GALESBURG, Ill. — Galesburg City Council voted 4-3 on Monday, Dec. 19 to approve a contentious sales tax increase.

The city's sales tax rate will now increase from 1% to 1.25%. It will become effective July 1, 2023, and city officials said Galesburg will start seeing that money in October. The increase is estimated to bring in approximately $950,000 to the city in annual revenue.

The money will be earmarked for capital improvements, such as improving roads, and will help fund a proposed new community center to be built at the former Churchill Junior High School.

Those are items that ranked high on a city-wide survey conducted earlier this year. The top three requests from Galesburg residents include attracting businesses and jobs, improving public roads and sidewalks, and increasing activities for youth.

However, the sales tax increase has divided Galesburg residents since the first reading of the ordinance on Dec. 5.

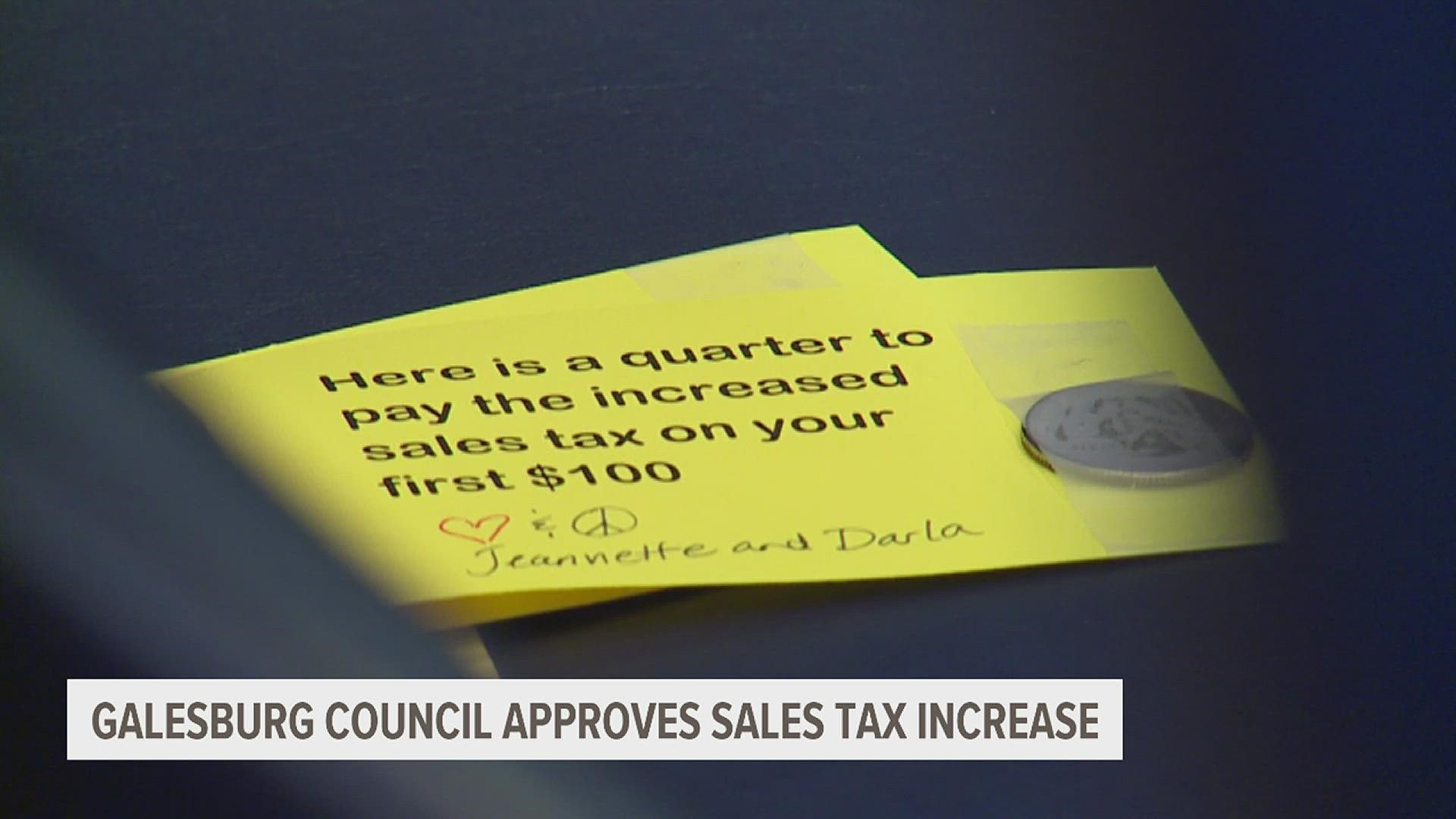

Some have put "No sales tax increase" signs in their yards. During the council meeting Monday night, others in support of the tax increase, started putting quarters in a bucket labeled "quarters for community."

"A lot of our roads can't take another winter. Our people are going to be hit by another winter," resident Samuel Carrington said. "More isolation, more cold, less help, less community, less support. Those are the people that we need to take care of. We don't need to take care of the people who are very carefully balancing that quarter of a penny for every dollar of a percent."

"We need the community center and the road work much more than we do not need to have the tax," resident Jerry Ryberg said.

Residents against the tax say it's unnecessary and that City Council hasn't fully come up with a plan to spend it yet.

"88.3% of the people who are business owners in the community have thought this is a bad time for a tax increase," said first ward council member Bradley Hix.

"You all represent your constituents and if the majority of your constituents are against the sales tax, then who are you listening to?"

Others were pushing for City Council to let voters decide on the tax increase.

"Put this on the ballot, please," one woman said. "Let the people vote. Let their voices be heard."

Those in support of the tax argued that Galesburg shouldn't put off this decision anymore. A proposed referendum vote would have taken place in April, but council members ultimately voted against the referendum 4-3.

Galesburg's sales tax is only a portion of the total tax residents pay. With the new quarter of a percent sales tax increase, the general merchandise tax rate will now become 9% and the tax rate on prepared food and drinks will be 11%.

Watch more news, weather and sports on News 8's YouTube channel