MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index rose by 4.0%, NASDAQ rose by 2.2% and DJIA is up by 5.7%.

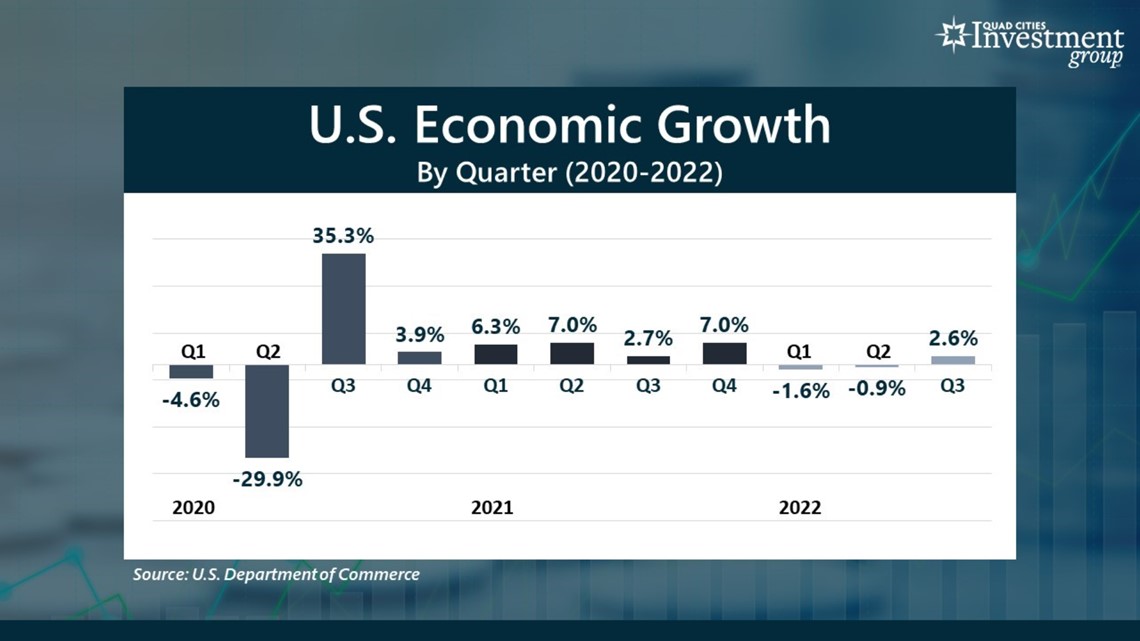

On Thursday, the Department of Commerce reported that the US economy grew at an annualized rate of 2.6% in the July through September 3rd quarter. Despite the sudden rebound in America’s economy, the future remains worrisome. Many economists are already forecasting the economy will dip back into a recession sometime next year.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's David Bohlman to discuss the expected recession's timeframe, and its potential severity on Monday, Oct. 31.

David Bohlman: What are your initial thoughts on this latest economic report just released by the Department of Commerce?

Mark Grywacheski: In the July-September Q3 the economy grew at a very respectable annualized rate of 2.6%. This effectively ended the technical recession we got in first and second quarter. A technical recession is defined as two consecutive quarters of negative economic growth. But remember, the technical recession in the first and second quarter was not severe enough to be declared an “official” recession.

But whether you call it a technical recession but not an official recession at this point really doesn’t matter. Yes, third quarter's return to a positive growth rate is a good thing. But what’s on everyone’s mind right now are these economic storm clouds on the horizon where the growing consensus is we’ll likely dip back into a more severe recession by the 2nd half of next year.

Bohlman: What’s the difference between a mild and severe recession and what have some of the more recent recessions been?

Grywacheski : A good example of a mild recession was in the first and second quarters of this year. We had a slight contraction in economic growth in the first two quarters but the labor market, consumer spending, industrial production and many other facets of the economy were still fairly strong. And that’s why this “technical” recession was not declared an “official” recession.

But then compare that to the first and second quarters of 2020. Yes, it was short-term, but it was much more severe as governments around the world shuttered entire sections of their economies and effectively closed their borders. We saw weakness in the economy, labor market, industrial production – that negative impact was very deep and expansive across the economy.

Back in 2008/09, we had a severe and long-lasting recession caused by the sub-prime mortgage crisis. So, recessions do happen. But when they do, we hope they’re short and mild to limit the impact to consumers and businesses.

Bohlman: How can Wall Street essentially “predict” a recession will happen and how can we tame our anxiety around the possibility of a recession?

Grywacheski : To help get this inflation under control, the federal reserve has been aggressively raising interest rates. The problem, however, is that these higher interest rates will take a punishing toll on consumers, businesses and the economy. It takes about 6-9 months for all these rate hikes to filter their way through the economy. And that’s why a recession is expected in the 2nd half of next year.

No one can say with absolute certainty a recession will happen or how severe and long-lasting it might be. But do your best to financially prepare yourself in the event we do get a severe, long-lasting recession. It’s hard to save money with this high inflation but try and buildup a cash reserve in case you do lose your job. Avoid carrying any credit card debt, especially with these rising interest rates. Hold off on any large discretionary purchases – until things calm down. The better you prepare in advance for any potential recession, hopefully, the less anxiety this uncertainty creates.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel