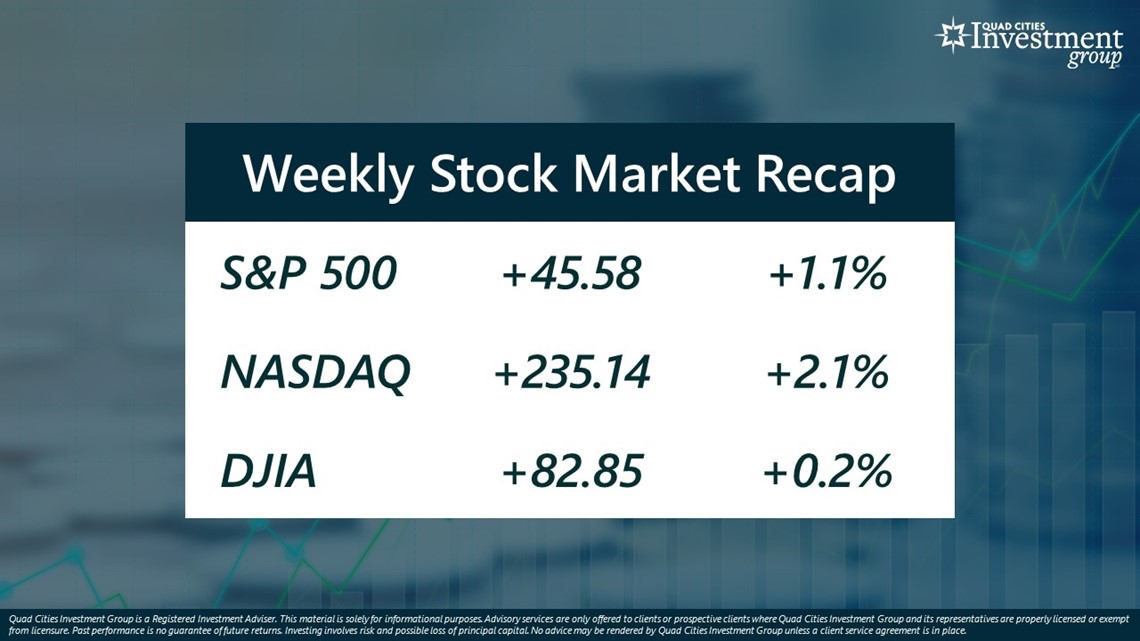

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index rose 1.1%, NASDAQ rose 2.1% and DJIA rose 0.2%.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's David Bohlman to discuss some ways you can take advantage of the New Year's resolution season to shore up your financial and household finances.

With the end of 2022 quickly approaching, many Americans are already contemplating their New Year’s resolutions. Whether it’s to eat a bit healthier, take up a new hobby or to finally take that dream vacation you’ve always wanted, New Year’s resolutions are the perfect time to set new goals for positive change. But including some financial resolutions into your list of goals can be a great way to shore up your personal and household finances.

Bohlman: What would be one of your top financial resolutions you would suggest for 2023?

Grywacheski: One of my biggest suggestions is to reduce debt that carries a high interest rate, especially, credit card debt. Over the past year, credit card debt has soared to record levels. The average credit card balance is around $6,000. As interest rates have soared, the average interest rate people are charged on credit card balances is around 20%. And that means more of your money is used to simply pay the interest you’re charged rather than paying down the actual debt itself.

See if you’re able to transfer some/all of your credit card balance to one that offers a much lower interest rate. In some cases, some offer a 0% promotional rate for up to 12 months. This will allow you to more quickly pay off that high interest credit card debt.

Bohlman: Some experts argue that one of your resolutions should be to finally make those home repairs or improvements you’ve been putting off. They say that the money you put into your house now can save money down the road and potentially add to its value. What are your thoughts?

Grywacheski: For home repairs, it’s understandable that people fix things to get them back to working order or to prevent further damage. It’s part of being a homeowner.

But with high inflation, rising interest rates and a high probability of a recession next year, home improvements is an area I would suggest caution on.

- With high inflation, these projects will now cost a lot more to complete than they did just a few years ago.

- With high interest rates, it will now cost you a lot more to borrow money to fund many of these home renovations.

- With the expected economic downturn next year, you need to consider if your job is potentially at risk.

You need to carefully assess if now is the right time to be considering these home improvement projects that can cost a lot of money.

Bohlman: What might be some other financial resolutions people should consider to better their financial health in the New Year?

Grywacheski: As with any resolution, try to be specific and realistic. Don’t get overwhelmed and maybe just pick one to start. But here are some great ideas- what I like to call Piggy Bank Resolutions.

- Keep track of your expenses: Most people don’t have any idea how much they are spending or where their money is going. By keeping better track of your expenses, you can then decide if you want or need to make changes.

- Emergency fund: I know times right now are tough, but it’s recommended to have 3-6 months of expenses in an emergency fund.

- Review your credit report: With the heightened risk of data breaches and identity theft, it’s important to review your credit report. Each year, you’re entitled to one free credit report from each of the 3 credit reporting agencies. Go to annualcreditreport.com to start the process.

- Estate planning: Do you have a will? Do you have financial healthcare Powers of Attorney? Planning for your death or incapacity is hard to do, but it is important.

Watch more news, weather and sports on News 8's YouTube channel