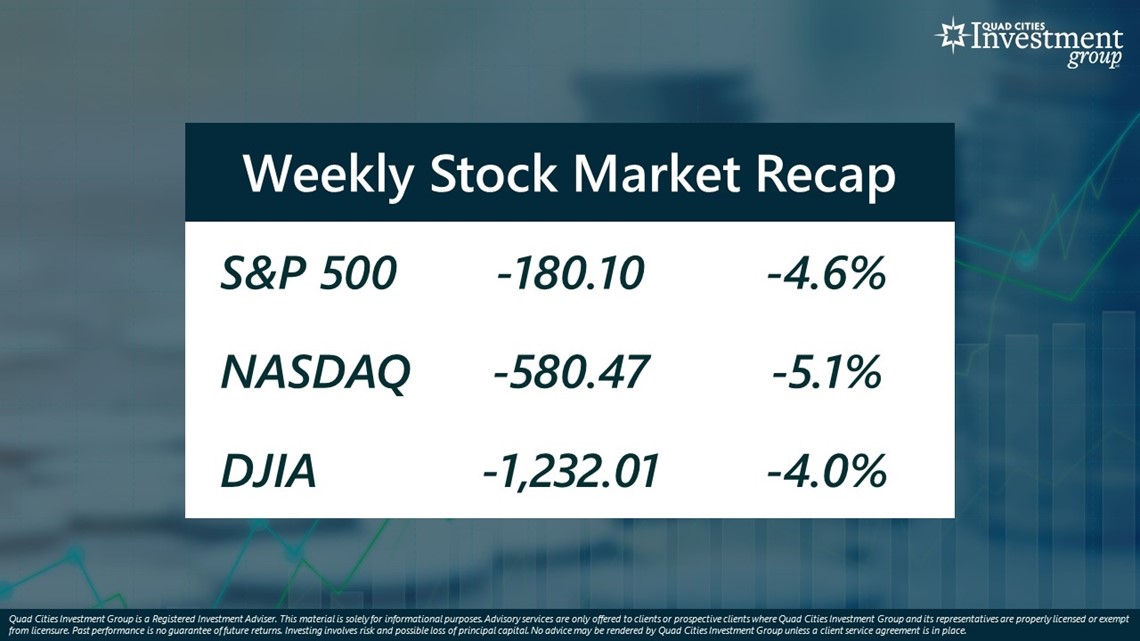

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index has fallen by 4.6%, NASDAQ fell by 5.2% and DJIA fell by 4.0%.

Mark Grywacheski with the Quad Cities Investment Group recapped the rising federal funds rate with News 8's Ann Sterling on Monday, Sept. 26.

Here's the full conversation:

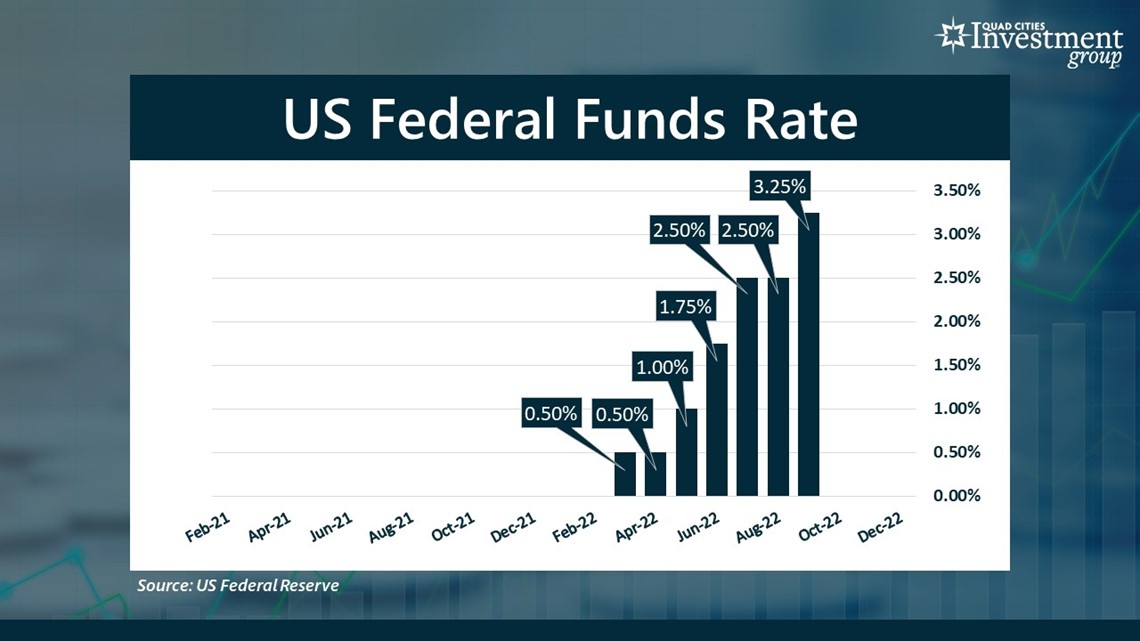

Sterling: On Wednesday, the Federal Reserve raised the benchmark fed funds rate by another 0.75%. What did we learn from the latest rate hike by the Federal Reserve?

Grywacheski: Following the announcement of this latest rate hike, Fed Chairman Jerome Powell gave the Fed’s insight on why it needs to be so aggressive in raising interest rates. He said there’s more and more evidence that inflation will remain historically high for quite some time. Most likely, for most, if not all, of 2023 and potentially even into 2024. The longer this inflation lasts, the greater the risk any economic recession becomes larger and more severe. To help get this inflation under control as soon as possible, the Fed argues it needs to be very aggressive in raising interest rates.

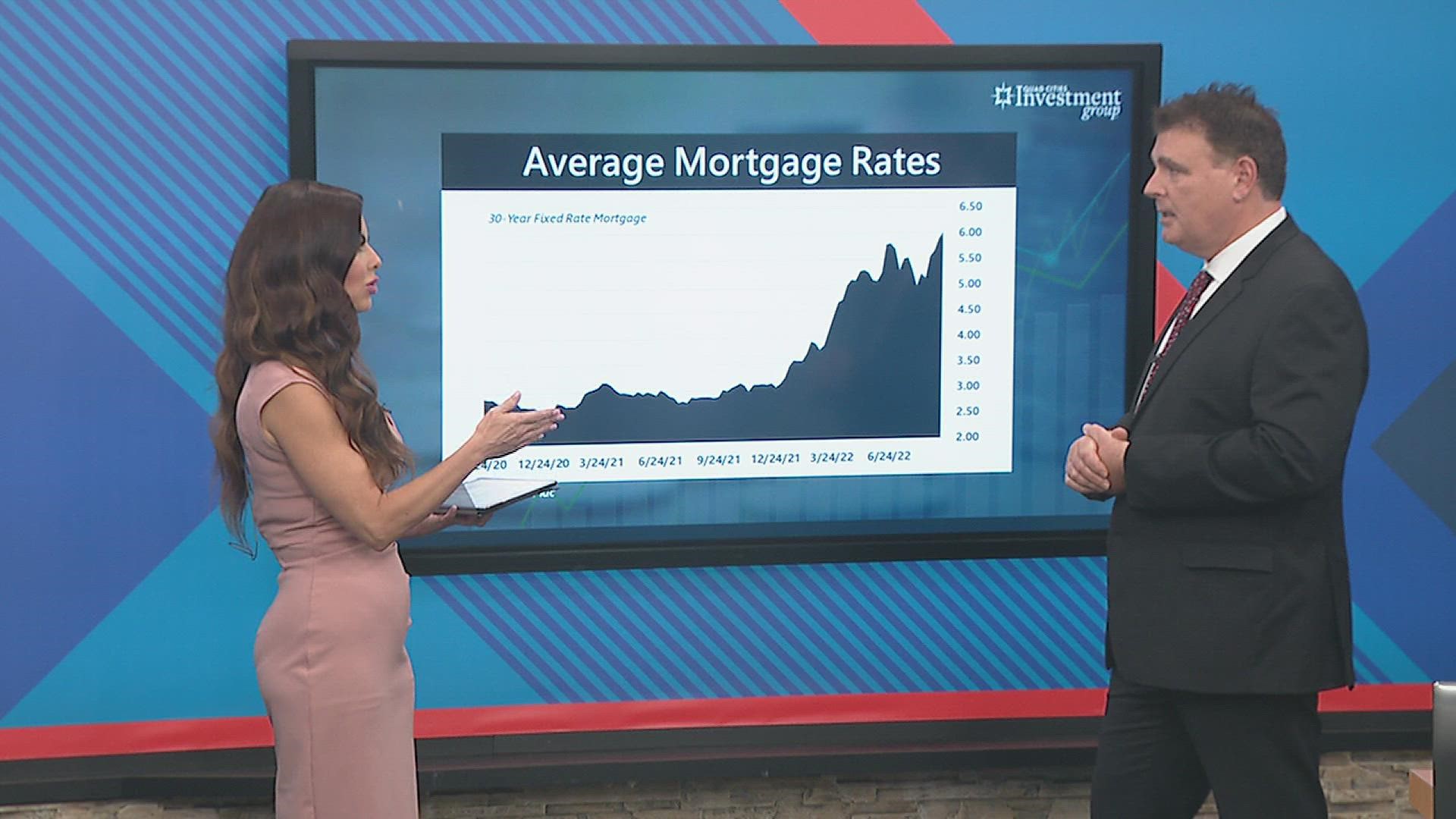

From April 2020 to February 2022, the fed funds rate was near-0%. But in the past 6 months, the Fed has raised the fed funds rate from near-0% to 3.25%. By year-end, that rate is expected to go even higher to 4.25-4.5%.

Sterling: One of the comments made by Chairman Powell was that he acknowledged these interest rate hikes will deliver some level of pain to American households. What did he mean by that?

Grywacheski: Historically, when the Fed raises interest rates, it does so in a very gradual/measured pace. It wants consumers/businesses/economy to be able to better absorb the impact of these rising rates. But because inflation has become such a concern, it needs to aggressively raise interest rates. But the risk of having so many interest rate hikes in such a short, compressed window of time is that it risks sending the economy into a severe recession.

The Fed argues that the long-term pain caused by not addressing this inflation will be much, much greater than any short-term pain caused by these interest rate hikes to the economy and labor market.

Sterling: How do these interest rate hikes impact seniors or those living on some type of fixed income?

Grywacheski: On the positive side, interest rates on bonds, CDs and savings accounts are rising. Seniors and fixed-income people often rely on these types of investments to provide for, or at least supplement, their retirement living expenses.

12 months ago, people were struggling to get a return of 0.25%. But now, many government bonds or CDs are paying a 3.5%-4.0% interest rate.

The challenge is that inflation is at 8.3%. So, even though seniors/fixed income persons are receiving a much-higher return on their investments, it is still less than ½ of the annual increase in inflation. Also, seniors/fixed income persons often spend the vast majority of their income on basic necessities. And, as we’ve discussed, basic necessities have been hit the hardest with respect to price increases.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch "Your Money with Mark" segments Mondays during the 6 a.m. hour of Good Morning Quad Cities or on News 8's YouTube channel.