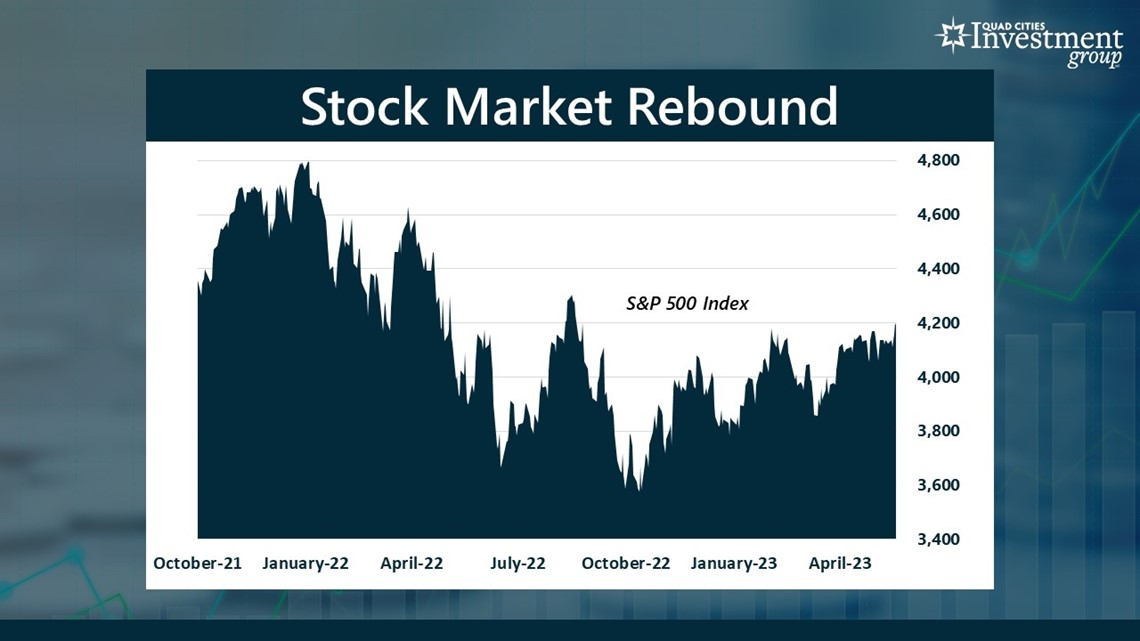

MOLINE, Ill. — Last week, the benchmark S&P 500 stock index closed at its highest level since August 2022. The index also posted its best weekly performance in nearly two months. But the question on every investor’s mind is – will it continue?

News 8's David Bohlman spoke with Mark Grywacheski from Quad Cities Financial Group Monday morning to discuss it.

Bohlman: What’s behind this ongoing rebound in the stock market and how much longer do you think it will last?

Grywacheski: The ultimate goal is to return/exceed the all-time high that was set back in January 2022. In the entire 130+ history of the US stock market, the stock market has always recovered, it’s always gone on to set new all-time highs- we just don’t know how many days/weeks/months that will be. In my opinion, it’s going to take patience, and here’s why.

From the all-time high in January 2022 to the low point of this decline in October 2022, the S&P 500 fell 25%. The primary catalyst was high inflation. Since October, the stock market has been gradually rising on the expectation that the worst of this inflation is likely behind us.

But there are 3 main obstacles to returning to the January 2022 all-time highs:

- I think inflation will remain historically high well into 2024.

- That means that interest rates will remain higher-for-longer.

- To what extent does the economy go into a recession later this year.

Until Wall Street gets some clarity on these issues, I think that return trip to a new all-time high will be choppy and may take some time.

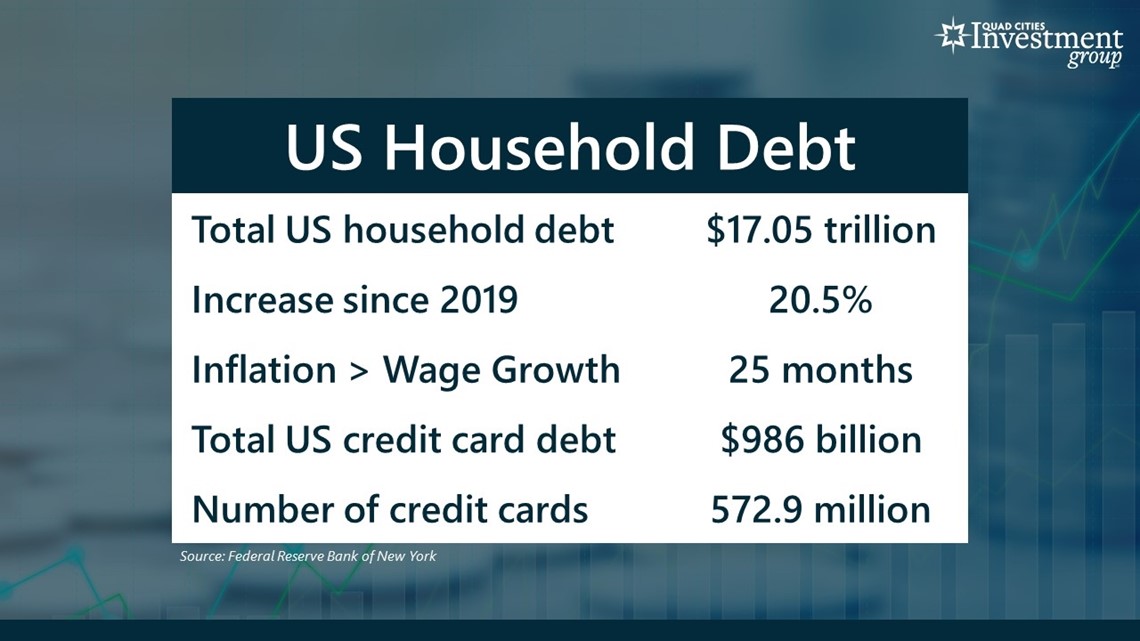

Bohlman: Recently, the Federal Reserve released its latest report on household debt. How are household budgets holding up in this current environment?

Grywacheski: Total HH debt currently stands at $17.05T. A record high.

- Since the end of 2019, before the pandemic, this is a massive 20.5% increase in HH debt.

- For 25 consecutive months, inflation has exceeded wage growth.

- Americans currently hold $986B in credit card debt. Also a record high.

- The number of credit cards held by Americans now stands at 572.9M. Also a record high.

Bohlman: Looking at that 20.5% increase in household debt over the past few years, why has household debt risen so quickly?

Grywacheski: One of the main reasons is that for 25 consecutive months, inflation has outpaced annual wage growth. In other words, the rise in consumer prices have been greater than the rise in wages. To bridge that gap, Americans have been forced to take on debt.

But second, it’s unfair to say that “consumers should simply live within their means and not take on a mountain of debt”. The hallmark of this two-plus-year inflationary cycle is that many of the goods and services hardest hit by inflation are basic necessities – food, clothing, shelter and energy. These are not high-end luxury items that consumers can do without. Americans need to buy these items to provide for themselves and their families. And to do that, for many consumers, that means taking on a lot of debt

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.