MOLINE, Ill. — Stimulus checks are going out, but many News 8 viewers still have questions about if and when they'll be getting their money. We took your questions over email and Facebook to financial expert Mark Grywacheski.

Here are the answers to some common questions and concerns about the stimulus check. News 8's Katherine Bauer goes more in-depth during her interview with Mark, posted at the bottom of this article.

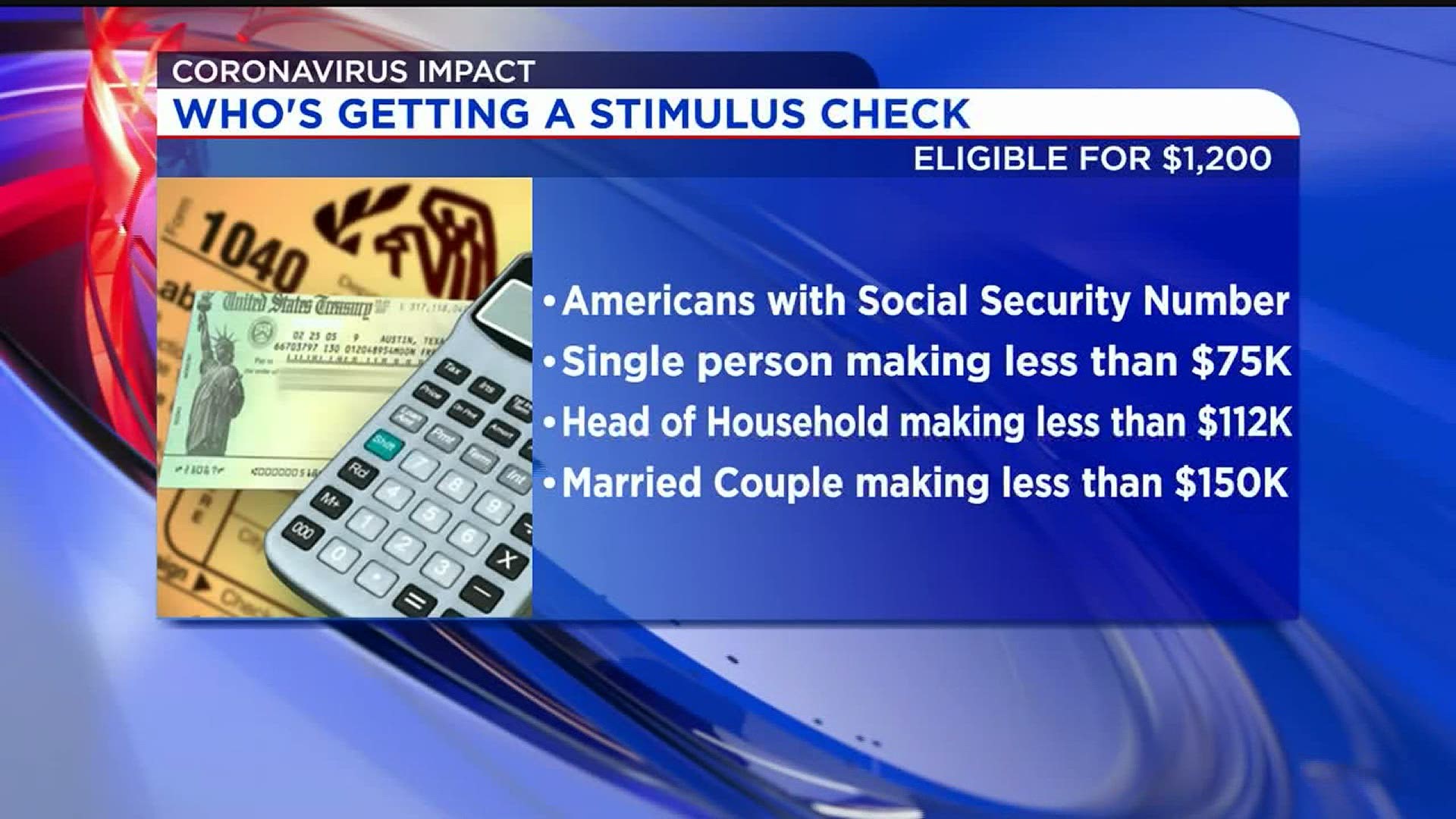

Question: Generally speaking, who will receive a stimulus check?

Answer: These stimulus checks go to any American with a social security number, but there are some qualifications.

You get the full $1,200 f you have an annual gross income between:

- $0 to 75K for single people

- $0 to 112K for heads of households

- $0 to 150K for married couples filing jointly.

Above those amounts it starts to phase out at a rate of $5 for each $100 of additional adjusted gross income.

Question: My mother gets a Social Security check and did not file taxes for the last two years. Will she get a check, and if so how does she get it?

Answer: If you don't file taxes but do get Social Security payments or veterans benefits, the government will use that information for your payment.

Question: How does the stimulus apply to young people? Do young people, who are not claimed as a dependent, get the $1,200? I'm thinking of high school and college students between 16 to 20 years old. How old do dependents have to be for their parents to get $500 for them?

Answer: Parents will receive a $500 payment for each dependent child 16 or younger. But if that dependent child is 17-24 and a high school/college student, you won’t receive a check.

But if that young person is financially independent and has filed a tax return in 2018 or 2019, that person is eligible for a $1,200 payment.

Question: How will the stimulus check impact when I file my taxes next year? Will it impact my refund or how much I have to pay in taxes?

Answer: These payments are not taxable and will not impact your tax refund.

Question: Will people on disability get a check?

Answer: Yes, people who receive disability payments will also receive a $1,200 payment.

Question: Are all direct deposits complete? How long will I have to wait for a paper check?

Answer: Direct deposits started around April 11 and most people should have already received it. If you don’t use direct deposits, physical checks have already started to be mailed out. The IRS is sending out 5 million checks per week. The IRS has a tracking tool on its website you can use to track the receipt of your check.

Question: Do I include the stimulus check income when I file my weekly unemployment claim?

Answer: No, again these stimulus checks are not counted as income.