MOLINE, Ill. —

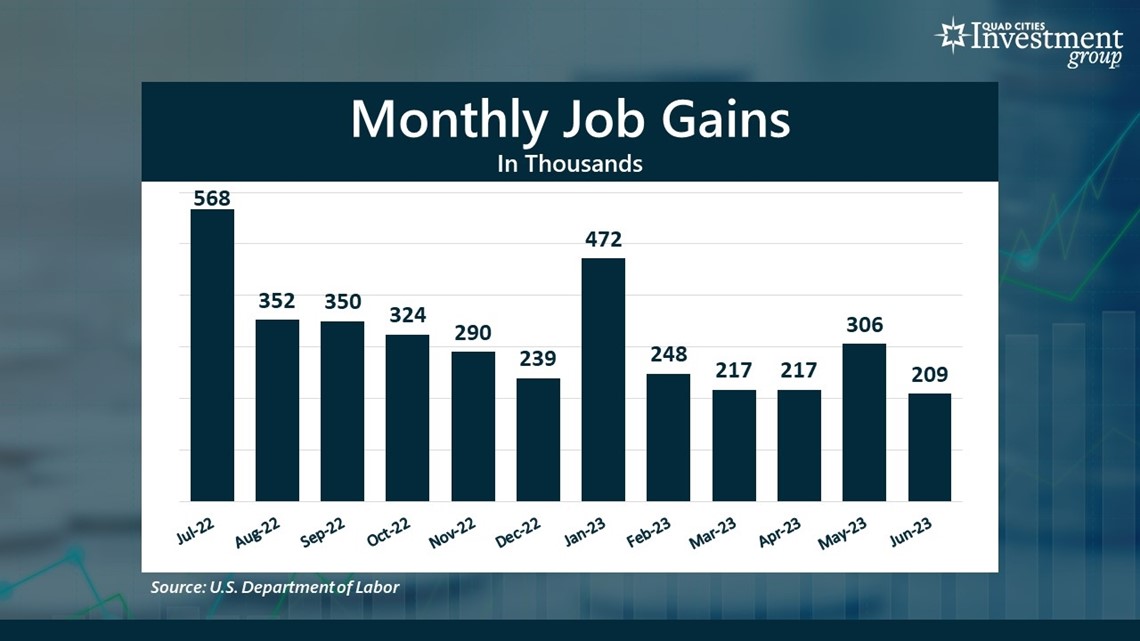

Despite concerns of a potential recession, the US labor market has remained quite resilient. So far this year, the economy has added an average of 278,000 new jobs per month. On Friday, the Department of Labor released its monthly Employment Report for June. Last month, the economy added 209,000 new jobs while the national unemployment rate fell from 3.7% to 3.6%.

News 8's David Bohlman met with Financial Advisor Mark Grywacheski with Quad Cities Investment Group to discuss the June employment report, and jobs gains in the manufacturing sector.

Bohlman: Are you surprised the labor market has remained this strong despite all the concerns of a recession?

Grywacheski: The labor market has remained quite strong and I think the degree of this strength has surprised a lot of people. But that said, the general consensus at the start of the year was that the labor market would gradually weaken. And that’s what we’re seeing. If you look at this graph, there has been a gradual decline in the number of new jobs being added each month. In June, 209K new jobs were added. But this was the lowest monthly job gain dating all the way back to December 2020 (2.5 years ago). And in the June Employment Report, the Dept. of Labor revised downward the number of jobs added in April and May by a combined 110K. By the end of the year, the national unemployment rate is expected to rise from its current 3.6% up to 4.1%-4.3%. So, even though the labor market is still stronger than expected, it is still gradually getting weaker.

Bohlman: Obviously, the Quad Cities has a sizable manufacturing footprint. But of the 209,000 jobs added last month, only 7,000 were in the manufacturing sector. Why is the manufacturing sector lagging behind?

Grywacheski: Of the 1.7 million new jobs added so far this year, only 15,000 have come from the manufacturing sector (0.9%).

Back in early 2020, government mandates and restrictions shut down entire sections of the US economy. It was primarily the service industries- bars & restaurants, movie theaters, hotels, the travel industry. It created this transformational shift of consumer spending, labor and resources away from services and into physical goods. For the most part, Americans were stuck at home and they loaded up on recreational & sporting goods, hobbies and home & garden supplies.

But as the economy started to reopen, we’re starting to see this return shift of consumer spending, labor and resources out of physical goods and back into services. And whereas we’re seeing strong job growth in the service sectors, job growth in the manufacturing sector is lagging behind.

Bohlman: When do you think we’ll start to see a faster pace of job growth in the manufacturing sector?

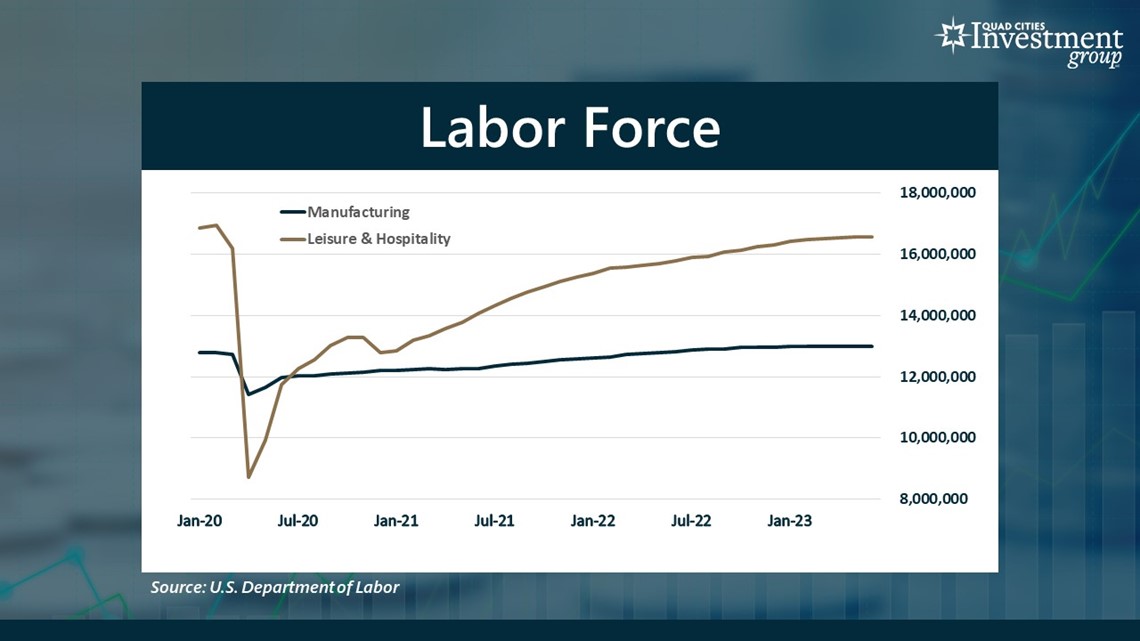

Grywacheski : This graph shows the labor force- the number of workers- in both the manufacturing and the Leisure & Hospitality (the service) sector. You see the impact those government mandates in early 2020 had on the service sector. In February 2020, the Leisure & Hospitality sector employed about 17 million workers. Two months later, the Leisure & Hospitality sector had lost 50% of its labor force. Now, as the economy reopened, it’s been a very gradual process. But 2 ½ years later, Leisure & Hospitality has yet to reach its pre-pandemic labor force of 17 million.

Because factories remained open during the pandemic and we saw that initial shift in consumer spending out of services and into physical goods, overall, the manufacturing labor force has held up fairly well. But again, as we continue to see this return shift in consumer spending away from physical goods and back into services, we should continue to see relative strength in the service sectors and challenging times for the manufacturing sector.