MOLINE, Ill. — U.S. consumers have faced a growing list of challenges. High inflation, rising interest rates and the future outlook of the economy all are weighing on their level of optimism.

Monday, July 4, on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with Quad Cities Investment Group recapped the latest Consumer Confidence Index report, which showed confidence among American consumers was at its lowest level in 16 months.

Find the full conversation between Grywacheski and News 8's Josh Lamberty below.

Lamberty: What exactly is the Consumer Confidence Index and what insight does it provide on the state of American consumers?

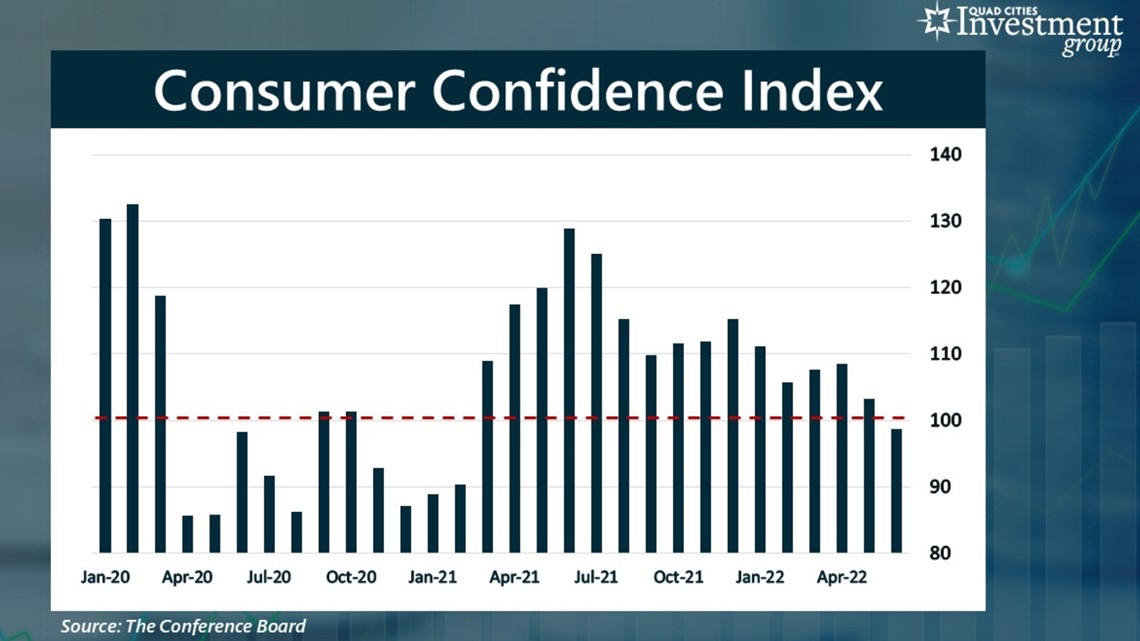

Grywacheski: The CCI is a monthly gauge of consumer optimism. It has a benchmark of 100. Any level above 100 indicates optimism by consumers on their future outlook on jobs, their income and the economy. Below 100 indicates pessimism.

In June, the index was reported at 98.7 – which means that consumers are no longer optimistic about their future outlook. The importance is that consumer spending drives more than two thirds of the nation’s economic growth. Consumers tend to spend their money more freely, which in turn drives our economy forward.

Obviously, there are a number of challenges that consumers are facing. But in your opinion, is there a key factor behind this current decline in confidence?

For much of 2020 and 2021, consumer confidence was heavily influenced by the pandemic. As the number of reported cases of COVID-19 spiked, consumer confidence tended to decline. Likewise, as the number of cases fell, confidence rose.

But for the past 12 months, consumer optimism has been following a different trend: inflation. Since June 2021, the CCI has been steadily declining. In February 2020, inflation was reported at just 1.7%. Today, that rate has soared to 8.6%, the highest since 1981.

Why do think inflation is playing such a large role in the level of consumer confidence?

Inflation has really become personalized. It’s placed a tremendous strain on household budgets. This high inflation is costing the average American household an extra $5,500/year in higher costs. For low-income individuals, retirees and even the middle class, it’s created a financial hardship. Even basic necessities like food, clothing, housing and transportation are becoming unaffordable for many Americans.

What are your latest thoughts on inflation? How much longer should we expect this to continue?

Whether we’ve seen the peak of this inflation is unknown. We’ll find out over the next couple of months, but inflation is expected to remain historically high for quite some time. What we’re seeing is that the timeline for when we get back to a more “normal” rate of inflation keeps getting pushed back. Inflation is expected to remain high for most - if not all - of 2023 and potentially into 2024.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.