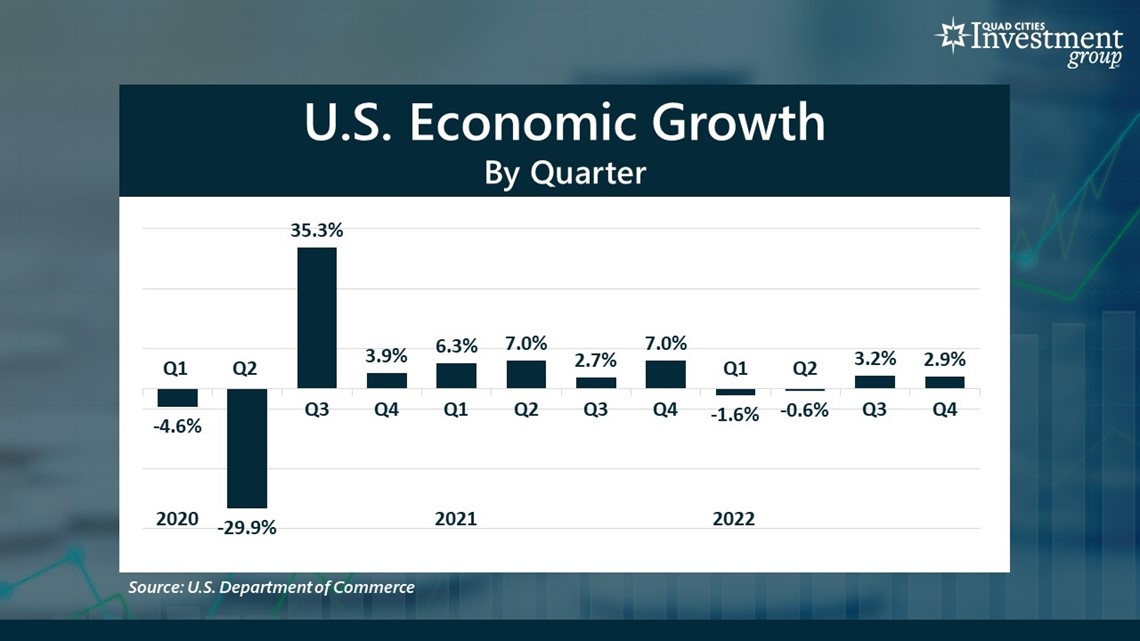

MOLINE, Ill — On Thursday, Wall Street got its first glimpse of economic growth in the October through December 4th quarter. The Department of Commerce’s Gross Domestic Product report showed the US economy grew at an annualized rate of 2.9% in the 4th quarter of 2022, exceeding Wall Street’s forecast of 2.7%.

Sterling: What are your thoughts on this latest report on the state of the US economy?

Grywacheski: Any time you talk about the economic growth you need to dive into the details and see what parts of the economy were behind this 2.9% growth rate. The single most important part of the economy is consumer spending- which drives more than 2/3 of our economy’s growth.

In the Q4, the growth rate for consumer spending was a fairly modest 2.1%. But that was partially offset by significant declines in business spending and residential housing. One of the main sources of economic growth in the Q4 came from the buildup of inventory by retailers to ensure they had enough goods on hand for the retail holiday shopping season. But that’s a temporary event.

So, when you look at the entirety of this report the results were a bit more mixed.

Sterling: Obviously, there’s been a lot of discussion on a likely recession in 2023. But does the fact that economic growth in the 4th quarter was better-than-expected (2.9% vs 2.7) change that recession narrative in any way?

Grywacheski: Unfortunately, it doesn’t for a couple of reasons.

- Back in the Q1 and Q2, the economy went into a technical recession- 2 consecutive quarters of negative economic growth. But it wasn’t declared an “official” recession because despite the 2 quarters of negative economic growth, we still had strength in consumer spending, industrial production and many other key parts of the economy. But now we’re starting to see cracks form in many of those once-strong areas of the economy.

- It’s the expected impact from rising interest rates, which act as a tremendous weight on the economy. And in the short-term, these interest rates are expected to go even higher.

Sterling: Do we now have a better idea of when a recession might hit or how severe it might get?

Grywacheski: There’s still tremendous debate on Wall Street on how severe any recession might be. Will it be short-term/mild or longer/more severe? That’s something that Wall Street is still trying to wrap its hands around.

As for timing, the general consensus is that we’ll likely get any recession in the 2nd half of the year. But we are starting to hear that maybe that timeline starts getting moved forward into the 1st half.

Sterling: Every day we continue to hear about more and more companies announcing layoffs. To what extent might any recession impact the labor market?

Grywacheski: The general consensus is that the unemployment rate will rise from its current 3.5% to around 4.5%-5% by year-end. That may increase/decrease somewhat based on just how severe any recession might be.

But one positive factor for the labor market is there’s a large buildup of unfilled job openings. Currently, there’s about 14.5 million unfilled job openings across the country. So, that should act as some type of “buffer” to the labor market. In other words, if a business enters a rough patch, ideally they could simply eliminate some of their unfilled job openings rather than lay-off any existing employees.

Watch more news, weather and sports on News 8's YouTube channel