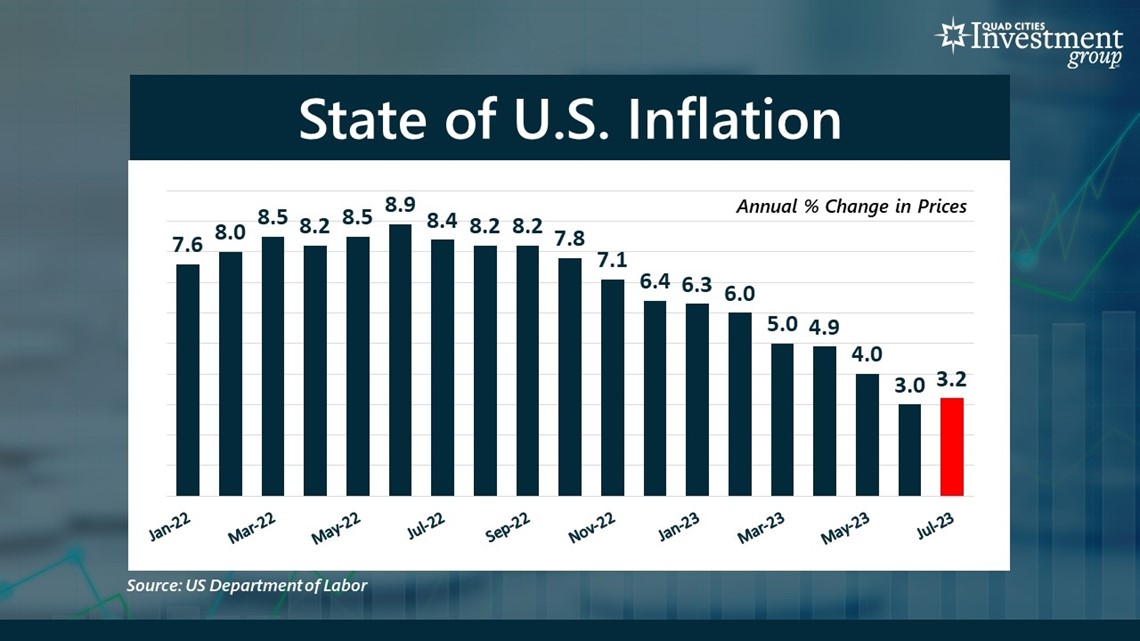

MOLINE, Ill. — Since reaching a post-pandemic high of 6.9% last June, the rate of inflation has been gradually declining over the past 12 months. But on Thursday, the U.S. Department of Labor reported that inflation has suddenly rebounded higher. In July, inflation rose from 3% to 3.2%. The surprise turn in inflation has many Americans asking, “What’s behind this latest jump in inflation?”

News 8's David Bohlman sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss this latest inflation report.

Bohlman: After declining for 12 consecutive months, why did inflation suddenly rise in July?

Grywacheski: When you dive into the inflation data, there’s a number of cautionary flags that exist that indicate the fight against inflation is far from over. As I’ve been cautioning people for a number of months, one of the main reasons inflation has come down over the past 12 months is from a decline in energy prices.

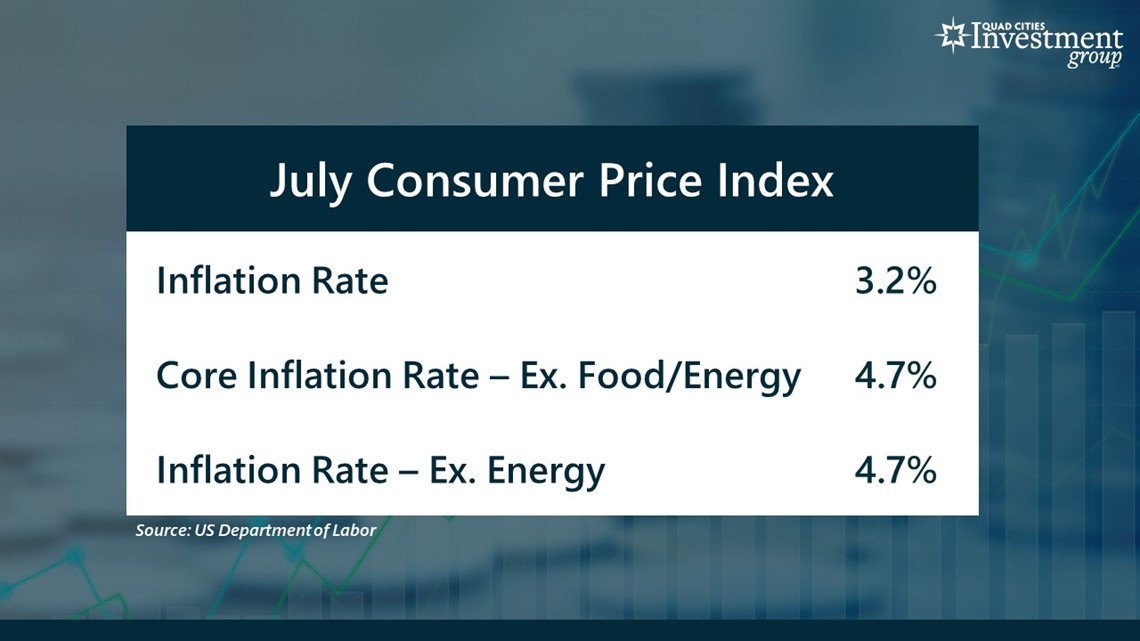

If you look at what’s called “core” inflation- which excludes the more seasonal and volatile food and energy prices from the inflation calculation- the rate of inflation would rise from 3.2% to 4.7%. Likewise, if you exclude only energy prices from the inflation calculation, the rate of inflation would also rise from 3.2% to 4.7%.

This conveys that outside the realm of low energy prices, inflation still remains quite rampant throughout the economy. But now those lower energy prices- which helped bring down inflation over the past 12 months- are starting to rise again. On Wednesday, the price of a barrel of crude oil reached a 9-month high.

Bohlman: Before this latest report, there had been some hope that the Federal Reserve might be done raising interest rates. How does this latest report impact the Federal Reserve’s decisions?

Grywacheski: What can we learn from Barney Fife? Barney Fife’s famous words - Nip it in the bud! And that’s what the Federal Reserve is trying to do with inflation- once and for all, to nip it in the bud. In my opinion, if the Federal Reserve doesn’t stay aggressive in trying to get this inflation under control (and that may mean additional interest rate hikes), it risks:

- Inflation re-igniting.

- Inflation remaining unnecessarily high (above 2%) for a longer period of time. And the longer this inflation remains above 2%, the longer it inflicts pain on consumers, businesses, and the economy.

Bohlman: Inflation has hit all of us really hard and parents may want to help their adult children who may be struggling financially. How can parents help their adult children without putting their own financial goals at risk?

Grywacheski: Many parents want to help pay for some/all of their kids’ college education or to help out with the down payment on their first home or to buy a car. As a parent, your first consideration is to assess your time to retirement. How long will it take to save up that money you’re giving to a child? If you’re 10-15 years away from retiring, you’ve got 10-15 years to rebuild your wealth. But if you’re close to or already retired, will that financial help put your retirement goals at risk?

Bohlman: Are there any tax benefits or considerations for giving money to your children?

Grywacheski: Each parent can gift a lifetime exemption of about $13M to each child tax-free. So, in most cases, there aren’t any tax consequences but check with your CPA or tax preparer for the latest IRS tax rules that constantly change. What many parents can do is rather than wait until their death for their estate to be transferred to their children, they can gradually start gifting some of their estate to their children while they’re still living.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.