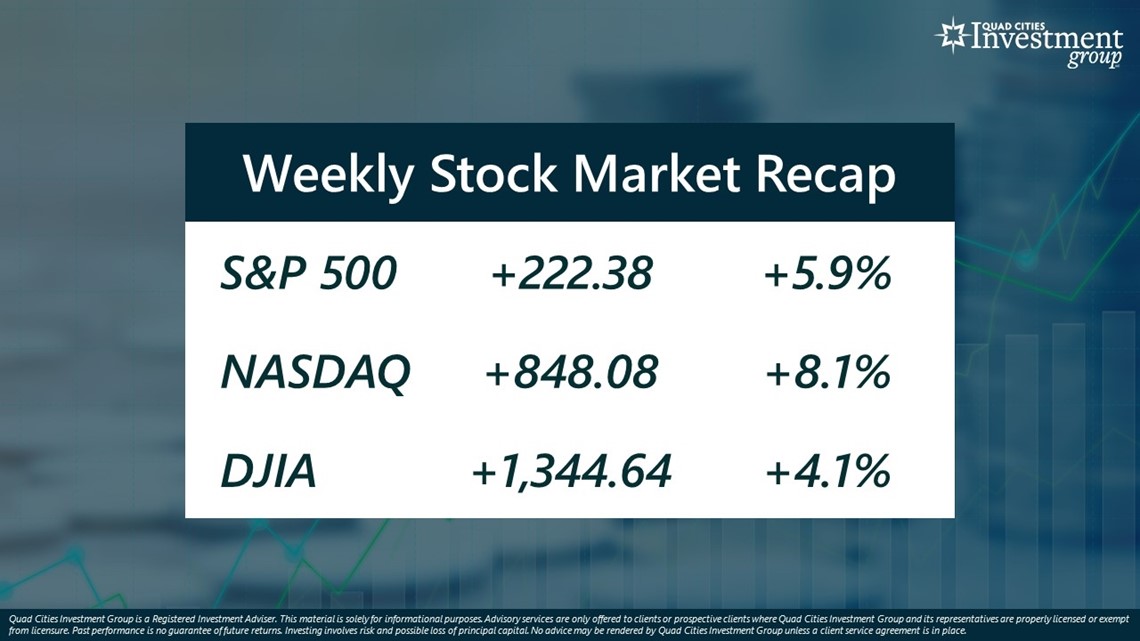

MOLINE, Ill. — Over the last week, the benchmark S&P 500 stock index rose by 5.9%, NASDAQ rose 8.1% and DJIA is up 4.1%.

On Thursday, the Department of Labor reported that the inflation rate fell from 8.2% to 7.7%. The better-than-expected inflation report sent stock prices surging on Thursday and Friday. The news helped send the benchmark S&P 500 stock index to its best weekly performance in over five months, while the NASDAQ had its biggest two-gain in over 14 years.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's Ann Sterling to discuss the inflation report that triggered the stock market's surge on Monday, Nov. 14.

Sterling: What was in the latest inflation report that triggered this surge in the stock market on Thursday and Friday?

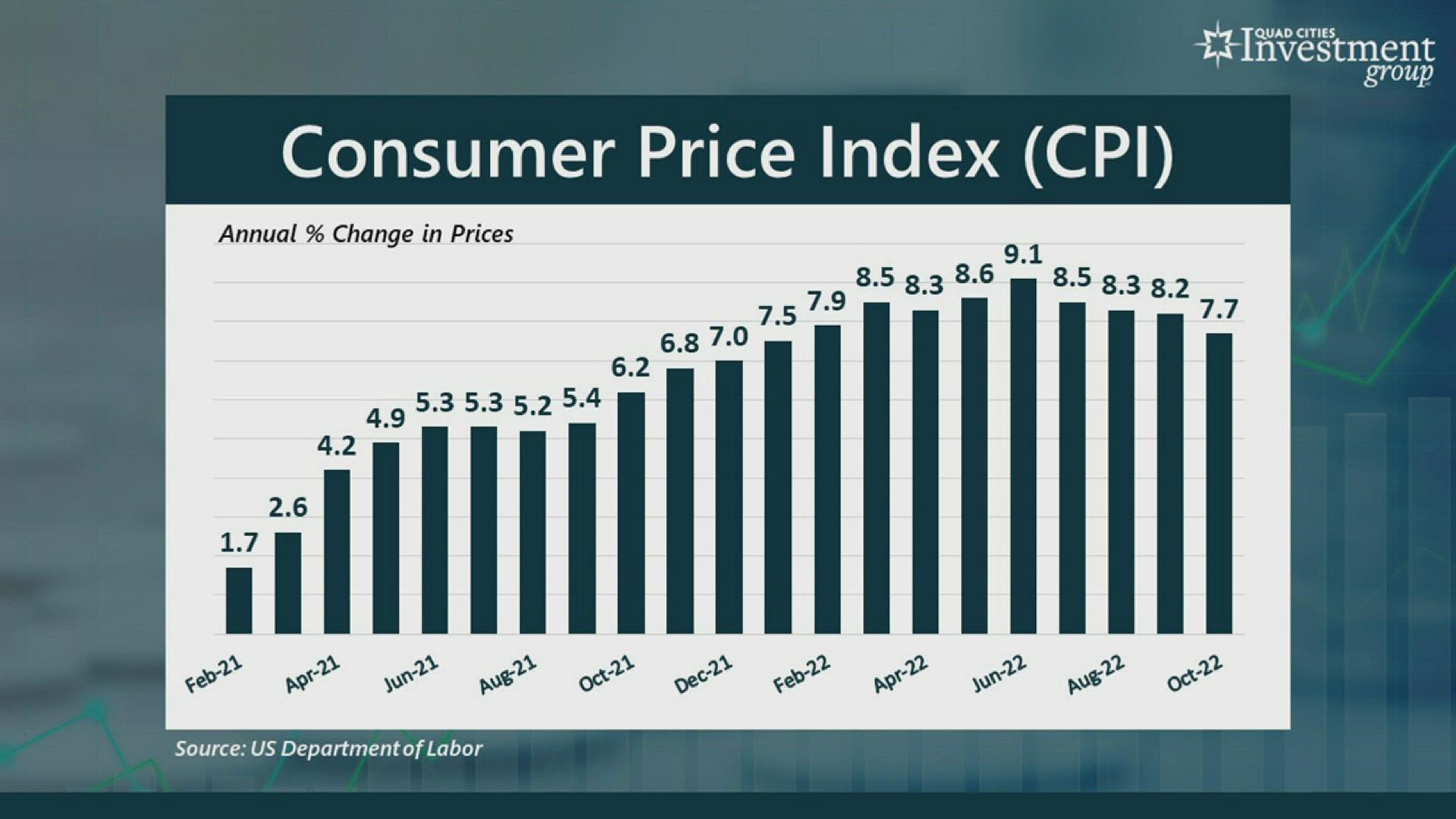

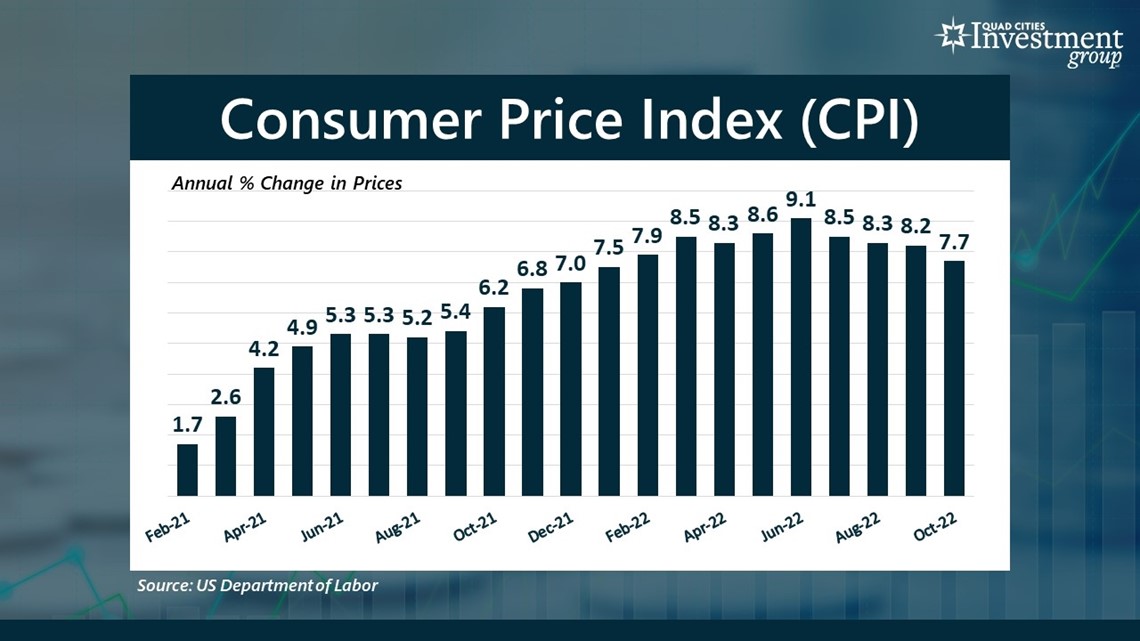

Grywacheski: Over the past four months, we’ve seen this gradual decline in the national inflation rate since it reached a high of 9.1% in June. But when you took a closer look at the data, it either failed to meet Wall Street’s expectations or it raised even more cautionary flags on the state of inflation.

But on Thursday, inflation fell from 8.2% to 7.7%, but more importantly, that 7.7% reported inflation rate beat Wall Street’s forecast of 8%. And it was the first time in 3-4 months that inflation came in below Wall Street’s forecast. And that’s what I really think triggered the stock market surge on Thursday and Friday.

Sterling: For much of the last 6 months, you’ve argued that “inflation will likely remain historically high for quite some time, potentially even into 2024.” Does this latest report in any way change your mind on the outlook for inflation?

Grywacheski: No, for a couple of reasons. In the short-term, there’s a number of areas in the economy that will continue to struggle with rising prices. Two examples at the top of my list are: 1. energy, and 2. housing rents.

From a longer-term standpoint, the number one cause of this high inflation is we’ve flooded the economy with money. Since February 2020, there’s roughly 42% more money circulating around the US economy. And all that money creates a tremendous upward pressure on consumer prices. And until we start to get this excess money under control, I still think it’s going to be until 2024 that we finally see a return to that 2% target rate of inflation we’d like to get back to.

Sterling : With the rally we saw on Thursday and Friday from this latest inflation report, do you think this rise in the stock market will continue?

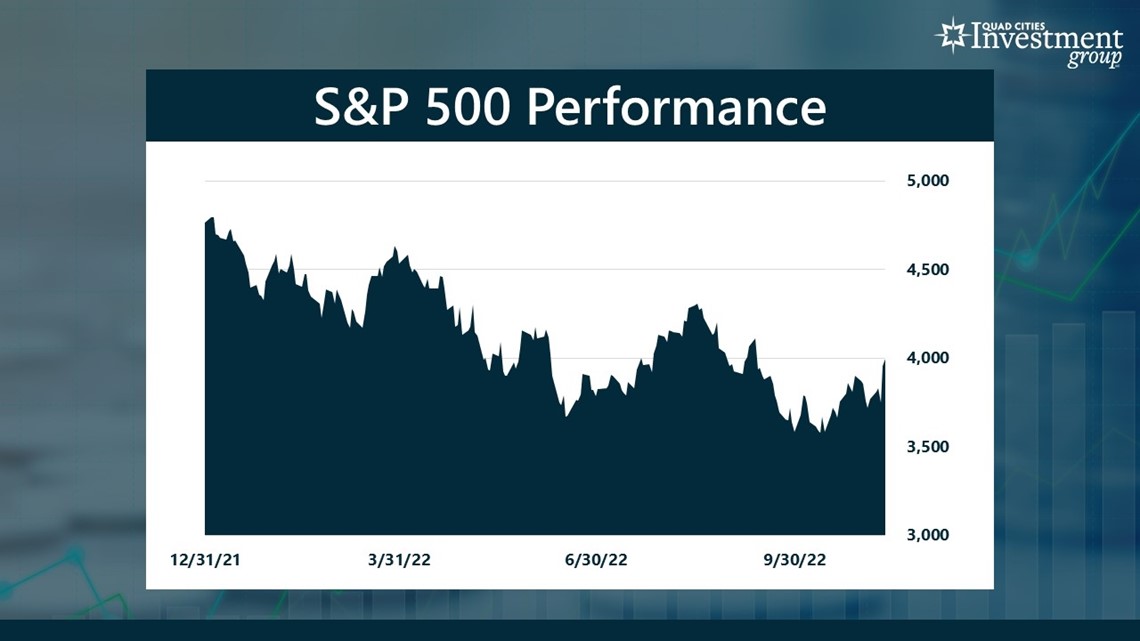

Mark: With this two-day surge in the stock market, I think we need to differentiate between a short-term jump in stock prices (which I think this was) vs. does this mean the stock market will quickly return to the all-time highs that were set back in late December/early January.

We need to remember what caused this 11+ month decline in the stock market in the first place – it was inflation. Wall Street needs to get some level of comfort that this inflation is finally under control – and it’s not there yet. And until it does get that level of comfort, I find it very difficult for Wall Street to be willing to push the stock market back to those all-time highs.

Yes, Thursday’s inflation report was good, but it was just one month. I think Wall Street wants further clarity on inflation, rising interest rates and to what extent do we get a recession next year before it fully commits to an extended rally.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch more news, weather and sports on News 8's YouTube channel