MOLINE, Ill. — In its attempt to keep inflation in check, the U.S. Federal Reserve has been aggressively raising interest rates for the last year-and-a-half. On Wednesday, the Federal Reserve once again raised its benchmark Fed Funds Rate by another 0.25% to a range between 5.25% and 5.5%. This would mark the highest rate in over 22 years.

Devin Brooks: With inflation declining to its current rate of 3%, why do you think the Federal Reserve felt the need to raise interest rates yet again?

Mark Grywacheski: The Fed doesn’t want to get in a position where it underestimates just how stubborn this inflation really is. As I said a couple of weeks ago, one of the main reasons inflation has been declining the past year is because of a decline in energy prices. But if you were to remove energy prices from the inflation calculation, the rate of inflation would jump from 3% to 5%. This conveys that, outside of energy prices, inflation is still quite widespread throughout the economy. Moreover, the price for a barrel of crude oil has risen about 18% over the past month.

If the Fed were to take its foot off the gas pedal on trying to quash inflation, it risks inflation re-igniting. For you Fed historians, that’s exactly what happened in the late 1970’s. The Fed prematurely thought it had tamed inflation only to have it roar back to life.

Brooks: With interest rates at a 22-year high, in what ways are consumers being impacted?

Grywacheski: The Fed Funds Rate serves as a benchmark for many forms of consumer debt. So, as the Fed either raises/lowers the Fed Funds Rate, it will typically raise/lower interest rates on credit cards, bank loans, HELOCs and home mortgage rates.

The Fed’s goal by raising interest rates is to disincentivize consumer and business spending and thus help reduce inflationary pressures. Higher interest rates make it more expensive to borrow money to purchase goods and services on credit.

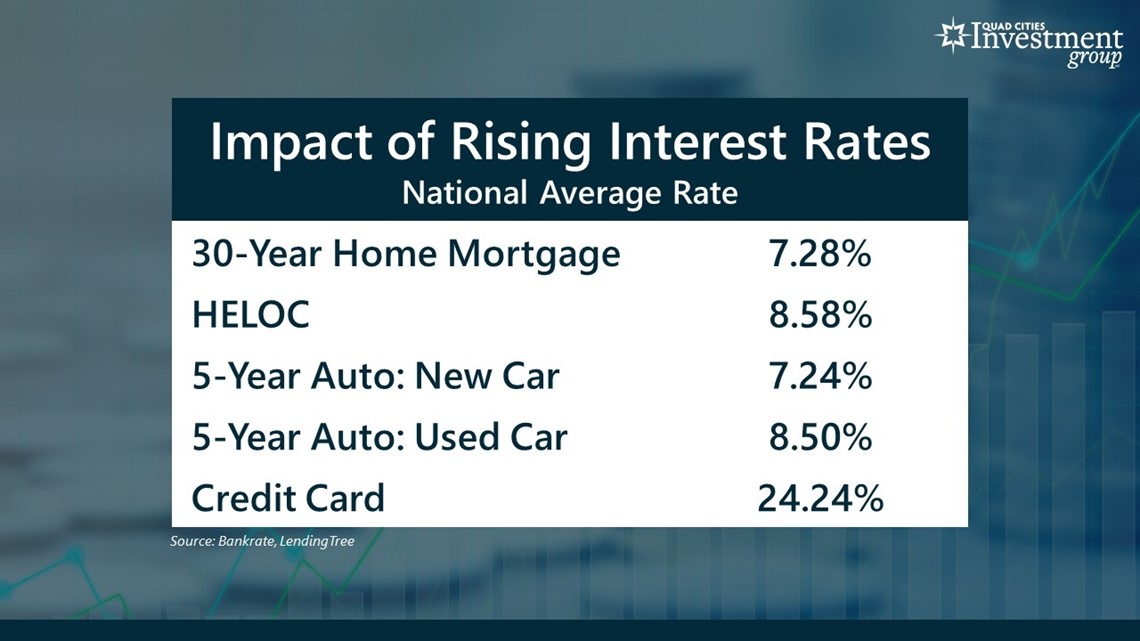

As a result, we’re seeing interest rates on consumer debt absolutely soar:

The national average rate on a 30-year home mortgage is 7.28%. Two years ago, the average rate was around 2.75%. Here’s an example: Assuming a consumer buys a $225,000 home and puts down a 20% down payment, this would increase the monthly principal and interest payment by $497, or $5,964 per year.

- The average interest rate for a HELOC is 8.58%.

- The average interest rate on a five-year auto loan has risen to 7.24% for a new car and 8.5% for a used car.

- Finally, the average interest rate on credit cards is 24.24%.

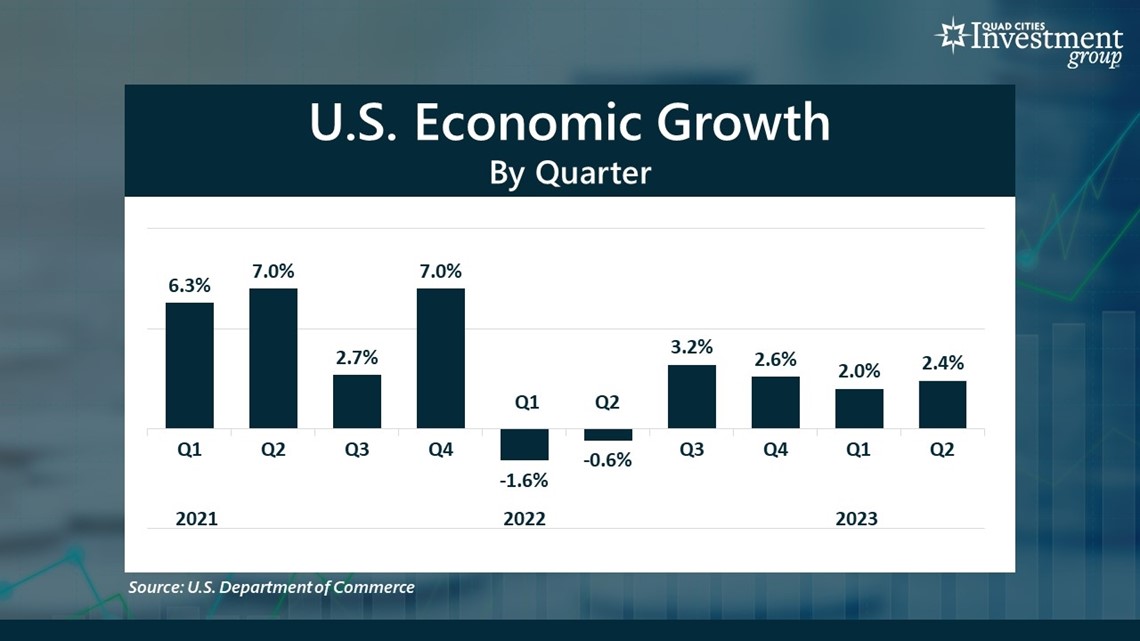

Brooks: On Thursday, the Department of Commerce reported the economy in the second quarter grew at an annualized rate of 2.4%, well above Wall Street’s forecast of just 1.5%. What are your thoughts on this stronger-than-expected report on the economy?

Grywacheski: It really was a pleasant surprise. This better-than-expected growth in the 2nd quarter was led by both consumer and business spending. So far this year, both the economy and labor market have remained quite resilient.

On Friday I spoke to a number of former trading colleagues of mine on Wall Street and for them there’s still tremendous anxiety and uncertainty over the 2nd half of the year. They do expect both the economy and labor market to weaken but where much of the uncertainty lies is if that weakness is strong enough to tip the economy back into recession. That’s where there seems to be much more debate.