MOLINE, Ill. — 2022 was not a kind year for the U.S. stock market.

In October, the S&P 500 had fallen by over 25%. But 2023 has brought some much-needed relief to investors. So far this year, the S&P 500 has gained 11.5% while the NASDAQ is up 26.5%. On Friday, the DJIA rose over 700 points, its biggest daily point gain of 2023.

News 8's David Bohlman spoke with Quad Cities Investment Group's Mark Grywacheski to discuss what this means.

Bohlman: What are your thoughts on this ongoing rise in the stock market?

Grywacheski: This rise in the US stock market this year requires some perspective. Without question, so far this year, the US stock market has performed quite well. But remember, the ultimate goal is to return to/exceed the all-time highs set back in January 2022.

- So far this year, the S7P 500 has gained 11.5%. But it’s still 10.7% short from its Jan. 2022 ATH.

- The NASDAQ is up 26.5% this year. But it’s still down 17.5% from its ATH.

- The DJIA is up 1.9% this year. But it’s still down 8.3% from its ATH.

In summary, the stock market has performed quite well this year. But in my opinion, I think any return to those all-time highs will 1. B choppy, and 2. May take some time.

Bohlman: Seeing how well the stock market has done this year, is this a good time for investors to put some extra money into the stock market?

Grywacheski: You have to ask yourself what is your investing timeline? – when you may need that money – will it be short-term or long-term?

In the short-term, I think there’s going to be a lot of volatility in the stock market. Remember, we still have high inflation, rising interest rates and a very uncertain outlook for the US economy. And until Wall Street gets some comfort on these issues, I think Wall Street will be very hesitant to push the stock market back to those ATH’s we had in January 2022.

From a longer-term perspective, there is an opportunity to buy into the stock market where stock prices are still well below their ATHs. But if you do, do what’s called dollar-cost averaging where you gradually put a little bit of money into the stock market over time rather than all at once. A good example of dollar-cost averaging is your automatic contributions to your employer 401K. Every paycheck, you’re gradually investing some of those dollars into the stock market.

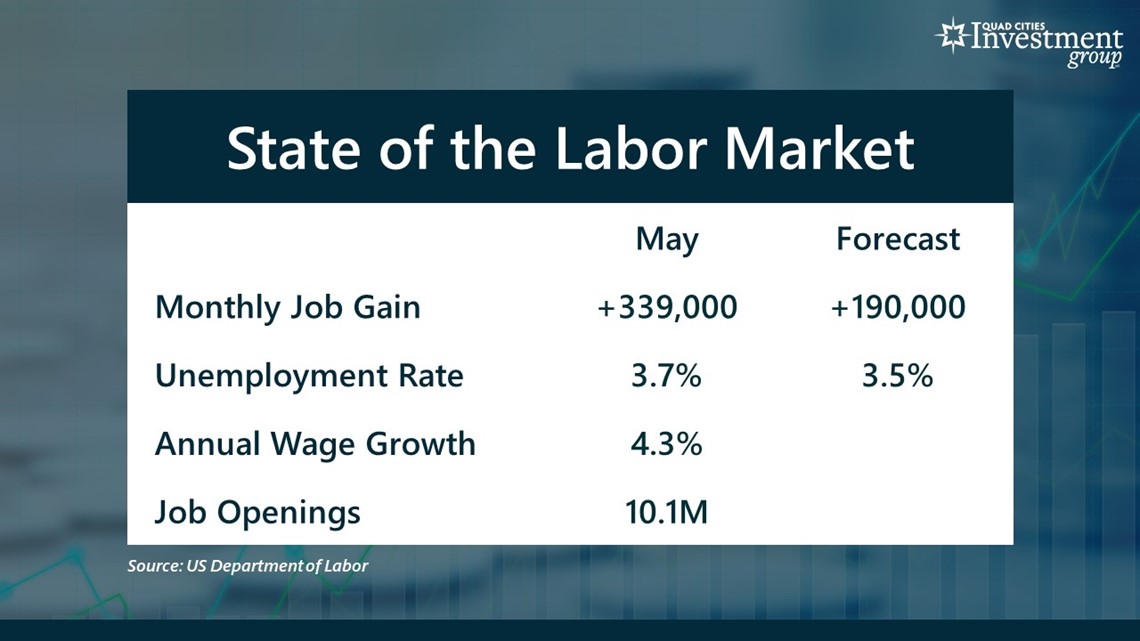

Bohlman: On Friday, the Department of Labor released its May Employment Report. Some say it was a very strong report while others say it was a bit mixed. What are your thoughts on the state of the labor market?

Grywacheski: There’s a lot of concerning areas of the economy, but the labor market is one of those facets that has remained quite robust. Regarding this latest data, I view it as a bit mixed. On the positive side, in May, the economy added 339K new jobs, well above the 190K that Wall Street had forecast. So far this year, the economy is adding 315K new jobs each month. There’s also 10.1M unfilled job openings across the nation- which shows that employers are still looking for qualified workers.

On the negative side, the unemployment rate did rise from 3.4% in April to 3.7% in May. Wall Street was expecting the unemployment rate to rise to just 3.5%. But also, annual wage growth was reported at 4.3%. With inflation currently at 4.9%, wages are just simply not keeping up with rising consumer prices.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.