MOLINE, Ill — Despite a rally in stocks on Friday, July 15, the U.S. stock market was unable to erase its losses from Monday through Thursday. For the week, the S&P 500 lost 0.9%, the Nasdaq lost 1.6% and the Dow Jones Industrial Average declined by 0.2%.

In the past 15 months, consumers have been facing higher prices at the checkout counter. But on Wednesday, the U.S. Department of Labor reported consumer prices in June rose another 1.3%, the largest monthly increase in 32 years. The national inflation rate also jumped from 8.8% to 9.1%, a 40-year high.

Monday, July 18 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with the Quad Cities Investment Group spoke with News 8's David Bohlman about the record inflation and when it could start to decline.

Find their full conversation below.

Bohlman: What did this latest inflation report tell us about the current state of inflation?

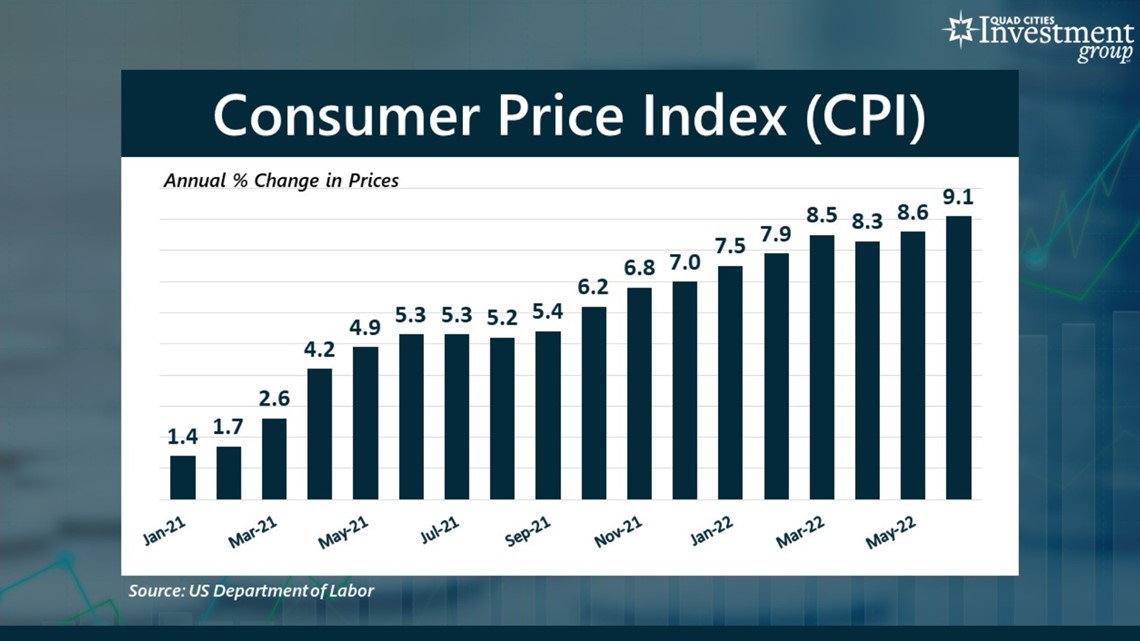

Grywacheski: To put this into perspective, back in January 2021, the annual inflation rate was reported at 1.4%. This means that consumer prices, on average, rose by 1.4% over the previous 12 months.

In June, consumer prices rose by 1.3%- in just one month! The national inflation rate jumped from 8.6% to 9.1%, the highest level since November 1981. It was above Wall Street's forecast of 8.8%.

When do you think this inflation will start to subside?

It’s almost impossible to predict when we’ll officially see the peak of this inflationary cycle. You look back at April when inflation fell from 8.5% to 8.3%, only to surge higher again in May and June. It’s going to take a few months to see how this inflationary landscape plays out.

That said, even when inflation does start to decline, I think it will be a very gradual decline and inflation will remain above that 2% target rate for most - if not all - of 2023.

We hear a lot about what’s causing inflation- it’s the labor shortage, it’s supply chain issues. What do you think is really behind this inflation?

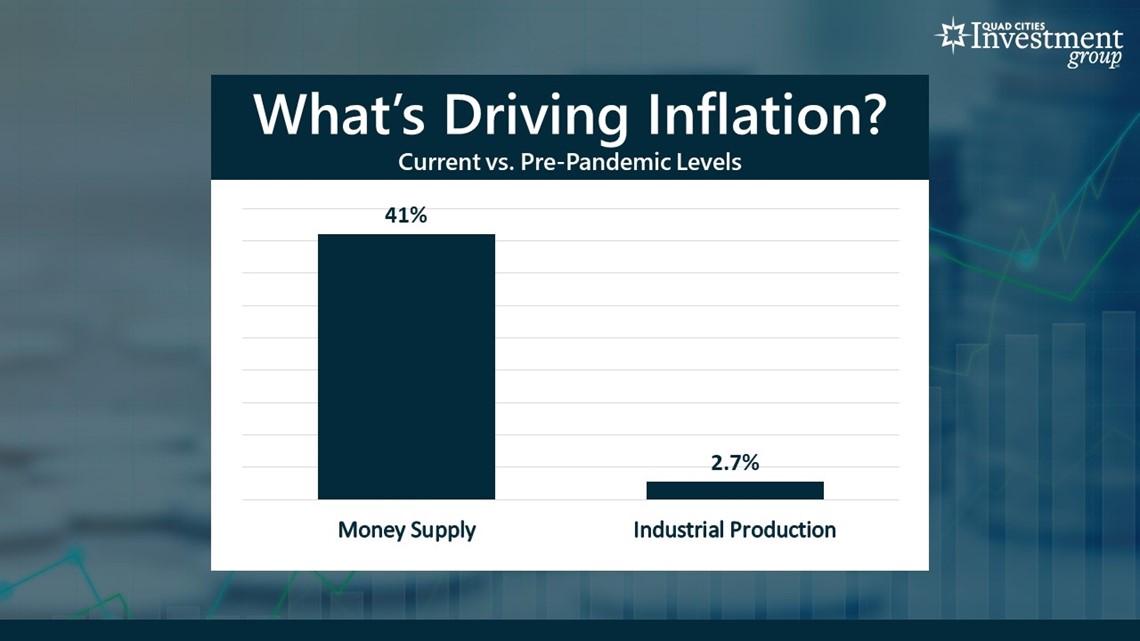

At its very core, inflation is caused by too much money chasing too few goods. Since February 2020, the U.S. money supply - the money circulating in the economy - has risen by 41%. When you suddenly add about $6 trillion of stimulus money into the economy, consumers and businesses tend to go out and spend it.

This creates tremendous upward pressure on consumer prices. The problem is industrial production - the number of goods being produced and manufactured in our county - has risen by only 2.7%.

You can argue the labor shortage and supply chain issues have limited the number of goods being manufactured, but even when those issues get resolved, you'll still have this giant gap between the money supply and the number of goods being produced. Until you start to see a little bit more of an equilibrium between these two, I think inflation is going to remain historically high.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Find more "Your Money with Mark" segments below: