Scam Alerts

Here's a list of common or recent scams impacting consumers nationwide and in the Quad Cities area. Check back with our list or send us information about a scam.

In 2020, consumers in the United States lost more than $3.3 billion to scams, according to the Federal Trade Commission. The commission received more than 2.1 million reports of fraud during the year. 34% of people who reported fraud in 2020 said they fell victim to the scam and lost money.

Protect yourself - your identity and money.

Here are the latest scams and what to watch for.

If you have a scam to report, text us at 309-304-0888.

Jury Duty Scam False calls from the Rock Island County Sheriff's Office

A scam has emerged in at least Rock Island County that uses a false claim of missed jury duty as its entry point, and is capable of impersonating government agencies and workers.

What happens

You get a phone call from someone claiming to be from the Rock Island County Sheriff's Office claiming that you missed jury duty and must pay a fine.

The caller, who is said to commonly use the number (309) 948-2059, is reportedly able to to spoof Caller ID and make it look like the call is coming from the department and may even use the name of an actual RICO worker.

The scammer will often request gift card numbers that they claim will be used to pay the fine.

How you can protect yourself

The RICO Sheriff's Office shared tips to avoid falling victim to this scam:

- Ignore the call or hang up immediately

- Never share personal or financial over the phone with an unverified person

- Never pay al alleged fine using a prepaid gift card or money transfer. This makes the scam nearly impossible to trace and undo.

- Don't let an authentic CallerID fool you into believing a caller is who they say they are.

Imposter Scams Calls, emails or texts from a fraudster posing as a legitimate person or entity

Imposter scams were the most common type of fraud reported in 2020. This is when a fraudster gets a victim to send money based on lies communicated through phone, email or text.

Imposter scams accounted for almost $1.2 billion in losses in 2020.

What happens

You get phone call, email or text from a seemingly legitimate entity or person, prompting you to take action.

How you can be sure it's a scam

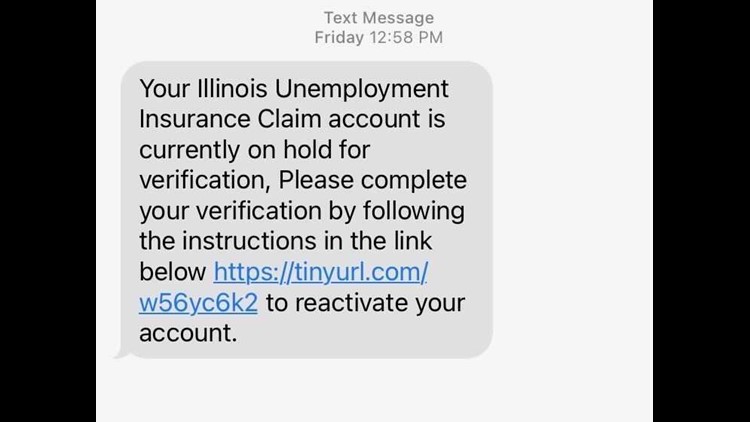

State departments have been posting public notices reminding the public that they will never text you in search of personal information.

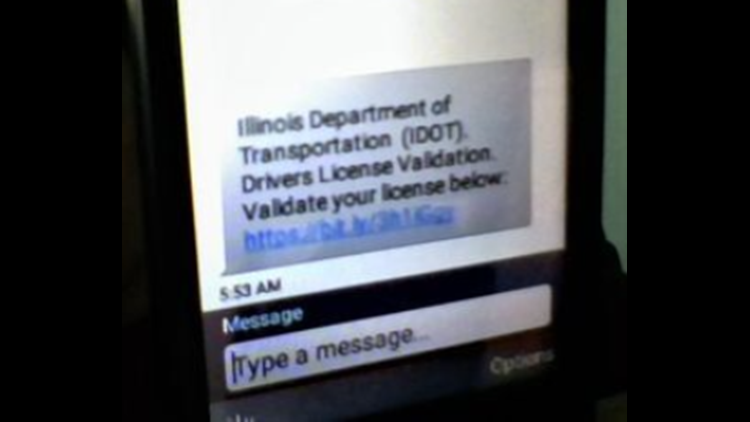

- Illinois Department of Transportation:

"While the messages might look official, IDOT will never request personal information, such as Social Security numbers or banking information, via text or email." - Iowa Department of Transportation:

The Henry, IA County Treasurer said the following about the text scams--

"Scam Text messages with a link have been reported that appear to be from the Iowa DOT and refers to a waiver on your driver license. This is a scam and should be deleted. The only text messages sent by the Iowa DOT are appointment reminders for anyone scheduling online driver license appointments with the Iowa DOT." - Illinois Department of Employment Security:

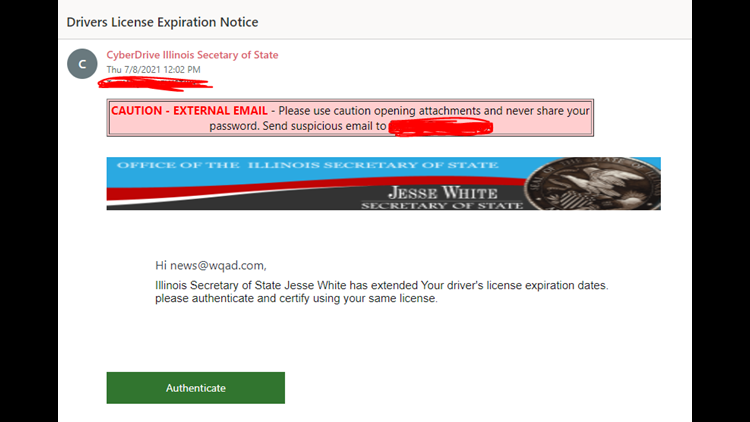

"Please note that individuals will never receive a text message from IDES seeking personal identifiable information, like your social security or driver’s license numbers." - Illinois Secretary of State:

"The Secretary of State’s office NEVER requests personal information, like a Social Security number, via text message or email.

How you can protect yourself

- Delete emails and texts that ask for personal information

- Do not click links included in the email or text, as it could contain malware

- Hang up on robocalls or callers that ask you to take immediate action or provide personal information

- Ask to use other identifying information other than your Social Security number

Examples of fraudulent communication

Online Shopping Scams Purchasing a product that never arrives

Online shopping scams accounted for the second most commonly-reported scams in 2020. This is typically when an online seller takes a customer's order and money, but never sends the product.

Online shopping scams cost Americans about $246 million in 2020.

What happens

Fraudsters create websites that offer difficult-to-find or high-in-demand products. They then process the buyer's payment without sending the item.

The Federal Trade Commission said in 2020 facemasks were the No. 1 most reported missing item. Sellers would blame shipping delays on the COVID-19 pandemic and then ultimately never send the product.

How you can protect yourself

- Read reviews before buying, or contact your state attorney general and local consumer protection agency for reports of complaints.

- Pay by credit card, which would allow you to dispute charges, should your purchase end up being a scam.

- Keep records of what you're purchasing, including the name of the company, purchase date and cost, return policy, and your bank statements.

- Pay attention to the site's privacy policy. The FTC says the privacy policy will explain what personal information is being collected and how it will be used. This allows you to make decisions on whether you agree with their terms.

Identity Theft Stolen personal information is used for fraudulent acts

In 2020, almost 1.4million cases of identity theft were reported to the Federal Trade Commission. That's about two-times the amount that were reported in 2019. Of those, more than 406,000 reports indicated someone misused a victim's information to apply for government documents or benefits. In 2019, there were 23,213 reports of this type of activity.

What Happens

An unauthorized person uses your private information for personal gain and illegal activity. For instance, the Federal Trade Commission says if someone steals your personal information, like a Social Security number or banking information, they may use it to make purchases, get credit cards, steal your tax refund, or take on your identity in other ways.

How to protect yourself

- Keep finances and personal documents hidden

- Don't readily give out your Social Security Number

- Stay proactive in checking your bills and bank statements to detect identity theft before loss occurs

Utility Scams Scammers threaten to disconnect service if they don't receive an immediate payment

Ameren Illinois is warning of an increase of utility scams in Knox County.

The power company said that during late July, five customers (including a customer in Galesburg) were duped out of a total of $3,100. At least 75 others called to report a scam.

What Happens

According to Ameren, scammers make it appear on caller ID systems as if the call is coming from the utility company. They ask customers to download Zelle, a money transfer app, and tell them to make immediate payment or face disconnection of service. They may also ask you to use a prepaid card or other non-traceable form of payment.

The scammers then give customers a different phone number to make a payment. They've been known to record a voice message that makes it sound like you've called the utility company. They may even given a fake identification number for a company truck that's "in" your neighborhood.

Other scams include asking for payment to replace a utility-related meter or claims you've overpaid your utility bill and need to provide bank account information to be refunded.

How to protect yourself

- Never share your credit card, debit card, social security, checking or saving account numbers to anyone who contacts you or comes to your home requesting this information.

- Never purchase a prepaid card or download a cash app to avoid service disconnection or shutoff.

- Legitimate utility companies do not specify how customers should make a bill payment and always offer a variety of ways to pay a bill.

If you suspect someone is impersonating an Ameren Illinois employee, end the conversation and immediately call Ameren Illinois at 800-755-5000.