ROCK ISLAND, Illinois — Illinois Gov. J.B. Pritzker signed a bill into law on Monday that will eliminate the state's 1% grocery tax at the start of 2026.

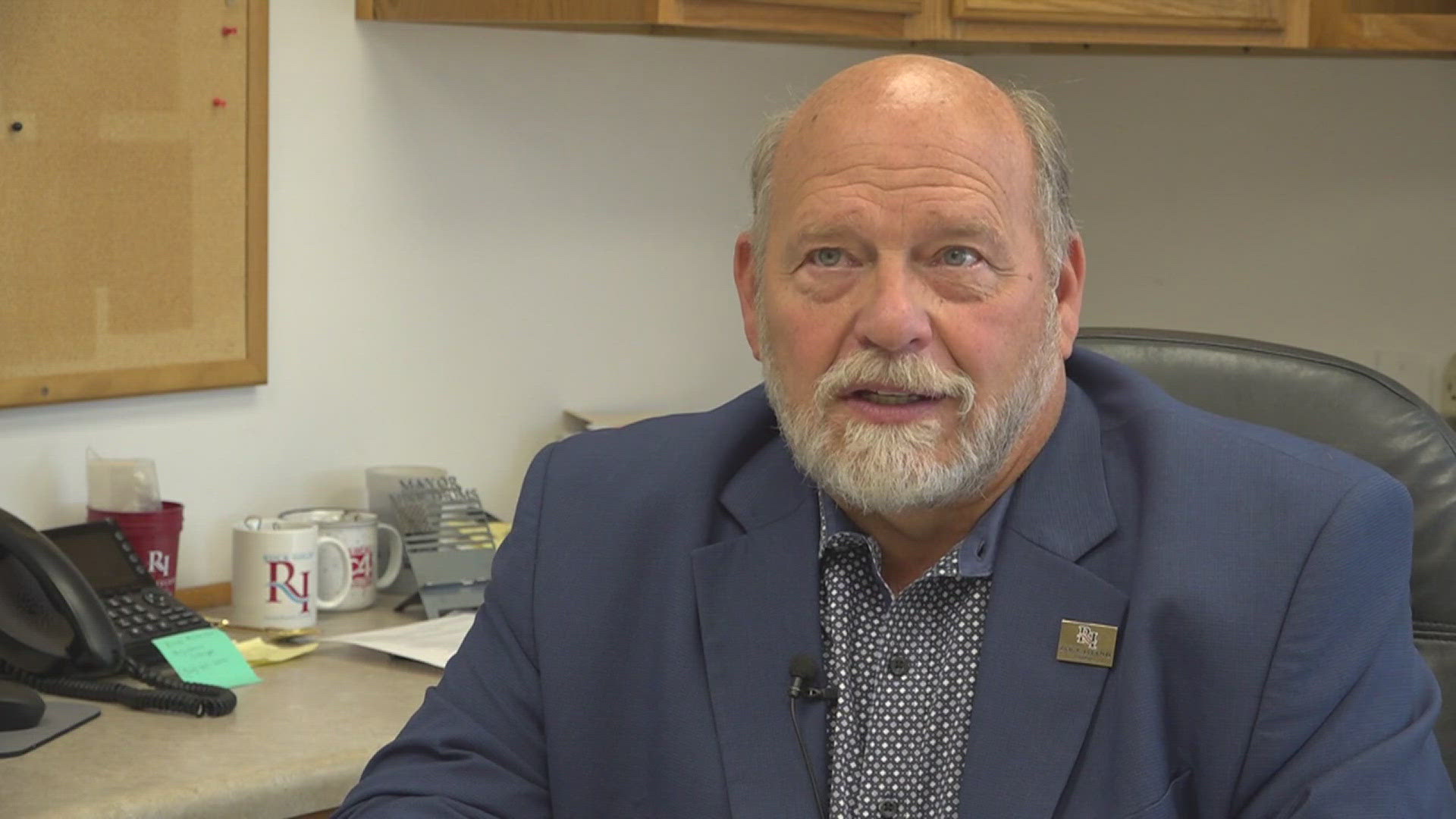

Revenue from the tax goes to cities across the state. For Rock Island, that 1% tax on groceries is a major source of income as it brings in around $1 million a year. Rock Island Mayor Mike Thoms said the money goes to numerous city uses.

"We would use it for road repairs, police and fire salaries and pensions, building improvements," Thoms said.

Thoms said the city has been weighing their options on what to do when the law becomes active, as cities can vote to have the tax added locally.

"One is to do nothing and try to cut expense and find other revenues," Thoms said. "Or we could vote to reimplement the 1% sales tax for groceries."

But he said Rock Island will have to make a decision by October 2025.

"We could vote that we don't want it. We could take a vote that says we do want it," Thoms said.

Thoms said if they don't continue the grocery tax, they'll have to start cutting other funds and lowering city employment.

"We're 35, 40 employees less today than we were 10 years ago," Thoms said. "So we've already reduced the size of the city employment. The city has worked very hard at trying to control expenses and try to keep expenses low."

Thoms said this would only hinder Rock Island's growth in the future.

"If you cut back on economic development staff, that's your future income," Thoms said. "They're working on drawing businesses in here to get new revenue. So you don't want to cut that."

Illinois is one of 13 states that has a grocery tax. Thoms said the law was initially supposed to take effect immediately, but the lawmakers moved the start date to Jan. 1, 2026, to allow more time for cities to react to the changes.