the general rule of thumb in how much money should give?

Grywacheski: Experts say there’s no hard-and-fast rule on how much cash you should give as a wedding gift. The suggested range is between $100-$500. On average, people give about $160. But the amount you give should be dependent on a number of factors:

1. Your own budget; what can you afford to give?

2. How well do you know the wedding couple?

3. Are you already spending a sizable chunk of money on airfare and hotels just to get to the wedding?