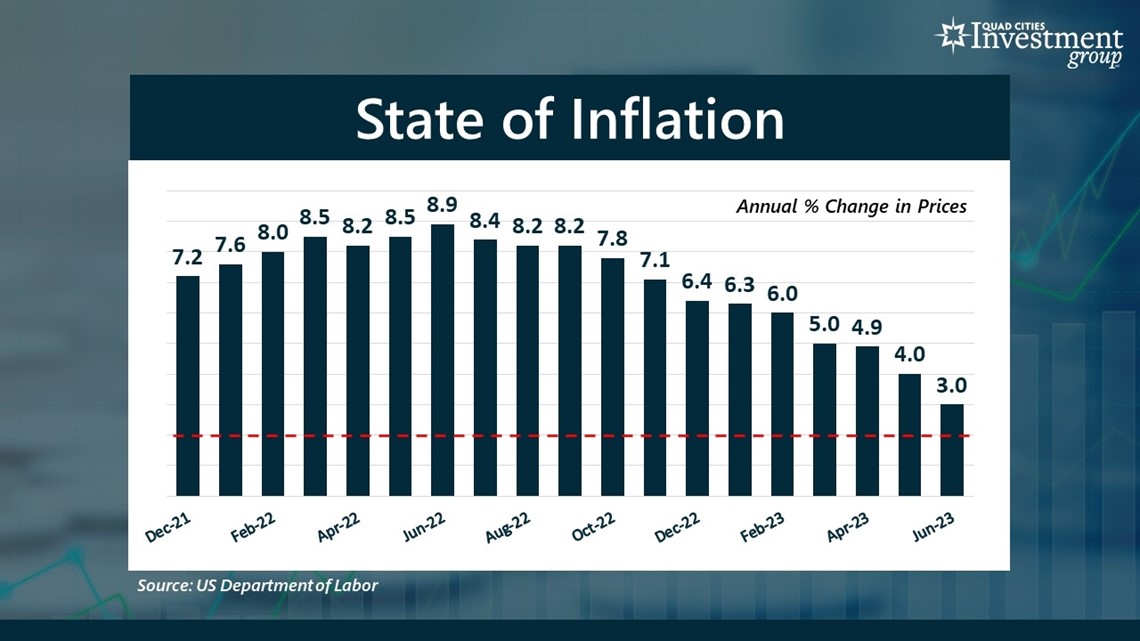

MOLINE, Ill. — For the past 2 ½ years, Americans have been struggling with rising consumer prices. Whether at the grocery store, your favorite retailers or at the gas pump, everything seems to cost a lot more money. But on Tuesday, the Department of Labor reported that the rate of inflation has declined from 4% to 3%. This is the lowest rate of inflation since March 2021.

News 8's Devin Brooks sat down with Mark Grywacheski from the Quad Cities Investment Group to break down what this means for Quad Citizens.

Brooks: If the inflation rate is declining, does that mean that consumer prices are now also declining?

Grywacheski: Unfortunately, no. Remember, the definition of inflation is the annual increase in prices for consumer goods and services. So, with an annual inflation rate of 3%, that means, on average, consumer prices are still 3% higher than they were 12 months ago. Now, within the realm of consumer goods and services you may see certain items were prices have declined. But, overall, consumer prices are still rising, just at a slightly slower pace.

Brooks: What are your thoughts when you take a closer look at this latest inflation data?

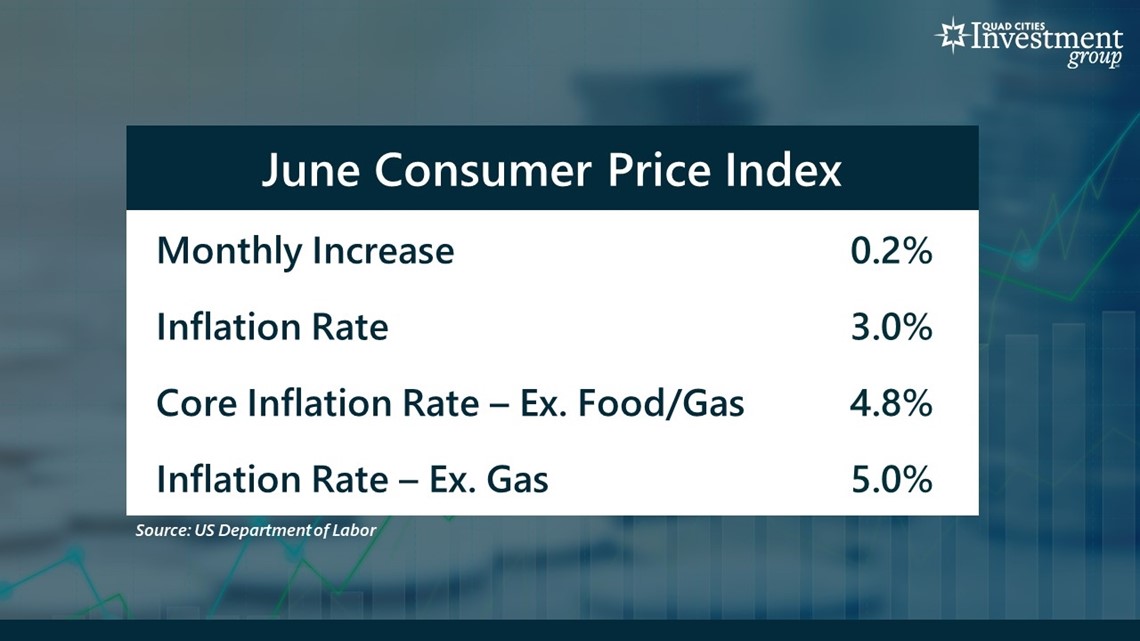

Grywacheski: First, it’s good to see that the overall inflation rate is declining. Last June, inflation was reported at 8.9%. But consumer prices are still rising. In June, consumer prices rose another 0.2% from May. This was the 37th consecutive monthly increase in consumer prices.

But, in my opinion, a lot of the decline in the inflation rate over the past 12 months is caused by a decline in energy prices. Last summer, gas prices reached a record-high of over $5/gallon. Today, that price is down to around $3.55/gallon- still high, but it has come down.

If you look at what’s called “core” inflation, which strips out the more volatile and seasonal food and energy prices, the inflation rate jumps to 4.8%. If you were to exclude gas prices only, the inflation rate jumps to 5%. So, this tells me that inflation is still very rampant and widespread outside of gas prices.

Brooks: You hear a lot of people over the past few months say that this environment of high inflation is over – and they point to the latest inflation rate of 3% as evidence. Do you agree? Do you think high inflation is essentially over?

Grywacheski: The ultimate goal is for inflation to return to its target rate of just 2%. But in my opinion, I think inflation will remain above 3% for quite some time for a number of key reasons.

1. Outside of gas prices, inflation is still fairly extensive.

2. In my opinion, this inflation was caused by roughly $6T in pandemic-related stimulus money flooding the economy. What did consumers, businesses and state/local governments do with all that money? They spent it. And this created an upward pressure on consumer prices.

Today, there’s still about 38% more US dollars circulating around the economy than there was before the pandemic. So, I think that will help keep this inflation higher for longer.