MOLINE, Ill. — Historically, low-income families and retirees tend to be the most vulnerable to the impact of inflation. But over the past two years, more and more middle-class households have been struggling to make ends meet.

According to a recent survey by financial services company LendingClub, 62% of all Americans now say they are living paycheck-to-paycheck.

Mark Grywacheski from Quad Cities Investment Group spoke with News 8's David Bohlman to discuss what this means.

Bohlman: We’ve seen inflation gradually decline from its peak of 8.9% in June to its current rate of 6%. Why do you think we’re still seeing so many people living paycheck-to-paycheck?

Grywacheski: One of the big misconceptions people often have is thinking that when inflation declines it means that consumer prices are also declining. The definition of inflation is the annual increase in consumer prices over the past 12 months. So, with a current inflation rate of 6%, this means that, on average, consumer prices are still 6% higher than they were 12 months ago. Consumer prices are still rising, just at a slightly slower pace. Consumers have been battling high inflation for 24 consecutive months.

But the hallmark of this current inflationary cycle is that:

- Very few items are being shielded from these high prices.

- The consumer goods and services being hit the hardest by rising prices are basic necessities- food, clothing, housing and energy.

And this makes it extremely difficult to navigate these high prices. You need to buy these items to provide for you and your family!

Bohlman: In another survey by LendingTree, 44% of Americans now say they have a side job to help make ends meet. This is up from 13% in 2020. What other ways can people help improve their financial situation?

Grywacheski: One of the things I really recommend that everyone can do is to focus on their cash outflows.

- Keep track of your expenses and how you’re spending your money. There’s so many people who don’t have any idea of how much they’re actually spending each month or where that money is going. Go through all your bills and credit card statements. In today’s world of automatic payments you’d be surprised at the number of people who are paying membership fees and monthly/quarterly subscriptions for things they don’t even use any more. This also allows you to identify and re-evaluate what specific costs are necessary living expenses vs non-essential costs that you may want to reduce or eliminate.

- This high inflation has forced consumers to take on a record amount of credit card debt. With high interest rates, many of those credit cards are charging an interest rate of over 25%! If you do have to carry a credit card balance, see if you can transfer that balance to a credit card offering a promotional 0% rate or one that simply has a much lower interest rate. It definitely pays to shop around and the internet is a great tool to search for these lower rate credit cards and promotions.

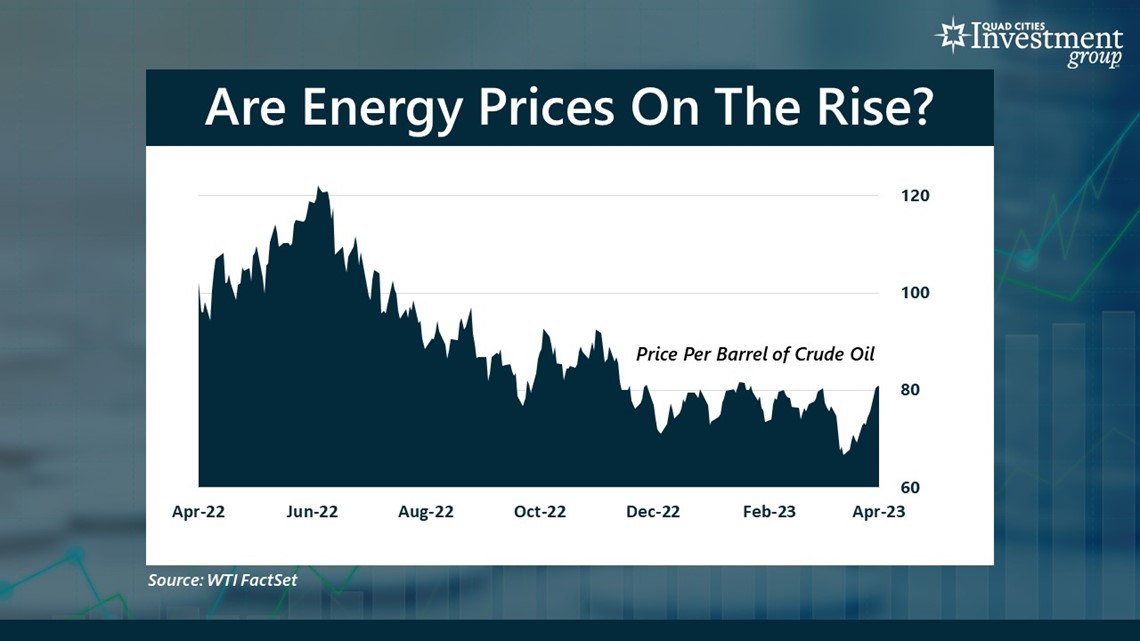

Bohlman: Last week, OPEC and Russia announced a coordinated production cut of crude oil. Does that mean we’ll start to see gas prices start to rise again and what impact might this have on inflation?

Grywacheski: This combined production cut of about 1.2 MBPD by OPEC + Russia is quite substantial and these cuts are expected to last through the end of the year. That’s on top of another production cut that OPEC + Russia announced in October. In the two days immediately after the announcement, the price for a barrel of crude oil rose 10% from $74 to over $81. Many analysts are now expecting crude oil prices to reach $100/barrel by year-end.

Any time crude oil prices rise, you’ll see a corresponding rise in prices for gasoline, diesel fuel, jet fuel, kerosene, heating oil- all of those products are produced from a barrel of crude oil. Higher energy costs inherently increase

the cost of manufacturing and transportation costs which ultimately get passed onto the consumer in the form of higher retail prices.

I would argue that the decline in inflation we’ve seen since June was primarily caused by a decline in crude oil prices. But if crude oil prices start to rise again- which is the intended goal of this production cut- I do have a very serious concern that we could soon start to shee inflation reverse its downward trajectory and start to rise again.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.