MOLINE, Ill. — Some Illinoisans can expect checks to come in the mail as soon as this week. It's part of the Illinois Family Relief Plan, which was tied into the state of Illinois' fiscal year budget.

The full budget for the year totaled about $46.5 billion. Amid record inflation, the state is giving $1.8 billion back to taxpayers:

- $520 million goes back to taxpayers through a one-time property tax rebate — 5% of property taxes paid, up to $300 per household.

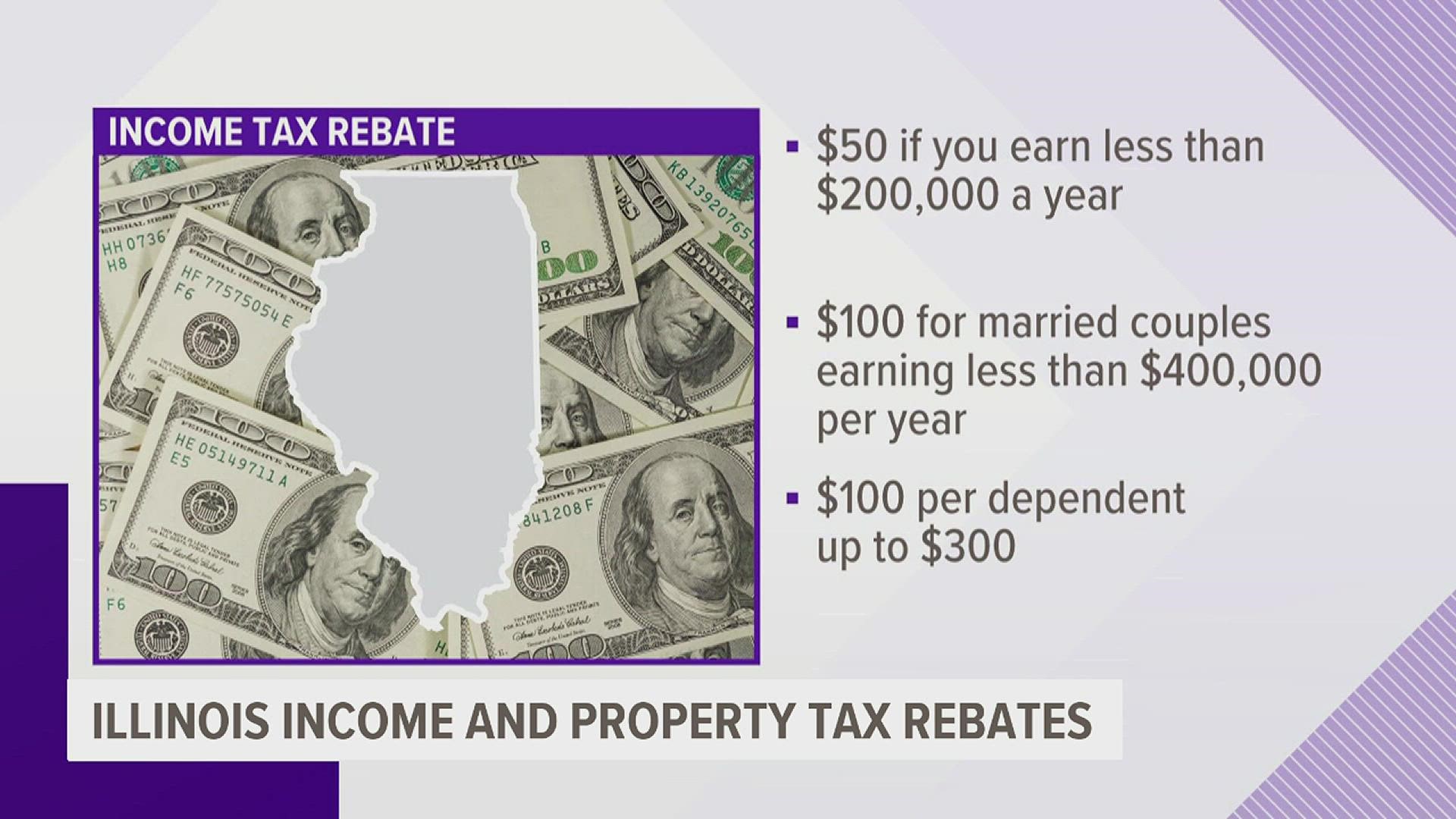

- $685 million goes back to taxpayers through checks for Income Tax Rebates — $50 per individual, $100 for married couples, and an additional $100 per dependent (up to $300).

To qualify for the Income Tax Rebate you must meet the following criteria:

- You must have been an Illinois resident in 2021, and

- Your adjusted gross income on your 2021 Form IL-1040 is under $400,000 (if filing jointly) or under $200,000 (if filing as a single person).

To claim your Income Tax Rebate:

You will automatically receive your rebate if you filed your 2021 IL-1040. If you haven't filed that yet, you have until October 17, 2022. If you have independents, you also must complete the Schedule E/EIC

To qualify for the Property Tax Rebate you must meet the following criteria:

- You are an Illinois resident, and paid Illinois property taxes in 2021 on your primary residence in 2020; and

- Your adjusted gross income on your 2021 Form IL-1040 is $500,000 or less (if filing jointly) or $250,000 or less (if filing as a single person).

To claim your Property Tax Rebate check:

It will happen automatically if you file(d) your 2021 IL-1040 and Schedule ICR. If not, you have until October 17 to file a Property Tax Rebate form (IL-1040-PTR) to get your rebate. You can submit that form electronically by clicking here. Or you may print this form and mail it to the address on the bottom of the form.

You can check the status of your rebates by clicking here.

Get answers to other frequently asked questions by clicking here.