MOLINE, Ill. — Keep your arms and legs inside the ride at all times.

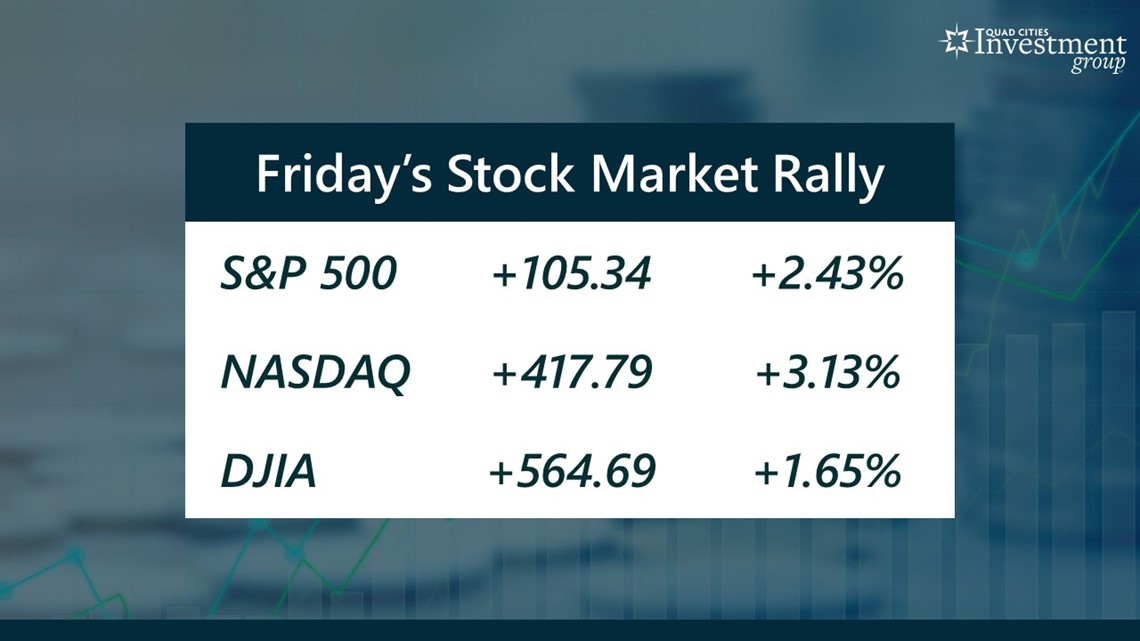

The rollercoaster ride in the U.S. Stock Market continues. For the week ending Jan. 28, all three indexes were set to have another week of losses, but then - a rally on Friday.

"Friday’s rally was certainly a welcome relief, but this is a stock market that will remain choppy for quite some time," Good Morning Quad Cities Financial Expert Mark Grywacheski from the Quad Cities Investment Group said. "Remember, this big sell-off and these big price swings is from Wall Street trying to dissect just how many interest rate hikes the Federal Reserve will need to get this inflation under control. The Fed is projecting just three rate hikes this year, most likely the first will come in March. But Wall Street is betting we’ll probably need four-five rate hikes this year followed by three more in both 2023 and 2024. And it’s this uncertainty over just how many rate hikes we’ll get over the next three years that should continue to drive a lot of volatility in the stock market."

Grywacheski explained during GMQC on Monday, Jan. 31 that we should not read too much into Friday's rebound. Instead, focus on the interest rate hikes that are on the way and would impact the economy:

"As designed, rate hikes are meant to 'disincentivize' consumer spending," he said. "Higher interest rate make it more expensive to buy goods/services on credit. But this inherently acts as a weight on economic growth. And that’s the concern we’re seeing reflected in the stock market. Will all of these interest rate hikes over the next few years cause a sharp decline in economic growth, and ultimately, the labor market?"

That is the question yet to be answered.

Click the video above to see the rest of our conversation.