MOLINE, Ill. — Over the past 15 months, the US Federal Reserve has pushed interest rates to a 43-year high. As a result, consumers have seen interest rates soar on their credit cards, auto loans, home mortgages and many other forms of consumer debt. But why is the Federal Reserve doing this and how does this process actually work?

News 8's David Bohlman met with Mark Grywacheski from Quad Cities Investment Group to discuss this matter.

Bohlman: What exactly is the Federal Reserve and what does it do?

Grywacheski: The Federal Reserve (The Fed) is often called the “bank for banks”- it helps facilitate many of the transactions and operations your local bank engages in to ensure the overall banking system operates smoothly and efficiently.

The Fed also serves as the decision-making body for US Monetary Policy. By manipulating the amount of money in the economy and interest rates, it seeks to influence spending, investment, employment and inflation to promote a healthy economy.

Bohlman: Why is the Federal Reserve raising interest rates and how does it go about doing that?

Grywacheski: Over the past two years inflation has shot up from 1.7% to a 40-year high of 8.9% in June 2022. Inflation has declined to 4.9% but it’s still above the ideal 2% target rate we want to get back to. Any inflation above 2% is deemed excessive and causes undue pain on consumers, business and, ultimately, the US economy.

Within its arsenal of tools used to keep inflation under control, the main tool is raising the benchmark fed funds rate. The fed funds rate serves as a basis for many forms of consumer debt. By raising the fed funds rate, the Fed seeks to disincentivize buying goods and services on credit. You’re now being charged a higher interest rate to borrow money on credit cards, bank loans, auto loans and home mortgages, among others. The Fed’s goal is to gently tap the brakes on consumer spending. If there’s less consumer spending, eventually, inflation should start to decline.

Bohlman: But raising interest rates also inflicts a lot of pain on consumers. Home mortgage rates shot up to 7%. Credit card rates are over 20%. Why would the Federal Reserve raise interest rates when consumers are already struggling with rising consumer prices?

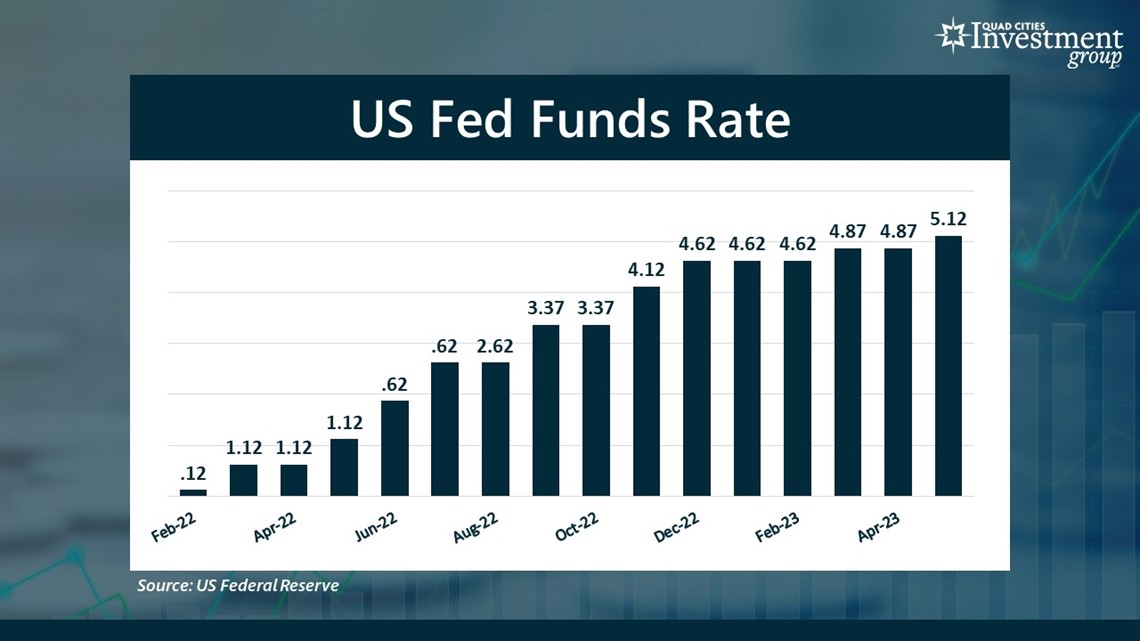

Grywacheski: The Fed finds itself in a very unenviable position. The Fed didn’t create this high inflation but as part of its mandate, it’s tasked with trying to get it under control. In my opinion, I think the Fed should have started addressing inflation much earlier. Instead, the Fed waited until March 2022 to start raising interest rates. Since March 2022, the Fed has raised the fed funds rate from near-0% to its current level between 5%-5.25%. This has been the most aggressive pace of rate hikes by the Fed since 1980.

The Fed acknowledges the pain these higher interest rates have on consumers. But the Fed argues the pain felt by consumers would be much greater- by allowing this high inflation to continue- than the additional pain caused by these higher interest rates.

Bohlman: The Federal Reserve holds its next meeting on Wednesday. Do you think the Fed is done raising interest rates or could we still see additional rate hikes later this year?

Grywacheski: The Fed isn’t expected to raise the fed funds rate on Wednesday but Wall Street does expect another 0.25% rate hike at either its July or September meeting and then announce a “pause” on future rate hikes.

But the second half of this year is so cloudy in trying to interpret what the Fed does later this year. What happens to inflation? Does the economy go into recession? The Fed could quickly find itself having to implement additional

rate hikes or it could start lowering interest rates based on how the economic data plays out in the second half of the year.