MOLINE, Ill. —

Americans are well aware of the toll that high inflation and rising interest rates have had on their budgets. But how is the American retail industry coping with similar challenges?

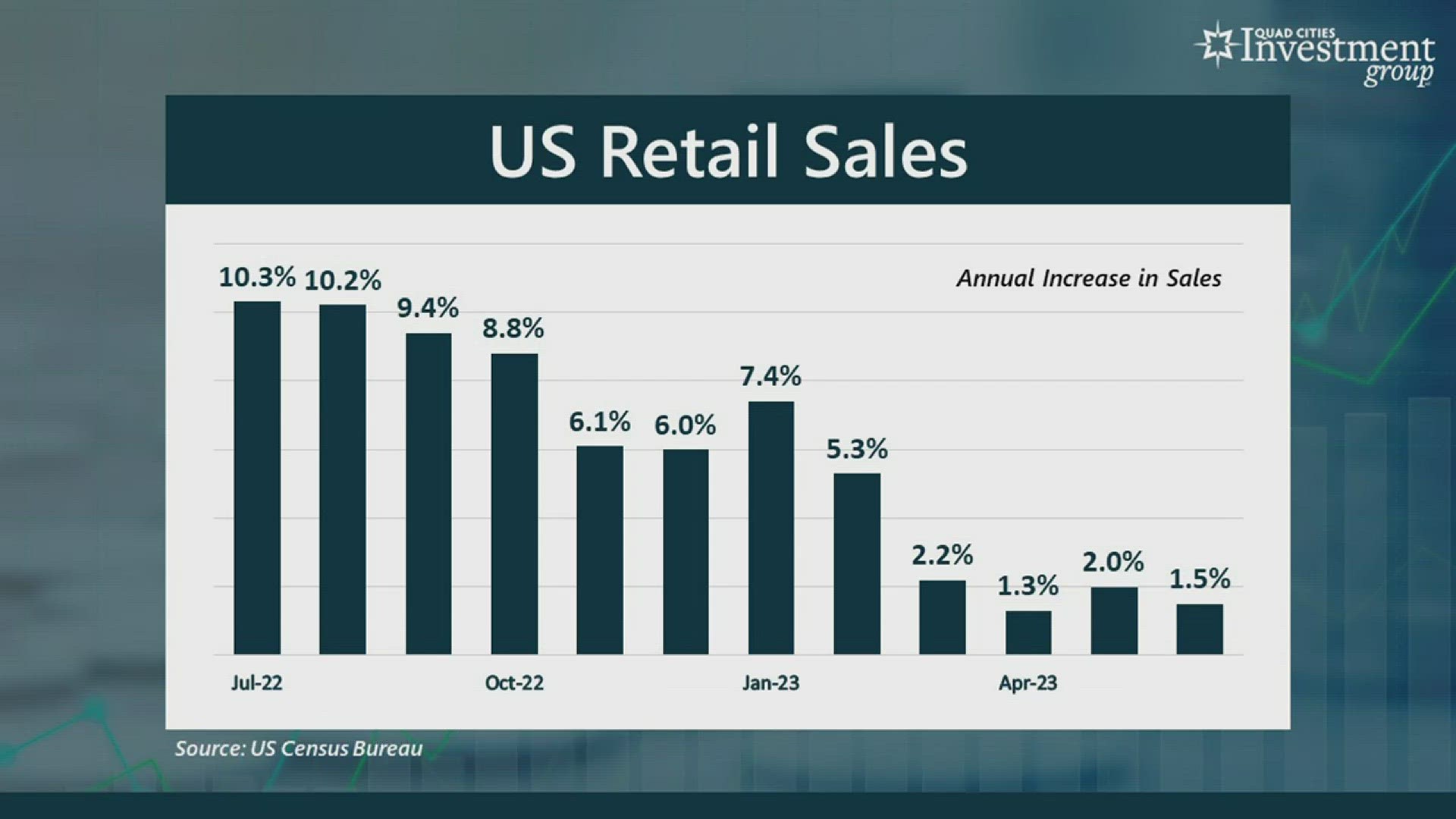

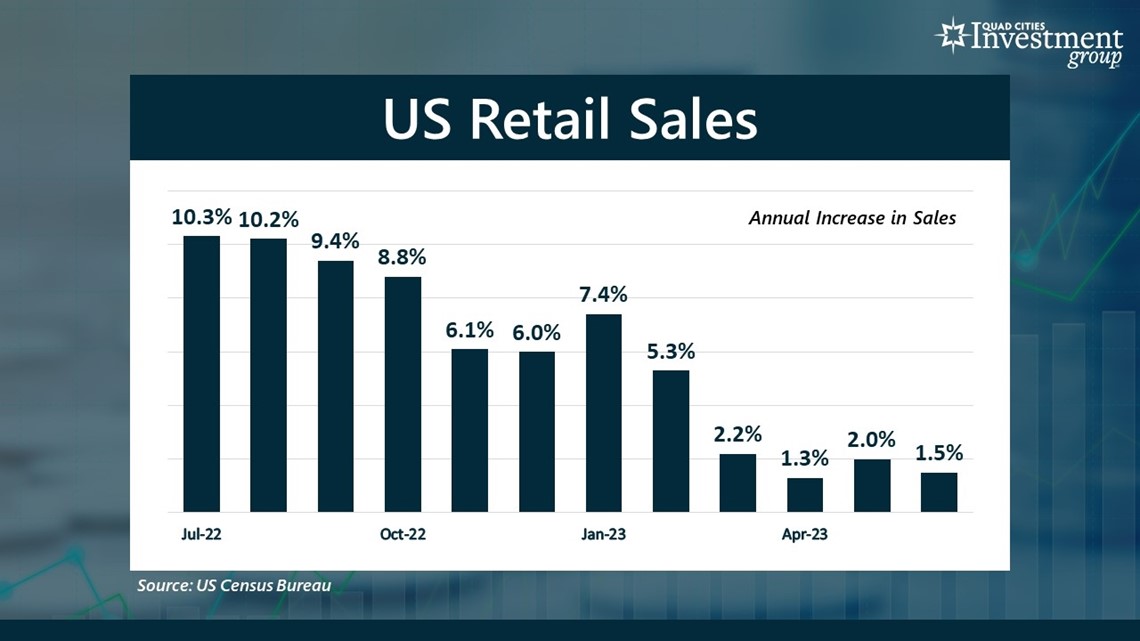

On Tuesday, the U.S. Census Bureau reported that sales among the nation’s retailers rose just 1.5% over the past 12 months. This was one of the lowest annual gains in retail sales in over three years.

David Bohlman: To what extent has this environment of high inflation and rising interest rates impacted the retail industry?

Mark Grywacheski: This environment has created its own unique challenges for the retail industry:

- Higher operating costs: The day-to-day expenses needed to keep that business up-and-running.

- Higher interest rates means bank loans are now much more costly to grow their business or to finance the purchase of inventory.

- Labor costs are almost 20% higher than they were before the pandemic.

- It costs a lot more to purchase their inventory.

- Shipping costs, warehousing costs, utilities – everything now costs a lot more to run that business.

Bohlman: Even though retailers are facing higher costs, to what extent do they offset that by also charging higher prices to consumers?

Grywacheski: This environment does create this viscous cycle of higher costs being passed from one entity to the next. Producers and manufacturers face higher costs. Those higher costs get passed onto the retailers who purchase those goods and services. Retailers then have their own set of higher costs. Ultimately, that stream of higher costs gets passed onto the consumer in the form of higher retail prices.

But the extent those higher costs can be passed onto the consumer varies significantly within the retail industry. For many retailers, especially your local brick and mortar stores, there’s tremendous price sensitivity in their ability to raise prices too much. They’re already competing against the big box retailers and online shopping giants like Amazon who have the efficiencies, technology, economies of scale and resources to inherently keep prices low. And they can absorb the impact of high inflation and rising interest rates a lot better than your local mom and pop retail stores.

Bohlman: What are your thoughts on the latest retail sales data that was just released last Tuesday?

Grywacheski: In June, retail sales rose 0.2% from May, below the 0.5% monthly increase that Wall Street was expecting. There has been a gradual decline in the year-over-year increase in retail sales. In June, retail sales were just 1.5% higher than they were one year ago. This was one of the lowest annual gains in over three years.

But also what’s important to remember is that retail sales data isn’t adjusted for inflation. So, with inflation at 3%, that means that, on average, consumer prices are now 3% higher than they were 12 months ago. If the dollar-value of retail sales has only increased by 1.5% over the past year, that means that consumers are actually buying fewer goods and services than they were 12 months ago.

Bohlman: How are retail sales expected to hold up over the next 6-12 months?

Grywacheski: Where there is broader consensus on Wall Street is that the economy is weakening. All things considered, consumer spending has held up fairly well over the past 12-24 months. But a lot of that spending has been at the expense of consumers taking on a lot more credit card debt or pulling money from their savings/retirement account. But cracks are starting to form from this expansive period of strain placed on consumers by these still very high costs.

Where there is greater disagreement on Wall Street is if this tipping point will take the economy back into another recession. On Wall Street, there’s now a 50/50 split on whether we do or don’t go into recession. But if we do go into recession, the general sense is that it would most likely happen in the second half of this year or into the first quarter of next year.