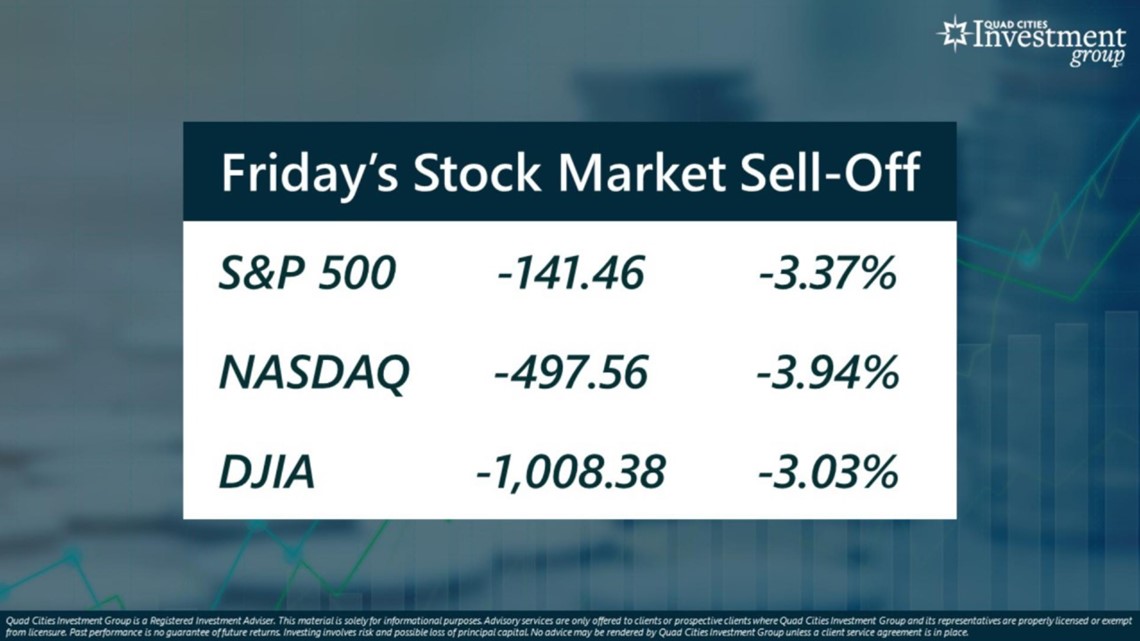

MOLINE, Ill. — For the second week in a row, all three major stock market indexes declined. However, last week's pullback was led by Friday's heavy sell-off.

All three indexes fell by over 3% last Friday — the S&P 500 lost 141 points, NASDAQ fell by 497 points and the DJIA lost more than 1,000 points.

Monday, Aug. 29 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with the Quad Cities Investment Group spoke to News 8's Ann Sterling about Friday's closing and how the Federal Reserve is attempting to curb inflation.

Sterling: It seemed that Friday's sell-off was triggered by comments made by Federal Reserve Chairman Jerome Powell. What exactly did he say that caused this sudden panic on Wall Street?

Grywacheski: The Fed is trying to engineer what’s called a "soft landing." In other words, to get this inflation under control, it needs to raise interest rates but in a way that doesn’t send the economy into a deep recession. If the Fed raises interest rates to high/too fast, it risks consumer spending coming to a grinding halt and potentially sending the economy into recession.

But on Friday, Fed Chair Jerome Powell reaffirmed that the Fed’s number one priority is getting this inflation under control. And that means that the Fed is willing to keep aggressively raising interest rates even if it inflicts some level of pain on the economy.

Sterling: Why would the Federal Reserve continue raising interest rates if it knows it may inflict some type of pain on the economy? Why is the Federal Reserve even considering this as an option?

Grywacheski: The Fed realizes that this extreme level of inflation is simply not sustainable. We see the punishing impact it has had on Americans, especially low-income and retirees, but also the middle-class. This inflation is costing the average American household an extra $5,500 a year in higher costs.

So, the Fed almost feels cornered. This high inflation can’t continue. So, in an almost desperate bid, it’s going to keep raising interest rates until it feels this inflation is finally under control.

Sterling: So, what does this latest news from the Federal Reserve mean for the stock market?

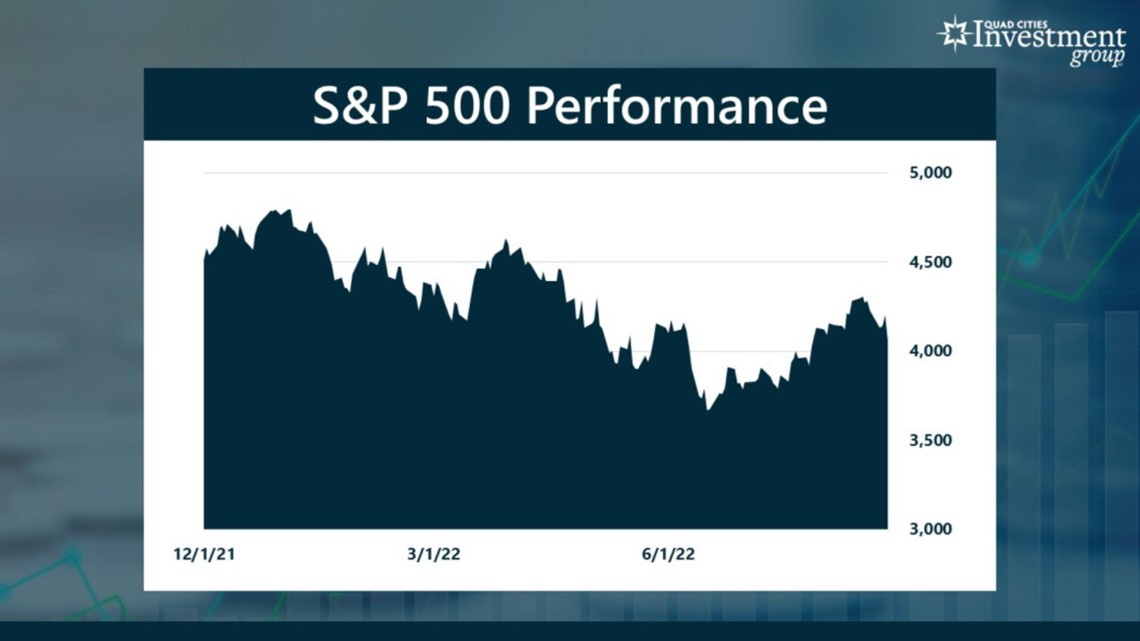

Grywacheski: This initial six-month sell-off was caused by concerns over high inflation, rising interest rates and concerns on the health of the economy.

For much of the past two months, we did see this rebound on the hopes that maybe inflation had peaked and that the Fed wouldn’t need to be as aggressive in raising interest rates. But on Friday, much of those hopes were dashed when the Fed said it doesn’t see a quick decline in inflation.

So, this is a stock market that’s going to require patience until Wall Street gets some level of comfort that inflation is under control. And I expect a lot of volatility through the end of the year.

Watch "Your Money with Mark" segments Mondays during the 6 a.m. hour of Good Morning Quad Cities or on News 8's YouTube channel.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.