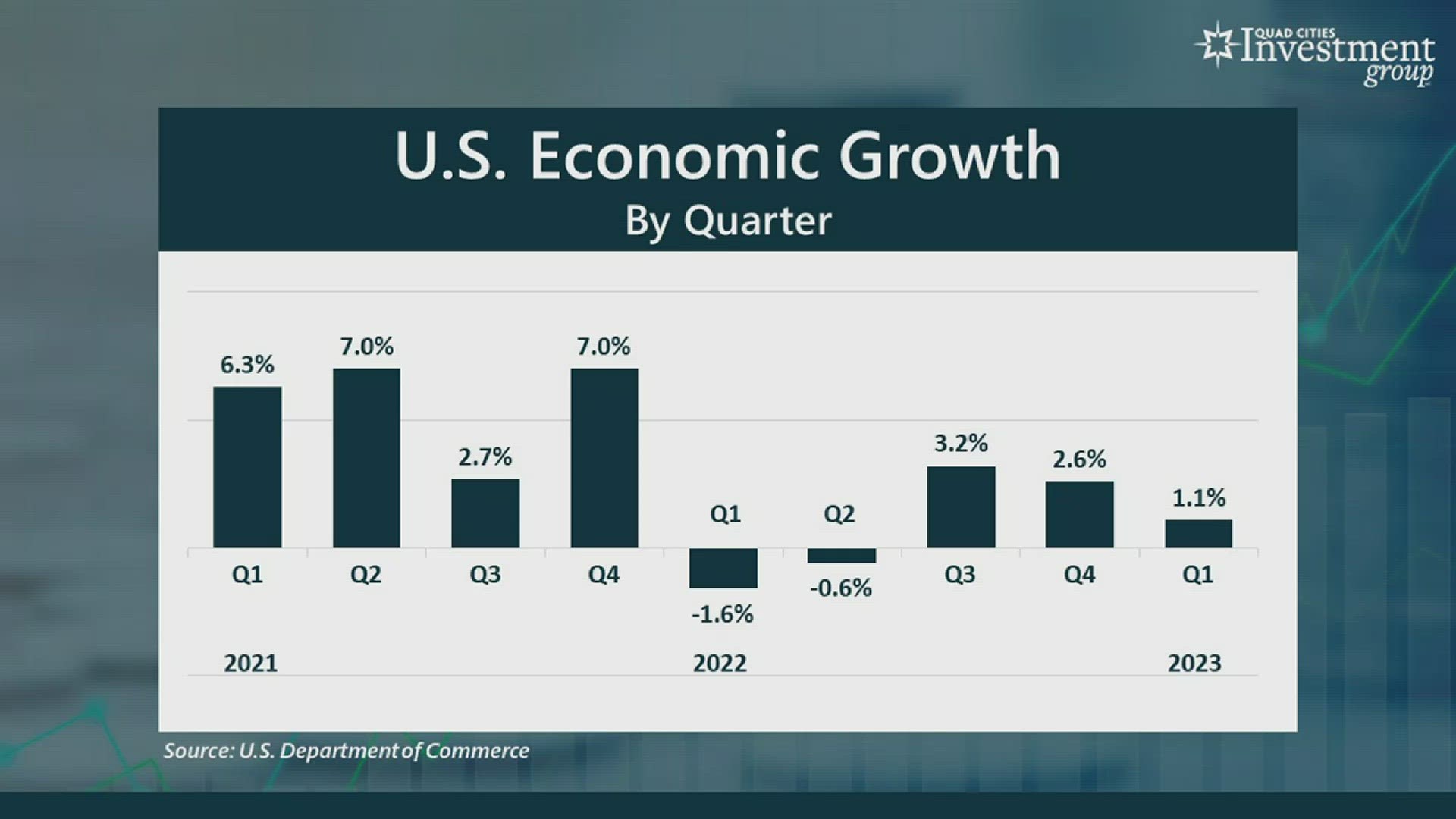

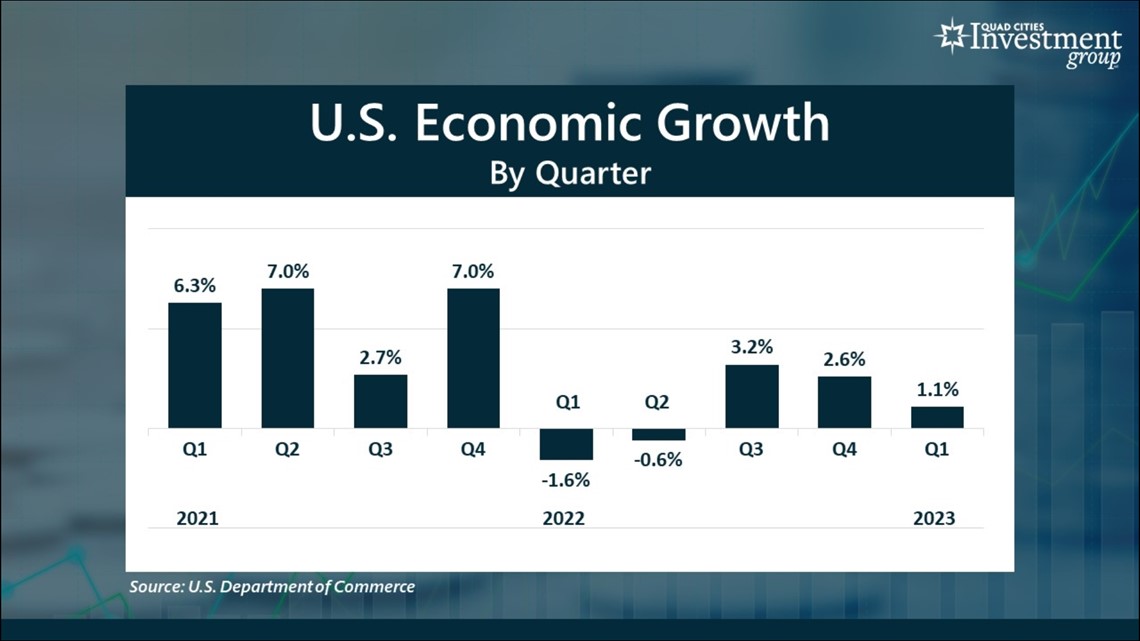

MOLINE, Ill. — Last week, the U.S. Department of Commerce reported that the American economy grew at an annualized rate of just 1.1% in the January-March first quarter.

This was well below Wall Street’s 2% growth rate forecast. The weaker-than-expected economic report fueled additional concerns on Wall Street that the American economy is weakening and is likely heading toward recession later this year.

Quad Cities Investment Group's Mark Grywacheski sat down over Zoom with David Bohlman to answer questions about what this means for Americans.

You can watch more "Your Money with Mark" segments on News 8's YouTube channel or on the News8+ app.

Bohlman: When you take a closer look at this latest economic report, what stands out the most?

Grywacheski: The downward trend in economic growth over the past few quarters is hard to ignore. But also, the fact that the 1.1% growth rate in the first quarter was significantly below the 2% rate that Wall Street was expecting. This trend of a weakening economy gives further support to the consensus expectation that the economy will dip back into recession sometime this year.

If you remember, back in the first and second quarters of last year, the economy entered a technical recession, which is defined as two consecutive quarters of negative economic growth – in other words, the economy actually contracted.

But, secondly, I think a lot of people were surprised that one of the strongest areas within the economy in the first quarter was consumer spending. And that’s critical because consumer spending typically drives about two-thirds of our nation’s total economic growth. In the first quarter, consumer spending increased at an annualized rate of 3.7%, the largest quarterly gain in nearly two years.

But how much longer can the American consumer hold up in the face of a steady barrage of high inflation and rising interest rates? That’s the main question that Wall Street is trying to piece together.

Bohlman: Does this latest economic report indicate that any potential recession might now be stronger than previously expected?

Grywacheski: No, it doesn’t. Even with this latest report, there are just far too many variables and unknowns over the next nine months to give any accurate measure of just how mild or severe any recession might be. Any time you start talking about the economy, the conversation inevitably turns to consumer spending- again, which is the main driver of the U.S. economy.

In my opinion, I think one of the key variables for just how strong consumer spending remains and how any recession ultimately plays out will be heavily dependent on the labor market.

Right now, the labor market is still quite strong. If the labor market remains fairly strong over the next nine months, that means there are more people employed- and that means there are more people receiving a paycheck- and that means there are more people spending their disposable income which ultimately keeps the economy going and minimizes the fallout of any potential recession.

Bohlman: If we do happen to enter a recession, what areas of the economy do you think might get hit hardest and what areas do you think might fare the best?

Grywacheski: A recession tends to be a broad-based decline across the full spectrum of the economy. But for the past 12 months, we’ve seen a steady decline in manufacturing and a steady strength in the service industries (bars/restaurants/movie theaters/travel industry) that I think will continue for the rest of the year. Here’s why.

Back in 2020 and into the first half of 2021, government lockdowns and quarantines forced a massive shift in spending away from services and into the purchase of physical goods. We were basically stuck at home and bought a lot of physical goods to occupy our time because we couldn’t go to the bars/restaurants/movie theaters.

But as the economy reopened, we continue to see this return shift in consumer spending, resources and labor out of manufacturing/physical goods and back into services. I think that’s a trend that will continue for the rest of 2023.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.