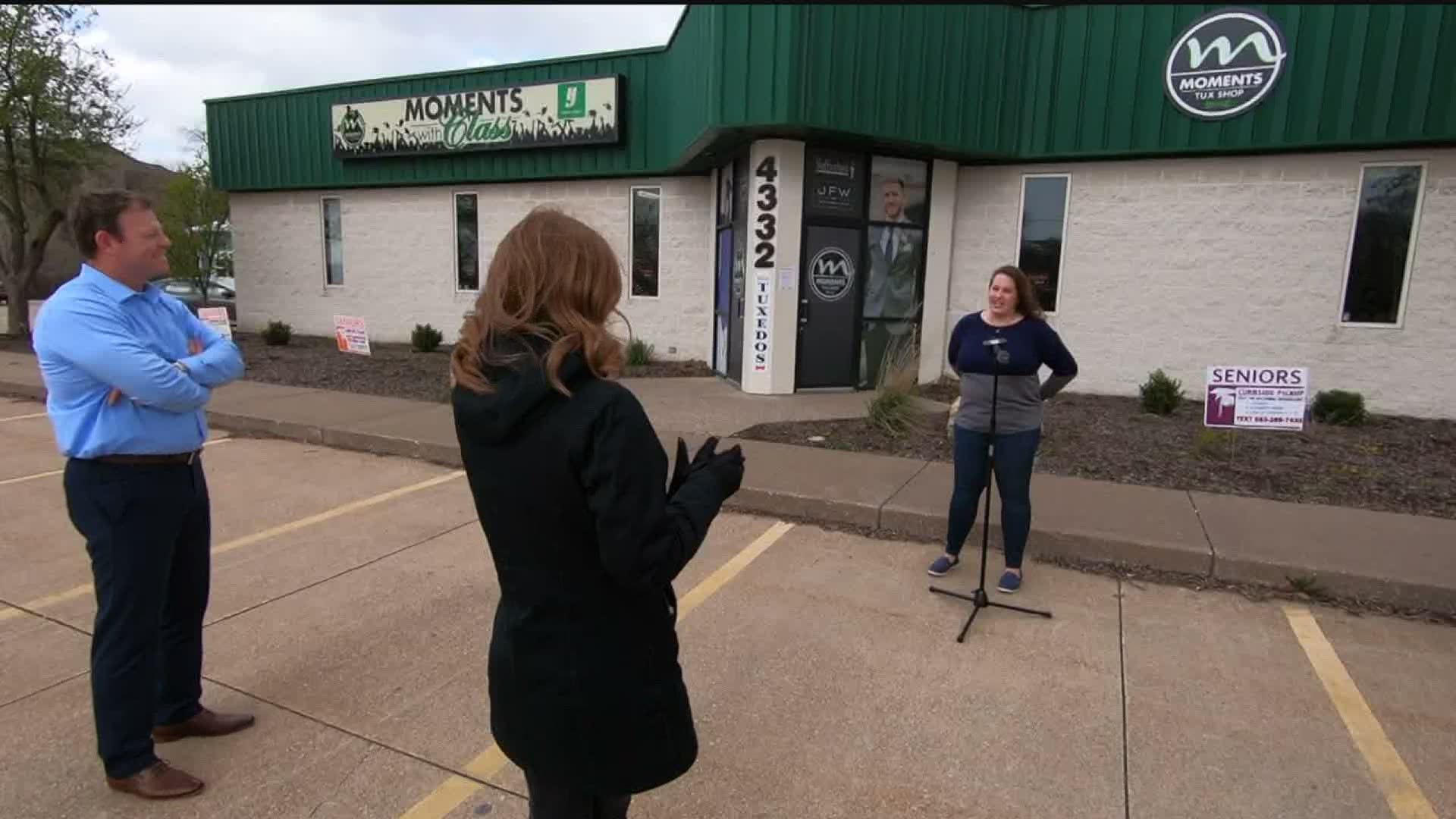

BETTENDORF, Iowa — Dustin and Julie James own "Moments with Class" a cap and gown business in Bettendorf. They started the business 11 years ago, expanded into the tuxedo business 6 years later, and recently Dustin added motivational speaking to the family business.

The three businesses depend on graduations, proms, weddings, and conferences. But with large gathering canceled across the nation due to state "stay at home" orders, their business has taken a hit, especially now - a time they call their "Christmas".

They say they tried to diversify their businesses to prevent putting their eggs in one basket, and to have at least one to fall back on.

"Did I ever think I'd have something affect all three at one time? Not in a million year," says Dustin.

They say the company had a lot of momentum heading into March, with revenue up 30%. But this month was a quick turnaround - applying for small business loans and grants.

"I don't really want to take a loan out to get me through tough times and have to go back and pay," Dustin admits.

Doug Wier, a financial advisor at Bettendorf Financial Group, says he's been working with small business clients 7 days a week (taking on about a dozen new clients) because he says "they're nervous".

Wier says he recommends his clients apply for grants and the Paycheck Protection Program (PPP). The loan program is part of the CARES act, and sets aside more than $300 billion for businesses with fewer than 500 employees.

"It's a loan, but if you hire people back and you hit a certain bogie ... or percentage, they'll forgive the loan," explains Wier.

Wier says he understands taking out a loan is intimidating, but with the PPP interest rate at 1% over 10 years, he says that's tough to beat.

The James' say they've been approved for the PPP and should hear back in a couple days how much they'll get, but there's still uncertainty that lies ahead.

"We have a great team of people who have been working for us for years and they want to know what to do and nobody knows what to do," says Julie.

"I don't want to spend my days sitting at a desk when I can sit with a customer or reach out to them," Dustin says.

For resources on small business grants and loans, financial advisors recommend checking out the Quad Cities Chamber of Commerce guide.