MOLINE, Ill. — Editor's note: The video above is from June 23.

There is more to election season than picking the right candidate to represent you. There are also many issues to be voted on.

For the Quad Cities area, there are quite a few propositions folks should know about before heading to the polls. We've broken down those issues below.

Election results can be found here on election day and below once the polls close at 7 p.m. on June 28.

Coal Valley Fire Protection District Proposition

Question: "Shall the maximum allowable tax rate for the Coal Valley Protection District be increased from .3% to .4% of the value of all taxable property within the district, as equalized or assessed by the Department of Revenue?

What it means: Voters will be able to vote on a small property tax increase that would benefit the Coal Valley Protection District.

Who it impacts: Coal Valley residents living in either Henry or Rock Island counties.

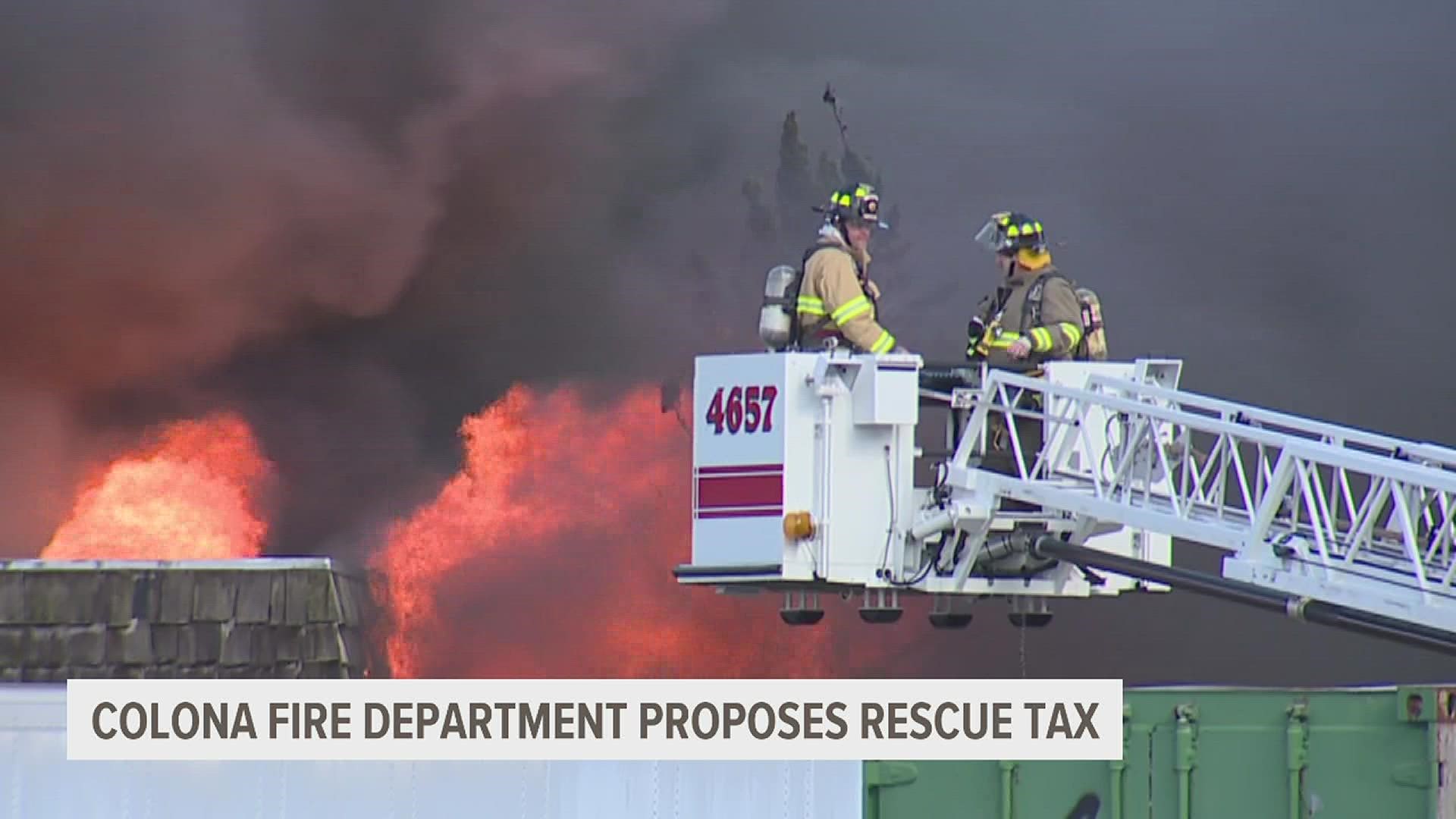

Colona Fire Protection Proposition

Question: "Shall the Colona Fire Protection District levy a special tax at a rate not to exceed 0.10% of the value of all taxable property within the district as equalized or assessed by the Department of Revenue for the purpose of providing funds to pay for the costs of emergency and rescue crews and equipment?"

What it means: Voters will be able to vote on a small property tax that would go to the Fire Protection District, letting them hire more firefighters.

Who it impacts: Colona residents and others served in the Fire Protection District.

City of Silvis Proposition

Question: "Should the City of Silvis continue to use the Civil Service Commission to hire staff instead of hiring them directly to fill open positions with the city?"

What it means: The commission, filled by three members appointed by the mayor, hires full-time employees for the city, instead of the city doing it directly. Voters will choose whether to keep using the Commission or let the City hire on its own.

Who it impacts: The local government of Silvis, Illinois, and its prospective employees.

Short background: The commission survived a previous disbanding vote in 2020.

Preemption Township Public Question

Question: "Shall Preemption Township allow legally equipped and registered ATVs and UTVs with legal drivers to operate on designated Preemption Township highways?"

What it means: Licensed drivers would be able to drive ATV or UTV vehicles on some highways in the Preemption Township.

Who it impacts: Drivers in the Preemption Township.

Short background: Community groups in the area have voiced concerns about ATVs/UTVs on the roads in the recent past.

Greene Township Fire Protection Tax Rate

Question: "Shall the maximum allowable tax rate for the Greene Township Fire Protection District be increased from .60% to .90% of the value of all taxable property within the district as equalized or assessed by the Department of Revenue?"

What it means: The tax would constitute an about 30-cent-increase per every $100 in tax that would help supplement the cost of providing ambulance services.

Who it impacts: Greene Township taxpayers and people in emergency medical situations that may require ambulance service.

To stay up to date on election coverage, download the WQAD News 8 app and subscribe to our YouTube channel.