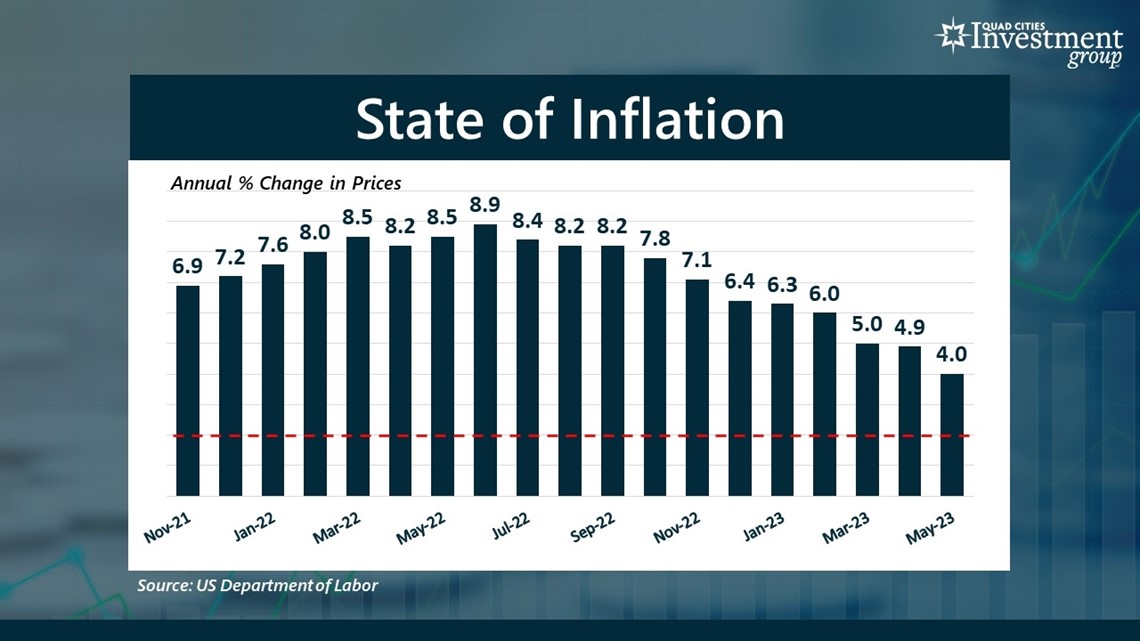

MOLINE, Ill. — On Tuesday, the U.S. Department of Labor reported that inflation declined from 4.9% down to 4%. The 4% inflation rate represents the lowest level of inflation for the country in two years.

So, is the battle over inflation finally coming to an end? Also, does this latest inflation data mean the Federal Reserve is done raising interest rates?

Our financial expert Mark Grywacheski joined us Monday morning to help answer those questions.

Bohlman: What are your overall thoughts on this latest inflation data from the Department of Labor?

Grywacheski: The headline number of the inflation rate falling from 8.9% down to 4% is certainly a positive. But when you dive into the metrics a bit more, there’s still a number of cautionary flags. Two of the identifying hallmarks of the current inflationary cycle are:

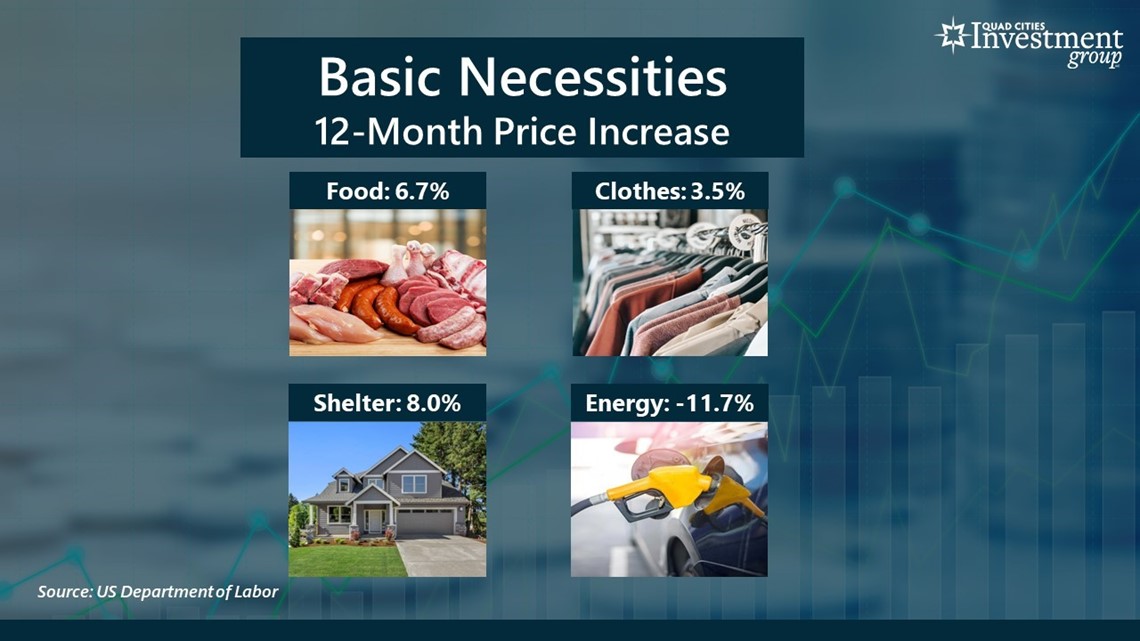

- It’s extremely expensive – Very few goods and services have been shielded from rising prices.

- The area of consumer goods and services that has been hit the hardest has been everyday basic necessities.

Over the past 12 months, energy prices have declined by 11.7%. But prices on food, clothing and especially shelter continue to rise at a very fast pace.

So, despite this improvement, inflation is still heavily imbedded in the majority of household spending.

Bohlman: Inflation has declined from its peak of 8.9% to a two-year low of 4%. Do you think we’re finally nearing the end of this inflationary cycle?

Grywacheski: Without question, progress has been made, but I think inflation will remain historically high – above 2% target rate – well into 2024.

I would argue that the main catalyst behind this decline from 8.9% to 4% is the decline in energy prices. Last summer, energy prices (gasoline/diesel fuel/natural gas) were at/near all-time record highs and they’ve since come down. But if you were to remove energy prices from the inflation calculation, inflation would immediately jump from 4% up to 5.5%.

This means we’re still seeing broad-based inflation across the realm of consumer prices. The problem with energy prices is that it’s an extremely volatile category. As history has shown, it can quickly surge higher again.

Because inflation is still so rampant outside of energy prices, I think it’s going to be well into 2024 before inflation get’s back to the 2% target rate we want to return to.

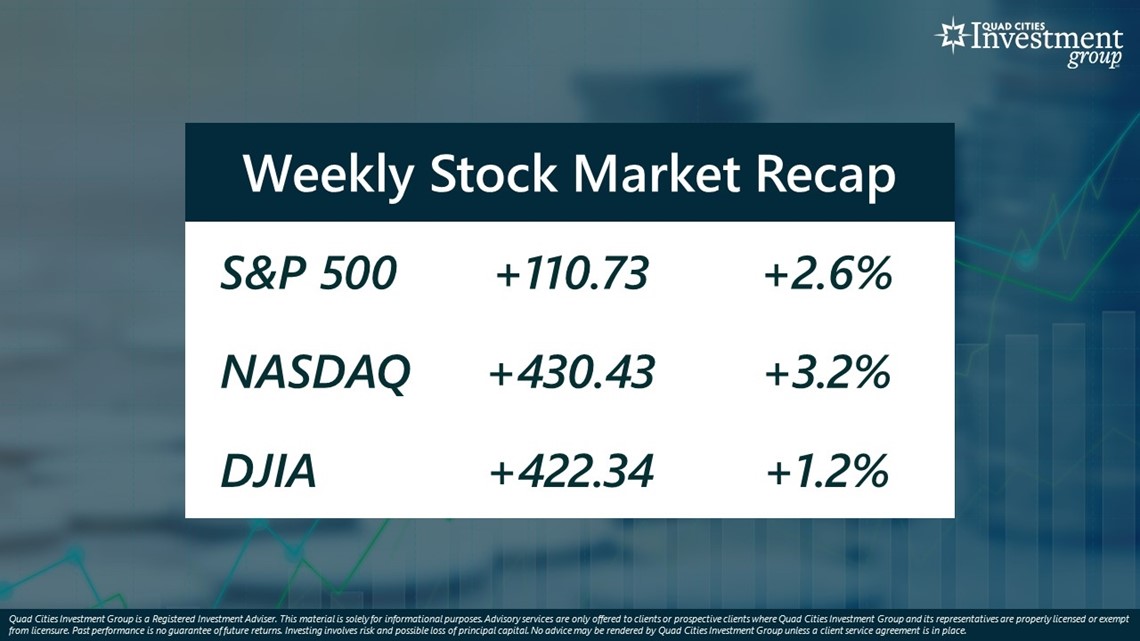

Bohlman: On Wednesday, the US Federal Reserve really shook up Wall Street when it announced we should expect two more ¼-point interest rate hikes by the end of the year. What are your thoughts on this latest announcement?

Grywacheski: Going into the Fed’s June meeting on Wednesday, Wall Street was broken up into two camps:

One thought (including me) the Fed would implement one more ¼-point rate hike to the benchmark fed funds rate within the next few months and then take a pause on future rate hikes the rest of the year.

The other camp thought we “might” get one more ¼-point rate hike but then the Fed would actually start to lower interest rates near the end of the year.

But the Fed really surprised everyone when it said we should expect two more ¼-point rate hikes in the upcoming months and not to expect the Fed to start lowering rates at all this year.

The Fed acknowledged that even though tremendous progress has been made in lowering inflation, there’s still a lot more work to be done in getting inflation back down to 2%.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel