MOLINE, Ill. — For most Americans, the money received from their tax refund is an important part of their household finances and budget. But according to the Internal Revenue Service, the average tax refund this year was about 11% lower than the year before.

Mark Grywacheski from Quad Cities Investment Group spoke with News 8's David Bohlman to discuss what this means.

Bohlman: What do you think is causing this sudden decline in the average tax refund this year?

Grywacheski: With all the pandemic-related stimulus measures we’ve seen over the past few years, it’s caused a fair amount of volatility in the average refund that many taxpayers receive. For example, in 2022, the average tax refund was about 13% higher than the year before. This past year, as you just mentioned, it declined by about 11%.

The main reason for this 11% decline is that a number of pandemic-related tax credits and stimulus payments expired or were phased out. Tax credits are a dollar-for-dollar reduction in the tax liability you owe. For the stimulus checks, you could either choose to receive a direct cash payment or you could choose to receive it as part of your tax refund. Because there are now fewer tax credits and stimulus payments, you now owe more taxes and thus you’ll likely receive a lower tax refund than you did from last year.

For me, the bigger concern and the area for greater potential pain for taxpayers comes in 2025 when most of the tax cuts that were implemented back in 2018 are set to expire. Unless these tax cuts get extended, even the very lowest tax brackets for low-income families are set to rise.

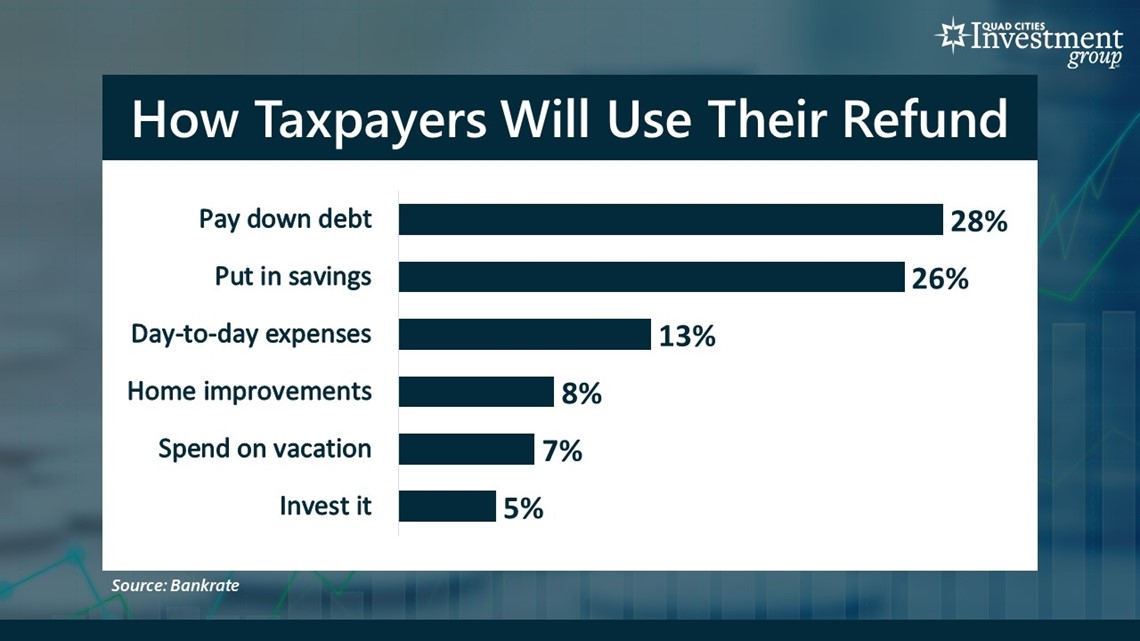

Bohlman: In a recent survey by Bankrate, most taxpayers say they will use their refund check to either pay off debt or to put it in savings. What other suggestions do you have for how people might spend their refund money?

Grywacheski: It’s understandable why people want to use their refund to either pay off debt or to add it to their savings. For the past 2+ years, high inflation has forced millions of Americans to either take on more credit card debt or to pull money from their savings/retirement accounts just to keep up with rising prices. In fact, within the past 6 months, credit card debt reached an all-time high while the household savings rate was near an all-time low.

If possible, build up your cash reserves. There’s a more-and-more consensus the U.S. economy will slide into recession this year- most likely in the 2nd ½ of the year. What we don’t know is what type of recession will it likely be. Will it be fairly short-term and mild or will it be longer and much more severe? But also, to what extent will any recession impact the labor market?

These extra cash reserves can provide some emergency funding if your job might be at risk or until we get through this expected rough patch in the economy.

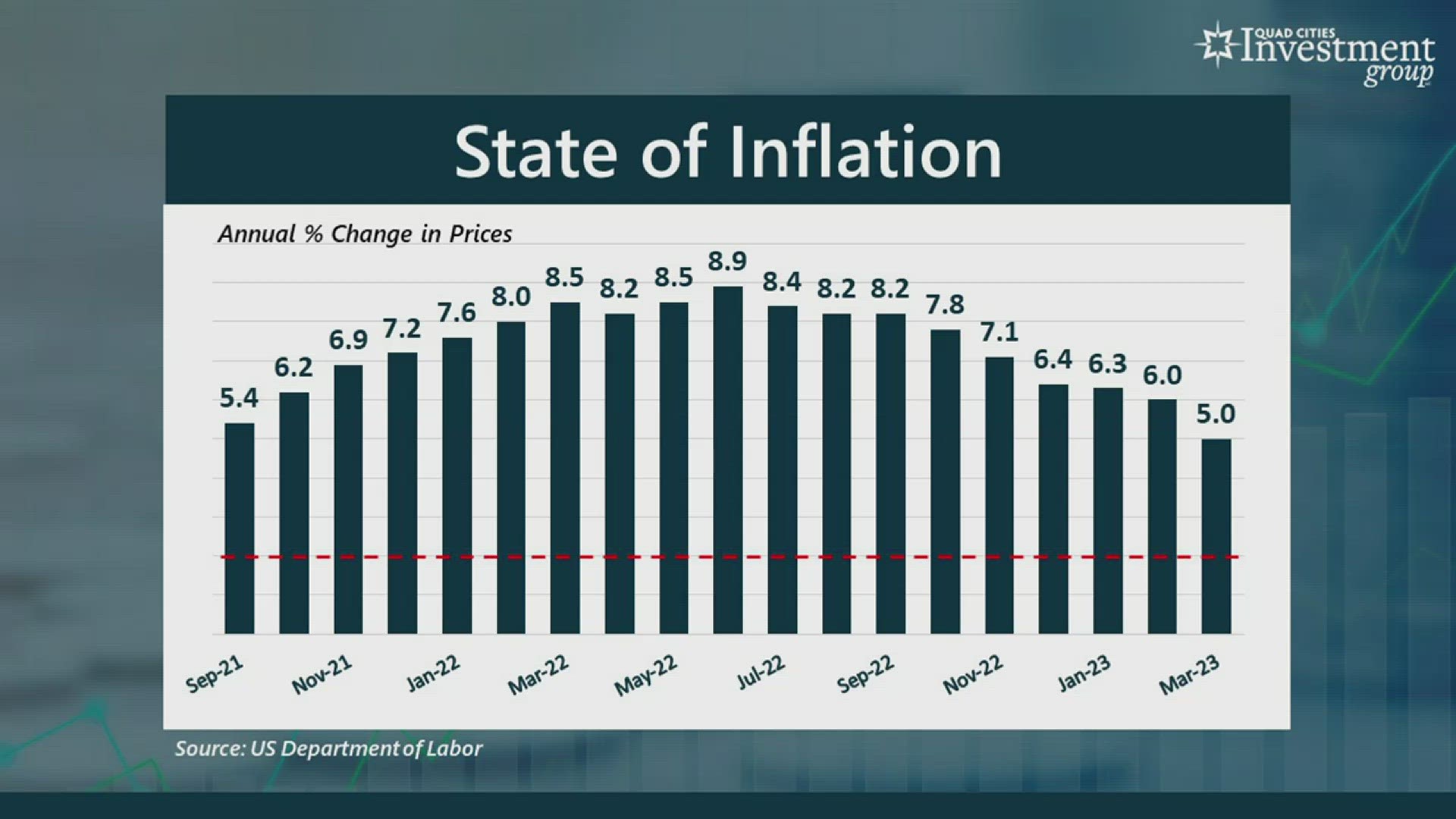

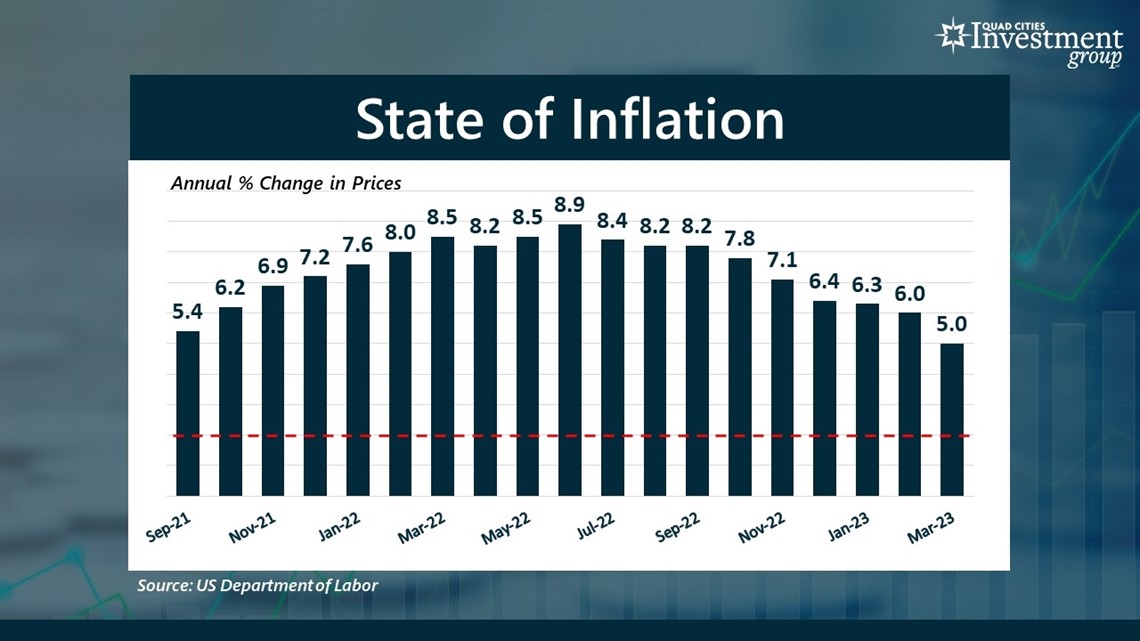

Bohlman: You’ve argued that we should expect inflation to remain historically high for the rest of this year and even into 2024. But the Dept. of Labor recently reported that the rate of inflation further declined from 6% down to 5%. Does this latest data in any way change your outlook on inflation?

Grywacheski: Unfortunately, it doesn’t. Going back to the early days of 2021, I’ve long argued that inflation wouldn’t be “short-term and mild” but that it would be much more longer-lasting and severe. Even though inflation has fallen from its peak of 8.9% back in June, it’s going to take a long time for us to return to that 2% target rate we want to get back to.

This inflation was caused by the government dropping $6T in pandemic stimulus money on the economy. And what did consumers, businesses and state/local governments do with all that money? They spent it! And that created a tremendous upward pressure on consumer prices. Today, there are still 38% more dollars circulating around the economy than there were before the pandemic. And all that money, in my opinion, will keep inflation historically high at least into 2024.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel