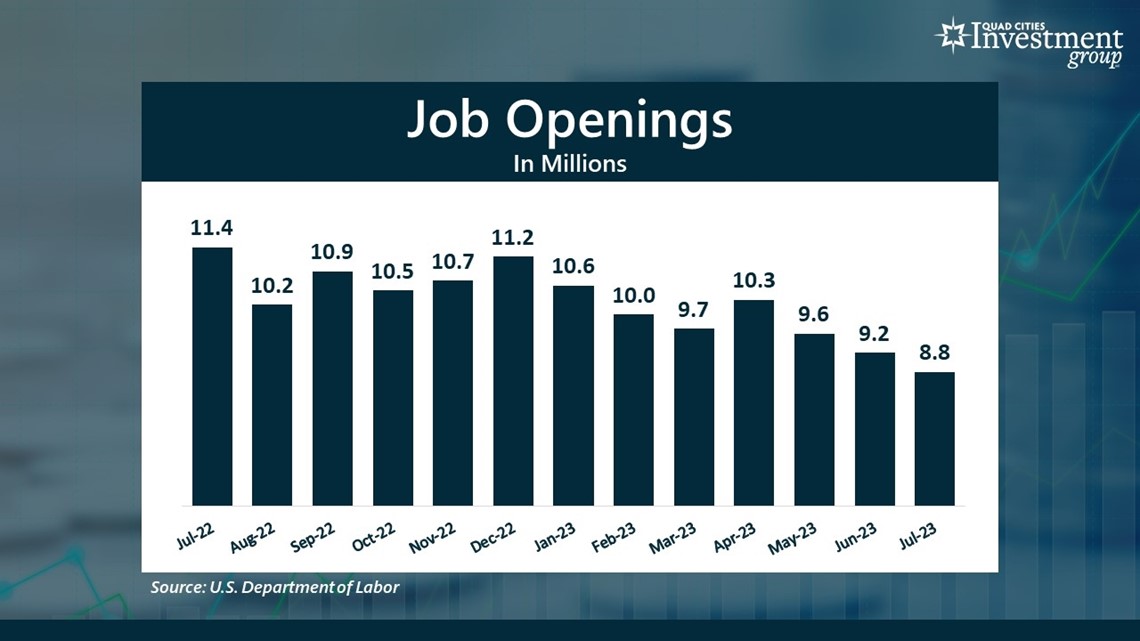

MOLINE, Ill. — Last Tuesday, the US Department of Labor reported the number of job openings in the country has dropped to a two-year low. The 8.8 million job openings reported was 732,000 fewer than the 9.6 million that Wall Street was projecting. Since the beginning of the year, the number of job openings across the nation has declined by more than 2.4 million.

News 8's Devin Brooks sat down with Mark Grywacheski of the Quad Cities Investment Group to discuss and analyze these new labor reports.

Devin: Why have we been seeing this sudden decline in the number of job openings across the country?

Mark: I don’t want our viewers to think that the sky is falling with respect to the labor market. Overall, the labor market remains fairly strong. The 8.8 million job openings is still a very large number of open positions waiting to be filled. More importantly, this conveys that employers still have a strong demand for qualified workers.

But that said, this latest report does give further evidence that the labor market is gradually starting to weaken. We continue to see a steady decline in the number of job openings across the country. The current 8.8 million job openings is the lowest reported number of job openings since March 2021. Since the beginning of the year, the number of job openings has declined by 2.4 million.

So, even though the labor market is still fairly strong, we’re starting to see more and more cracks form within that strength.

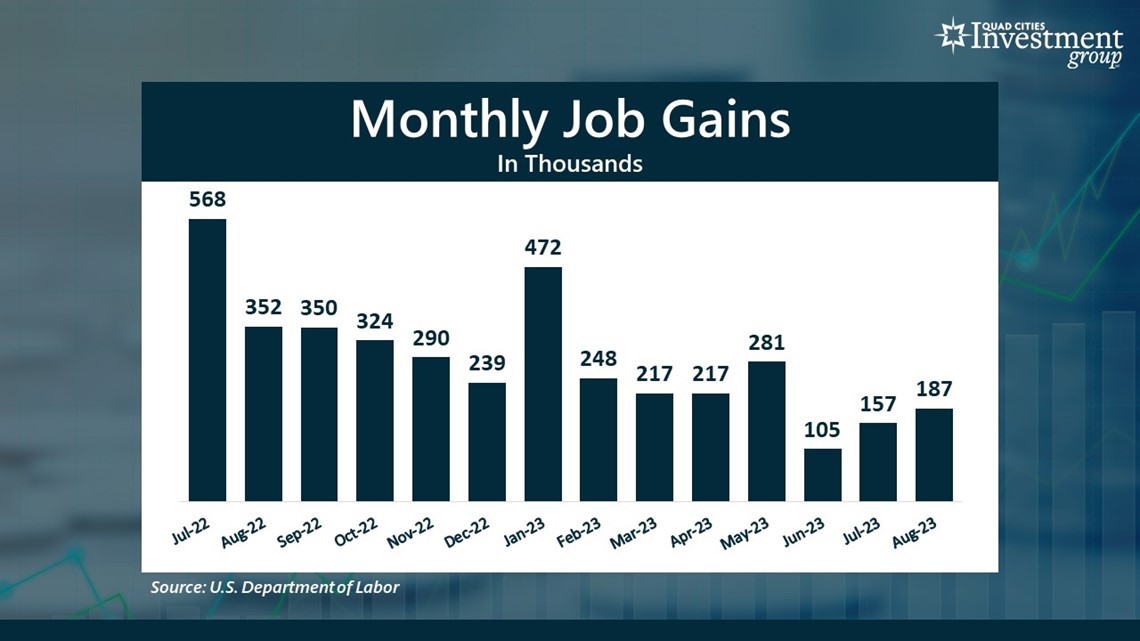

Devin: On Friday, the Department of Labor also released the August Employment Report which showed the economy added 187,000 new jobs last month but the national unemployment rate jumped from 3.5% up to 3.8%. What are your thoughts on this latest Employment report?

Mark: Again, it reinforces that argument that even though the labor market is fairly strong, more and more cracks are starting to form. The unemployment rate jumped from 3.5% to 3.8%, but 3.8% is still near a 50-year low. A 3.8% unemployment rate is not a sign of distress or collapse within the US labor market.

But that said, it’s also further evidence the labor market has been gradually weakening.

- We continue to see a steady decline in the number of new jobs being added each month.

- The number of job openings has been steadily declining.

- Over the next few months, the unemployment rate is expected to slowly creep even higher.

It’s not a doom-and-gloom outlook for the labor market, but we need to be aware the labor market is going through this transition.

Devin: We just wrapped up the back-to-school shopping season. But we’re literally less than two months away from the November-December holiday shopping season, the retail industry’s biggest event of the year. Will consumers be willing to spend their money given the state of the labor market and the ongoing concerns of a recession?

Mark: With respect to a potential recession, the three biggest factors are consumer spending, consumer spending and, oh by the way, there’s consumer spending. The reason I say that is that consumer spending drives more than 2/3 of the country’s total economic growth. And if consumer spending suddenly plummets, the odds of a recession increase substantially.

In my opinion, the strength of consumer spending will rely heavily on the continued strength of the labor market. When jobs are plentiful and consumers are optimistic in their job security, they tend to spend their money more freely – which drives the economy and can keep the economy out of recession.

Now, so far, consumer spending has remained fairly strong. But with savings accounts shrinking, household debt at record levels and now further evidence of a weakening labor market, will consumers have the confidence and ability to really open up their pocketbooks for the upcoming November-December holiday shopping season? And I think that will become a growing debate on Wall Street the closer we get to the holiday shopping season.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel